Tax time warning: scams running hot, so be prepared to defend

A surge in scams in 2022 threatens to easily eclipse victims’ losses last year, and your tax return is a key target for criminals.

SmartDaily

Don't miss out on the headlines from SmartDaily. Followed categories will be added to My News.

Scammers are celebrating the start of the new financial year with a smorgasbord of victims who are trying to navigate tax time.

Cybersecurity specialists say fear of upsetting the Australian Taxation Office can lead to irrational decisions, being duped by a scammer, then losing thousands of dollars and possibly your identity.

Total scam losses are surging. In the first five months of 2022, more than $257m was stolen by scammers, according to the Australian Competition and Consumer Commission’s scamwatch.gov.au. That is almost 80 per cent of all losses in 2021 ($324m).

NortonLifeLock senior director Mark Gorrie says ATO-related scams have “become rampant in the past couple of years”.

“A key way to protect yourself is to understand how the ATO works and to be aware of the different tax scams,” he says.

Here are seven types of tax scam that should be on your radar.

ATO IMPERSONATORS

Gorrie says tax season produces a “prime opportunity” for ATO impersonation schemes.

“With this scam, the criminals call taxpayers or use robocalls posing as ATO representatives to persuade individuals to provide their bank account numbers or other identifying information,” he says.

“Remember, the ATO will not send an unsolicited pre-recorded message to your phone.”

PHISHING FAKES

Norton has observed several types of tax-related phishing attacks.

These pretend to be the person’s employer or a government representative seeking tax forms and personal information, Gorrie says.

“If you receive any request for sensitive data, Norton recommends verifying the identity of the requester and going directly to your employer and the ATO.”

MYGOV TRICKERY

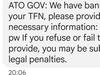

KnowBe4 security awareness advocate Jacqueline Jayne says the ATO receives reports of email and SMS scams asking people to identify their myGov or myGovID details.

“Scammers pretend to be from the ‘myGov customer care team’ and send emails telling people they need to verify their identity by clicking on a link,” she says.

“If you open the link, you will be taken to a fake myGov website where you are asked to sign in with your myGov details.

“Remember, myGov will never send you a link in an email or SMS.”

CRYPTO ATTACK

“Scammers are opportunistic so it makes sense that there would be a scam involving tax and cryptocurrency,” Jayne says.

“Here we see smishing – a malicious SMS – pretending to be from the ATO with a message stating that you are a suspect in cryptocurrency tax evasion and click here to connect to your wallet to sort it out,” she says.

“Please do not click on the link. The ATO will never send you a SMS or email with a link.”

FALSE REFUNDS

Jayne says this email scam impersonates the ATO with a message that you have a refund available, including a dollar amount.

“To claim the refund, all you need to do is open and fill out an attached form,” she says.

“Do not reply to this email or open the attachment. If you are expecting a tax refund, contact the ATO directly on 1800 008 540 or contact your accountant.”

DODGY DEBT

From the lure of extra cash to the threat of debt, this next scam can come via phone call or SMS where you are told you have a tax debt, and will be arrested if you don’t pay now.

Jayne says scammers often demand payment via prepaid gift cards, credit cards or even cryptocurrency.

“If you receive this call hang up,” she says. “It’s also a big red flag if someone asks you to pay in this way. If you have a legitimate outstanding tax debt, the ATO may use phone, email or SMS to contact you. They will never demand payment using unusual methods, threaten arrest or use pre-recorded messages.”

FAKE TAX PREPARERS

Avast cybersecurity specialist Stephen Kho says some scammers claim they can do your tax return fast and cheap.

“These fake tax preparers often operate by accessing the myGov accounts of their clients and lodging their tax returns through the ATO’s myTax web portal, or take your personal details and your payment, and then disappear,” he says.

Kho says people should set up myGov with two-factor authentication, never share their myGov password, and check their tax preparer is registered with the Tax Practitioners Board.

SAFETY TIPS

• Know the status of your tax affairs and accounts.

• Use secure Wi-Fi when doing tax.

• Look for signs of scammers, including incorrect spelling or grammar or urgency to press a link.

• Use comprehensive security software and back up data.

• If uncertain, contact the ATO directly.

Source: NortonLifeLock

Originally published as Tax time warning: scams running hot, so be prepared to defend