A Current Affair host Ally Langdon doubles down on CommBank criticism

A Current Affair host Ally Langdon has doubled down on her CommBank criticism, insisting the bank has “nobody to blame but themselves”.

TV

Don't miss out on the headlines from TV. Followed categories will be added to My News.

A Current Affair host Ally Langdon has doubled down on her criticism of Commonwealth Bank after her tense interview with executive Angus Sullivan prompted an overnight backflip.

Commonwealth Bank were smashed after announcing that millions of customers would face the $3 fee from January if they wanted to withdraw their own cash from one of the bank’s branches, with even the assistant treasurer calling the decision “the worst Christmas present imaginable”.

Appearing on Channel 9’s A Current Affair, Angus Sullivan, the executive behind CommBank’s retail banking services, attempted to defend the controversial fee.

The fee applies to customers with a Smart Access account who choose to withdraw cash at a branch.

Langdon grilled Mr Sullivan on Tuesday, insisting that it “doesn’t sit well with families who are struggling as our banks make billions”.

Aussies then woke on Wednesday to the news that CommBank were pausing the change.

“Customers weren’t going to cop it,” Langdon said on Wednesday night’s program.

“Angus Sullivan came on A Current Affair defending the decision.

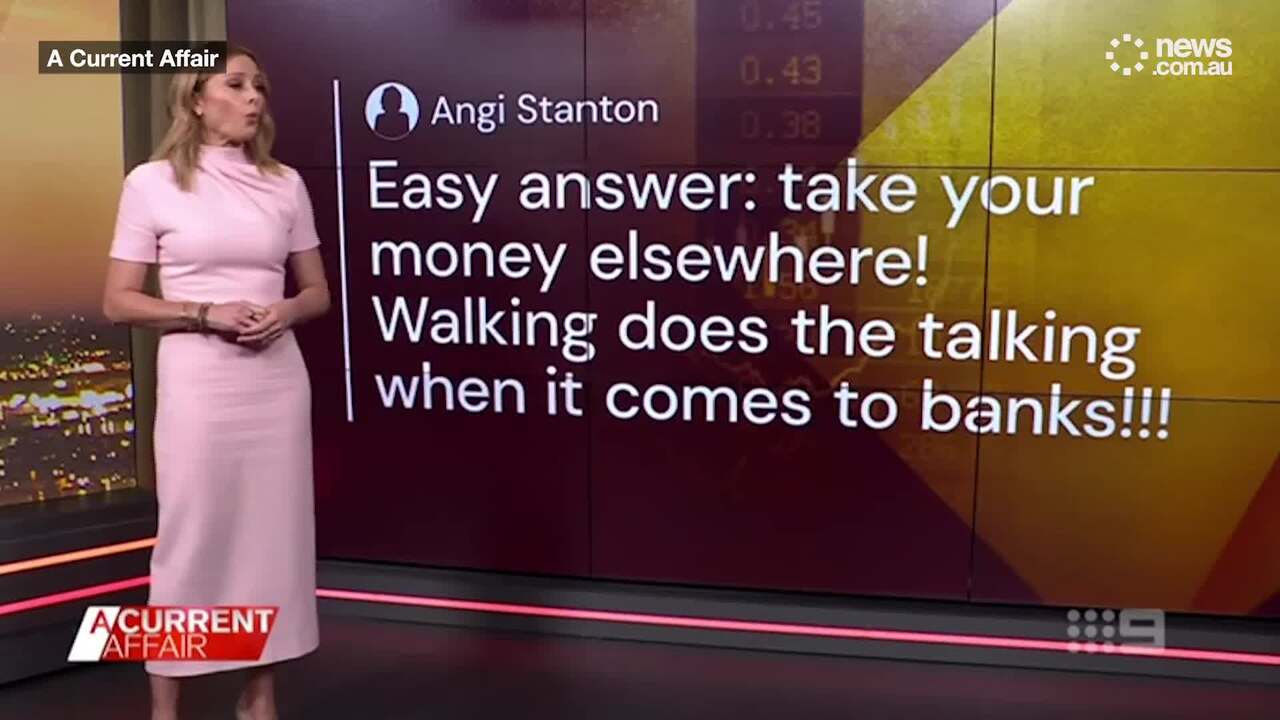

“That didn’t help, and the comments came flooding in.

“Kudos to CommBank for listening. However, it’s not scrapping the fee altogether, it’s just pausing those changes until it figures out another solution.

“So the question remains: How can a bank that raked in $9.8 billion last financial year justify charging customers to access their own money.

“It can’t. The damage from this, it just adds to the overall mistrust of the banks.

“They have nobody to blame but themselves.”

On Wednesday, Housing and Homelessness Minister Clare O’Neil said the charge was not fair or timely.

“I just think the government feels this is really unfair to customers, to Australians, especially just before Christmas,” she told Sunrise.

“Everyone’s had a bit of a tough year on the cost-of-living front and last thing they need is a kick in the guts from the Commonwealth Bank right before Christmas,” Ms O’Neil said.

The move “doesn’t seem fair or appropriate” given the bank had posted “huge profits” during a period when most Australians were struggling, she said.

“Come on, guys. It’s Christmas. We don’t need this right now.”

“This is not something the bank should be doing and we’re asking them to reconsider.”

Mr Sullivan issued a statement on Wednesday confirming the backflip, and admitting the bank had done a “poor job of communicating”.

“We have done a poor job of communicating this change to our customers. We are particularly conscious of the impact any change to planned fees and charges can have at this time of year especially given the cost-of-living pressures our customers face,” he said.

“The changes taking place are such that the approximately 90 per cent of customers we intend to move, and who we expect will be better off or the same, will be moved to the lower monthly fee account. If those customers don’t want to move, they can contact us to discuss their options.

“For the remaining customers we are changing our approach and we are pausing the migration. Instead, we will contact these customers over the next six months to discuss the most appropriate product for them given their needs.

“The changes outlined above do not affect approximately 9 million CommBank customers who are not on the Complete Access product.

“Commonwealth Bank maintains the largest branch network.

“Each of our branches has fee free ATMs and we have a moratorium on regional branch closures until at least the end of 2026.”

Originally published as A Current Affair host Ally Langdon doubles down on CommBank criticism