Sally Zou – Chinese businesswoman, political donor and utter mystery

STRANGE tweets, lavish political donations, disputes over business deals – Chinese businesswoman Sally Zou has been a magnet for controversy in SA. So what does she actually do, and where does she get her money?

SA Weekend

Don't miss out on the headlines from SA Weekend. Followed categories will be added to My News.

NO one answers the door at Sally Zou’s North Tce offices, housed in one of the Victorian-style town- houses usually favoured by surgeons and legal types.

Someone, presumably a staff member – a female with a Chinese accent – says via an intercom that Sally is “not here at the moment”.

We’ve been trying to ascertain whether the enigmatic purported mining mogul is still in Adelaide and, if so, where. While she has companies registered to a $5 million waterside home just north of Sydney, and owns a modest property in Broken Hill, it seems she has no property in South Australia.

And indeed it’s difficult to decide what Zou is best known for these days. Is it her status as a supposed steel mill heiress? Her claim to fame as the largest single donor to the state Liberal Party (and a substantial donor to the federal Liberals)?

Is it the bizarre cheque she tweeted out just before the state election, which turned out to contain the digits of now-Premier Steven Marshall’s birthday?

Is it the fact that she named a company the “Julie Bishop Glorious Foundation”, without running the notion past our former Foreign Minister?

Then there’s the Rolls Royce wrapped in the Australian flag, the full page ads in The Advertiser looking for food and wine suppliers for her export business, and even a house to live in.

Not to forget the legal bunfight over a Robe Tce mansion, and some profoundly bizarre tweets.

It’s a laundry list of eccentricity, made more fascinating by the fact that Zou has done her best to avoid media scrutiny, all the while exhibiting exactly the sort of behaviour both personally and through involvement in the political sphere, which demands that we pay attention.

But she has gone quiet of late.

The 41-year-old’s Twitter feed lies dormant and empty, denuded of poetic calls to unite Australia and China in trade, and odes to her chosen state of SA.

Her ebullient full page advertisements in The Advertiser, sometimes welcoming former prime minister Malcolm Turnbull to town, sometimes putting out unorthodox calls for someone to find her a house to buy, or food and wine to export to China, have not graced these pages in months. And it seems, in the wake of the March state election, the rivers of gold flowing to the Liberals have run dry. Maurice Henderson – the state Liberal Party’s chief fundraiser – won’t even confirm whether she’s in town.

But our sources confirm she is. Albeit lying low. That is, apart from an ongoing spat over cherries: 32 tonnes of them, which Zou is arguing she should not have to pay Torrens Valley Orchards for, because they were unsaleable when she took possession of them. That issue may force Zou into the witness box next week, for a rare, and very public, appearance.

Sally Zou first shot to prominence in Adelaide three years ago when The Advertiser’s Tim Williams reported on the “arrival” of her daughter Gloria – a supposed child star in China who was to attend St Peter’s Girls’ School.

Details of Gloria’s birthday party, held on a superyacht at Sydney’s Pittwater, and attended by low-level television celebrities, added a touch of glamour, along with the fact that her mother, Sally, was reportedly a scion of a family which was among China’s steel mill super-wealthy.

Details of this supposed family wealth have never been reliably confirmed by the Australian media, and the publicity-shy Zou has never explained where her money comes from.

The party was attended by full page advertisements in The Australian newspaper, indicating strongly where Zou’s political allegiances lay.

“My Dear Uncle Geoff Brock, thank you! It is you, on behalf of the South Australian Government, who gave me the title of China-Australia’s friendship little angel,” a letter from Gloria, contained in the advertisement, says.

“Dear Uncle Tony Abbott, do you still remember me? That three-year-old girl you carried through China Town in Sydney? That seven-year-old Chinese girl who wrote you a welcome letter for your visit to China and got a letter back from you? It is you who lets me know ‘everyone is equal and China and Australia are like a family’.”

Details of Zou – or in Mandarin Zou Sha – are sketchy, even in her home country. Translations of Chinese websites contain a range of material purporting to be background information.

One account, of unknown accuracy, says she is from Jiangsu province, where she attended Nanjing Agricultural University studying agricultural mechanical engineering from 1995-99.

It says Zou enrolled for an MBA at Greenwich University, Norfolk Island, from which she graduated in 2002. However, the credentials of the institution, which was a distance learning enterprise, are disputed and an Australian Government review decided it did not meet standards expected of an Australian university.

But since Zou doesn’t speak with the media, it’s difficult to know the facts of her background. But before she arrived in SA, a couple of court cases reportedly raised doubts about her business practices. Her Australia Gloria Energy group was sued in 2012 for failing to ship coal from Newcastle to China, and ordered to pay about $US700,000. A year later, the company collapsed, and creditors were not paid.

Also in 2012, another Zou company, Australia Victoria Capital was ordered to pay nearly half a million dollars to a Chinese company it had failed to deliver coal to, despite being paid.

Back in SA, in 2015 her associate Malcolm Peters told this newspaper that Zou’s company AusGold had interests including gold mining leases around Broken Hill, and was soon to start production at a new granite mine in the Murray Mallee. Zou said she was likely to employ 70 people in South Australia, and was on the lookout for more investments here.

So far none of Zou’s mining ambitions have come to fruition – she appears to have only limited interests in very early stage tenements in SA – and her NSW project appears to have stumbled in the early stages.

A question without notice in the NSW parliament in March this year raised the spectre of unpaid wages at the project.

“Given that AusGold – a mine launched by the Minister in Sydney last year with business identity Sally Zou – has reportedly failed to pay wages and entitlements totalling more than $1 million to workers at the Good Friday Gold Mine near Tibooburra in far west New South Wales, will the Minister inform the House what steps he and his Government have taken to ensure that all outstanding entitlements will be paid in full?” MP Adam Searle asked.

But while Zou may have stumbled so far in reaching her ambitions on the business front, in terms of becoming a talking point for SA’s political and business classes, she has succeeded spectacularly.

After that initial burst of publicity, Zou appeared happy to retreat from the public gaze for a while. But then, on Australia Day, 2017, readers of The Advertiser might have wondered about Aus Diamond Group – which had placed a strip ad on the front of the paper, and a full-page ad on the back, with this suggestion: “Let’s propose a toast to .... a bright future. Wishing you a sparkling Australia Day.”

Less than a week later, Zou was to become news herself, landing on page three of this newspaper after it was revealed she was by far and away the state Liberal Party’s biggest donor. Her company, AusGold, had donated $100,000 to the federal Liberal Party. But it was the $310,000 she donated to the state Liberals in 2016-17 which really raised eyebrows, dwarfing the contributions by regular supporters such as former Clipsal boss Robert Gerard who donated $83,400, pastoral company patriarch Hugh MacLachlan ($50,000) and Coopers Brewery managing director Dr Tim Cooper ($20,000).

To find out more, this reporter located a mobile phone number for Zou, who was clearly surprised to be rung by a journalist.

That call, lasting all of a minute or so, and signing off with a promise to “call back”, remains the sole conversation this reporter has had with Zou, despite many, many attempts to contact her for comment for this story, and the many which have gone before.

After the news of the donations broke, former state treasurer Tom Koutsantonis was more than happy to take a swipe at the Liberal Party’s newest, and biggest, donor. A look at her website, both then and now, gives the indication of strong ties to the coal sector.

“Meet Steven Marshall’s SA Libs largest donor. Anyone surprised it’s coal?” declared Koutsantonis, also at the time the Mineral Resources and Energy Minister, on Twitter.

Zou responded with apparent sarcasm, expressing big thanks to Koutsantonis for the “very good job” with the “big surprise” of a free ad. “I’m so happy! Well done,” she said. “AusGold will invest in diamond, iron & copper mine in SA. Dear Minister Tom Koutsantonis, how can you help AusGold to make it happen?”

SAWeekend has established that Zou has so far donated more than $500,000 to the Liberal Party nationally in the past couple of years, to the federal party and at the state level in SA, WA and NSW. Her latest donation was $31,788.88 to the SA division on March 19 this year, just two days after the state election.

While she was the SA party’s largest donor by a very large margin – and her contributions provided a valuable war chest to the Liberals who had by then been in opposition for 16 years and were facing disgrace if they couldn’t get over the line this time – there was arguably a lot of political risk to be had in taking large donations from a Chinese donor of mysterious background and, as her tweets would attest, some eccentricity of character.

But the party has never shied away from taking her money. It came in large chunks, which meant it had to be declared as a “special return” for a large gift. It was also a gift for journalists, as was her practice of donating the money in amounts dominated by the number eight – considered auspicious and linked to prosperity in Chinese culture.

The last of these “special returns” was on 11/8/2017 – a donation for $81,188.88 from Zou’s company AusGold Exchange.

But while the money was no doubt helpful at both the state and federal level, a quirky donor whose bizarre and party-political tweets ensure she’s kept in the media’s eye, does not always bring the kind of attention you want as a politician.

They say idle hands are the devil’s plaything. In the case of this reporter it meant doing searches on the businesses interests of prominent Liberal Party donors. And why wouldn’t you start at the top?

That search in June last year led to a media request to our former foreign minister Julie Bishop’s staff which surely amused, then rapidly bemused them.

“Did the Minister have any interaction with, or know of the existence of, the Julie Bishop Glorious Foundation Pty Ltd?”

The answer was no, but not surprisingly, that was not good enough for the Federal Labor opposition, who found the notion of the “Glorious Foundation” uproarious and grilled Bishop in Parliament.

The company search also turned up another curiously named company owned by Zou, called Australian Earthly Paradise. That company was registered to 9 Tallisker Rd, Deep Creek – the address of a pristine 1.5km stretch of coastal property currently on the market for $2.5 million, which was not then and is not now owned by Zou.

Zou’s tweets had also served to keep her top of mind for media and politicians – she has a modest following but one dominated by those with influence in these circles. Many of the tweets, often soon deleted, were odd calls to action, or protestations of her love for South Australia. Others were just, well...

“If U shed tears when you miss the sun, U also miss the stars ... This world doesn’t believe in tear, U must fight against your weakness...”

And: “All the splendour in the world is not worth a good friend ... A lot of things, we can be touched, but cannot shed tears, Beauty needs no pencil.”

One of Zou’s final tweets, before her Twitter feed went dark months ago, and coming just a couple of weeks before the March 17 state election, was one which will live on in state political infamy for years.

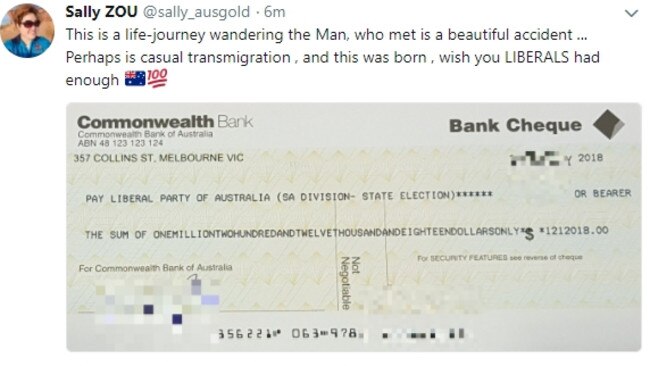

Late on a Friday afternoon, she tweeted out a Commonwealth Bank cheque, made out to the Liberal Party of SA.

It was for a staggering $1,212,018 and came with the message: “This is a life-journey wandering the Man, who met is a beautiful accident ... Perhaps is casual transmigration, and this was born, wish you LIBERALS had enough.”

Koutsantonis was on the ball, pointing out also via Twitter that the amount of the donation spelled out Mr Marshall’s birthday this year, January 21, 2018.

Unfortunately for the Liberals the money was never to surface. Questions about the appropriateness of taking foreign donations have gone unanswered, other than to say the party complies with the law. Nor has Marshall commented specifically on his relationship with Zou, despite several requests during the course of the events here depicted.

“I can confirm that Mr Marshall has met with Ms Zou, who operates Australian mining company AusGold and sponsors the Port Adelaide Football Club,” one typically anodyne response reads.

Zou’s image is certainly one synonymous with China’s new-rich. Confident, cashed up, and ready to make investments in Australian resources, food and real estate.

But reality does not have appeared to live up to the promise, at least from publicly-available information. In the middle of last year Zou ran into legal trouble, after backing out of the purchase of a stately mansion on Medindie’s millionaire’s row – Robe Tce.

Toop & Toop real estate agent Sally Cameron sued Zou, claiming she had failed to settle on a contract to buy Cameron’s sprawling property at 8 Robe Tce for $5.58 million in February.

The 4007sq m renovated property – which includes eight bedrooms, a main residence of 11 rooms, a renovated coach house, tennis court and swimming pool – was readvertised and sold two months later for $5.2 million.

Cameron’s lawyer said Zou paid two deposits totalling $250,000 but “defaulted” in her obligations to pay the balance of the purchase price for the property, which was built circa 1900 for then Mayor of Adelaide, Arthur Wellington Ware.

Cameron was seeking damages of at least $227,000, which included $130,000 being the difference between Zou’s contracted price and the resale price, less the deposit.

But lawyer Michael Durrant, of HWL Ebsworth, stated in Zou’s defence that his client was “induced to enter into the contract” on discussions with Cameron that she would be able to demolish the house.

“During the course of negotiations for the sale of the property, and prior to the defendant signing the contract, the plaintiff said words to the effect to the defendant that it would be possible to demolish the residence on the property and redevelop the site if she purchased the property,” he said in documents tendered to court. But he said the representation was “false” because the property was listed on the South Australian Heritage Register as a contributory item.

It was also argued that the case should be heard behind closed doors because of Zou’s “public profile”.

In effect, the contention was that Cameron, one of South Australia’s most highly regarded and experienced real estate agents, misled a purchaser into believing that a heritage-listed mansion on one of Adelaide’s premier blue ribbon terraces could be bowled over.

The case was later settled out of court, and the settlement, as is usual practice in these cases, remains confidential.

Investigations at the time revealed at least one other situation in which Zou was close to purchasing a property, then backed out. In that case the inability to build a golf course on the rural property was cited as the cause.

Clearly not happy with what was available on the market, a month after the Robe Tce revelations surfaced, Zou took a previously untried approach to buying real estate in SA.

In October last year she took out a double page ad in The Advertiser , putting out a call for her perfect property. In the advertisement for her company AusDiamond, Zou, who is the company’s proprietor, declared she was seeking “a home 20 minute’s drive from the Adelaide CBD” on “at least 3000sq m of total land”. She also flagged “a view to develop the property with minimum council approval”.

In the advertisement, Zou said she was “indeed an Australian resident”, was looking for a property in her “beloved South Australia”, and would also consider land without pre-existing dwellings. Her preference was properties with a 20- to 30-day settlement. The real estate industry was flabbergasted.

SAWeekend is not aware that Zou has succeeded in her property search.

Similar ads were soon thereafter placed calling for suppliers of wine, and then fruit and seafood, to be exported to China. Zou explained her intentions in a rare public statement, writing a column for The Advertiser. “Apart from making my home in Adelaide I am committed to the development of South Australia and to creating jobs here,” she wrote.

“As one who has made South Australia my adopted home I want the people of South Australia to share in my prosperity. To that end I have established two new South Australian based businesses — AusDiamond Mining and AusFood Alliance, which includes the Australian Romance Wine brand. As the names suggest, one will focus on diamond mining while the other is focused on food and wine exports to the world.”

That doesn’t appear to have gone smoothly, at least in one situation.

It’s now a case about cherries – 32 tonnes of cherries – which could see Zou sitting in a witness stand next week, explaining the financial intricacies of her company Aus Food Alliance, and why it doesn’t want to pay SA’s biggest cherry grower more than $400,000.

Torrens Valley Orchards’ Tony Hannaford is loath to talk about his dealings with Sally Zou until after the court case is wrapped up.

But The Advertiser is aware that a few cherry growers had early-stage chats with Zou about exporting their goods to China. Some shied away. Torrens Valley didn’t. Now the company is trying to get paid for its product, which Zou’s company will argue was not fit for sale.

The Supreme Court has, so far, been patient. Despite the matter taking some months to get to court, Zou only briefed her lawyer the day before the first court hearing in July. Lawyer David Elix said the debt was disputed, but was unable at that stage to articulate on what basis.

At the second hearing in early August Judge Graham Dart ordered that Aus Food produce a report which would show that it was solvent.

The third hearing was not until August 30.

Torrens Valley’s lawyers had expected at least a few days to peruse the report before going to court on Thursday, August 30. Indeed Brendon Roberts SC expected to get the document the previous Friday.

But the Court heard that Zou’s company did not even employ a forensic accountant to produce the report until the Monday of the week of the court hearing. Roberts cast strong doubts on the value of the report’s contents.

“We think that the prospect of this actually being true is extremely slim,” he told the court. “This, with the greatest respect, is fanciful.”

An example raised by Roberts was the prospect that Zou’s company generated more than $5 million in revenues from wine sales, on the basis of owning $190,000 worth of stock. The figures suggested a mark-up of more than 3000 per cent, he said. Zou has been given until at least September 14 to produce a report which is less “fanciful”.

And Roberts is determined to put her on the stand, to explain her company’s finances, and prove that it is solvent.

There are a few possible outcomes from the court process. Zou could pay the debt, and the matter goes away. Her company could be wound up, precipitating a process where more of her financial matters would be laid bare through the administration process. Or she could argue successfully that Torrens Valley delivered 32 tonnes of substandard cherries.

Should she be put on the stand, it will be the first time South Australians will get an unmoderated glimpse into the life of Sally Zou.

Based on what we’ve seen so far, it should be intriguing to say the least. ●

Additional reporting by: Renato Castello, Tom Bowden, and Tim Williams.