Federal Budget 2015: Hidden nasties you may have missed

WITH so many sweeping changes announced in the Budget, it’s easy to lose track. Here are the hidden nasties (and surprise sweeteners) that you may have missed.

Money

Don't miss out on the headlines from Money. Followed categories will be added to My News.

WITH so many sweeping changes announced in Tuesday night’s Federal Budget, it’s easy to lose track.

Here are some of the hidden nasties — and surprise sweeteners — that you may have missed.

THE HIDDEN NASTIES

● Climate change

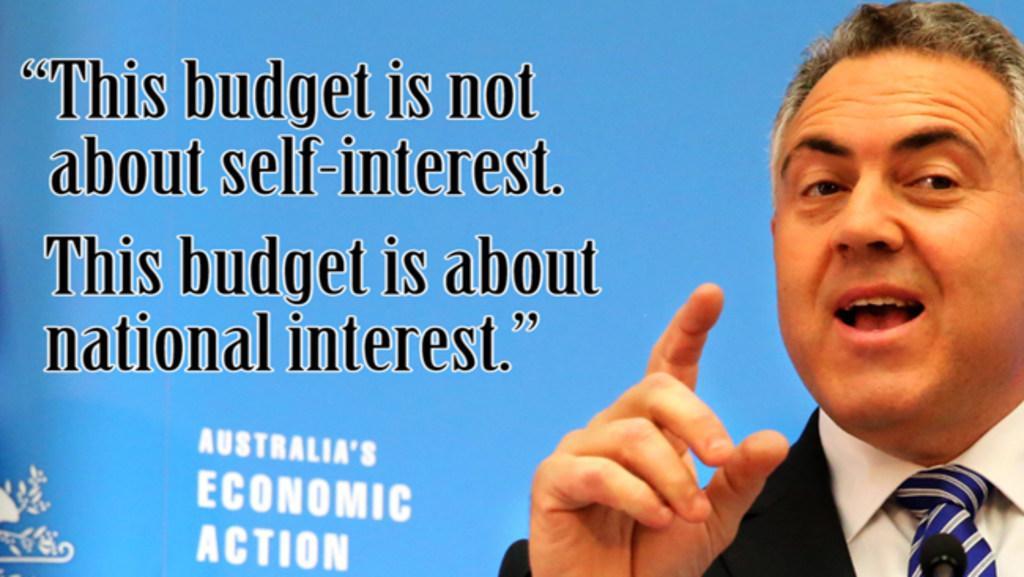

It’s fair to say that climate change is not a priority of the government in this Budget. The environment did not rate a mention in Treasurer Joe Hockey’s Budget speech and the amount of money devoted to climate spending has almost been halved. The government devoted $1.35 billion to climate change measures in 2014-15, but this has been reduced to $700 million in 2015-16. The funding level will dip to $500 million in 2017-18. The Budget also took the axe to the Green Army, the legion of tree planters who were a much vaulted part of the Abbott Government’s “direct action” climate policy. The program has been cut by $73.2 million in 2015-16, though it will still receive $701.9 million over the next four years. The National Landcare Program will also be trimmed by $12.3 million, and spending on the National Low Emissions Coal Initiative, which supports new technology to reduce carbon emissions, has been shaved by $3.4 million.

● The other taxes

We all know how much we get slugged in income tax, but it’s eye-opening to see just how much the government makes from what it calls “indirect taxation”. The GST is expected to pull in a massive $54.285 billion. On top of this, we shell out big for taxes on alcohol ($5.23 billion), petrol ($6 billion) and tobacco ($8.28 billion).

● Foreign aid

If you care about the welfare of Australia’s neighbours, you should know that the government has slashed the foreign aid budget by 20 per cent to $4.1 billion. Indonesia is the big loser, with its handout cut by 40 per cent, from $605 million in 2015-15 to $366 million in 2015-16. Aid to developing nations in Africa has been slashed by 70 per cent.

● Big families

Families with many children were entitled to a special tax break — the Family Tax Benefit A large family supplement — but this has now been axed. It will save the Budget $177.3 million.

● Arts

Sorry, arts lovers. Money for the $27 million National Program for Excellence in the Arts has been taken away from the Australia Council and handed to Attorney-General George Brandis. The budget for film funding body Screen Australia will also been trimmed $3.6 million over four years.

● FIFO workers

Aussies who fly in and fly out or drive in and drive out to work in remote mines can kiss goodbye the generous tax concessions they enjoy. The tax break is supposed to help out people living in remote areas, but the loophole will be closed for the 20 per cent of people who claim the offset but don’t actually live in those areas full-time.

THE SURPRISE SWEETENERS

● Employee share schemes

A lower-key measure that should make it easier for businesses to attract top-shelf staff is the tax concessions for employee share schemes. The reforms mean employees won’t have to pay tax on shares until they receive a financial benefit from those shares. Treasurer Joe Hockey said the change was “great for workers and it is great for innovative start-ups”.

● Youth Allowance boost

More young people, especially those from rural and regional areas, will be able to access Youth Allowance payments with the government vowing to simplify means testing from January. Some recipients of Youth Allowance may also end up with more money in their pockets.

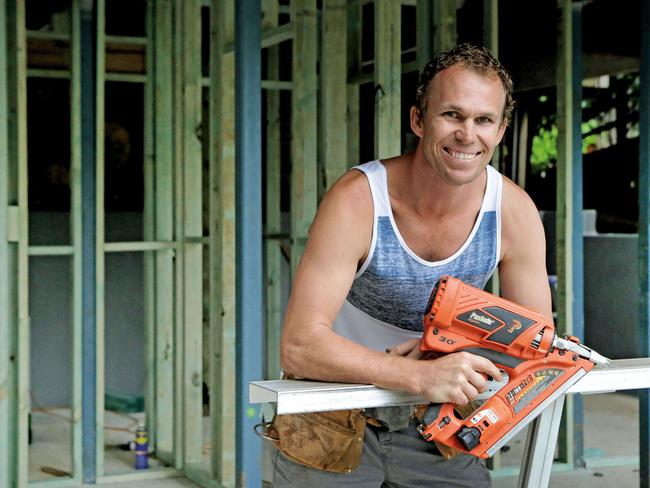

● $20,000 small business write-off

Small businesses with a turnover of less than $2 million per year will be able to claim back $20,000 for every piece of equipment they buy. For example, a tradie who buys new tools or a computer will be able to write off the whole lot as an immediate tax deduction.

● Nannies for shiftworkers

Shift workers such as nurses and police officers may be able access subsidised nannies thanks to a $246 million trial.

Originally published as Federal Budget 2015: Hidden nasties you may have missed