Speculation mounts some of Australia’s most iconic magazine brands are at threat of closure

They’re some of the best-known glossy magazines in Australia, but a new merger places many titles at risk of disappearing from shelves.

Books & Magazines

Don't miss out on the headlines from Books & Magazines. Followed categories will be added to My News.

Speculation is mounting about the fate of some of Australia’s most iconic magazines in the wake of Bauer Media’s purchase of Pacific Magazines.

It was announced yesterday that the German-owned publishing giant had acquired Seven West Media Group’s suite of titles in a deal worth $40 million.

Now, attention has turned to which brands will survive in the new consolidated landscape, where dwindling circulation and plummeting advertising revenue have become the norm.

The Daily Telegraph today quotes industry insiders as saying closed door meetings are already taking place, in scenes described as “the Hunger Games”.

“They’re not going to keep two magazines that essentially sell the same thing,” the source told the newspaper’s Confidential section.

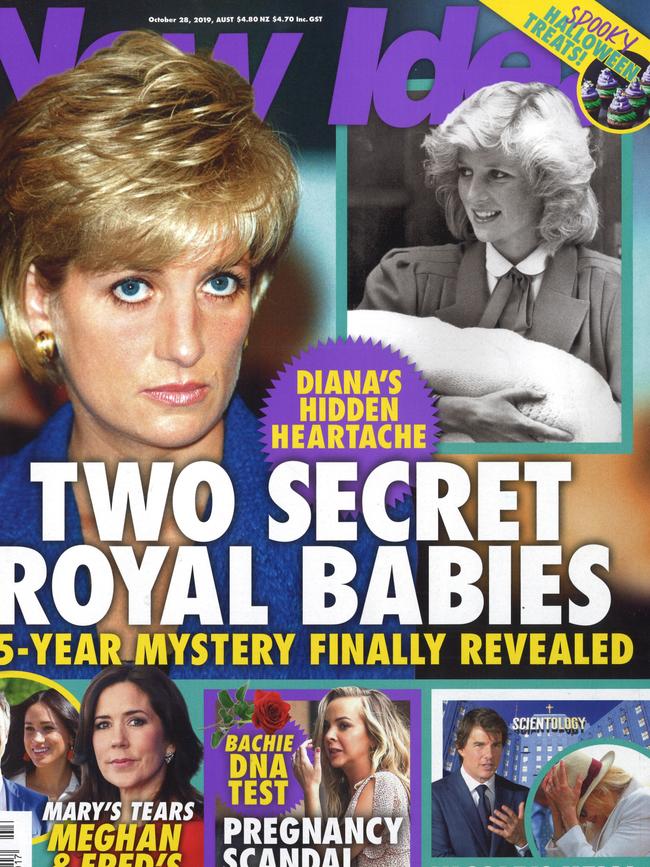

One touted merger is of New Idea from the Pacific Magazines camp and Woman’s Day, published by Bauer, into one new title, the newspaper reported.

Yesterday, Bauer Media chief executive officer Brendon Hill denied any magazines were on the chopping block.

Vivienne Kelly, editor of the media and marketing website Mumbrella, said there was too much crossover between titles, particularly in the celebrity space, for that claim to be true for long.

“I’m not sure many people believe that,” Kelly told news.com.au.

“They’re now going to have NW, New Idea, OK, Woman’s Day, Who … that’s so much duplication, so many journos writing about the same things and trying to pitch their covers to the same pool of consumers. There will have to be some consolidation.”

Some of those smaller titles could be among the first the join forces in a bid to expand one’s potential reach to an increasingly small pool of readers.

“There’s not much business sense in having two teams of journos sitting there dividing that pie,” Kelly said.

“It makes more sense to come together with one team to make one stronger brand rather than cannibalise the audience.

“Otherwise, it’s a lot of stories about Jennifer Aniston apparently being pregnant. They could get that number down a bit.”

But as for the merger of Woman’s Day and New Idea, the second and third most-read paid magazines respectively, Kelly doesn’t see that occurring.

“That one seems less likely to me. It feels like an odd combination.”

James Manning edits the industry website Mediaweek and told news.com.au he doesn’t expect any closures in the short-term, with Bauer likely to let the dust settle before making any decisions.

“The (Bauer) CEO told us that he expects all of the editorial staff to come across,” Manning said.

“In these things, there’s usually some sort of consolidation of back office teams — you don’t need two of everything.

“There could be a time but I don’t think it’s now. If they can shave off some of the cost bases for each of the titles, I think their futures will be guaranteed for a while longer.”

Bauer Media hasn’t been shy in ruthlessly cutting its underperforming titles, including some of the most iconic glossy magazines Australia has known.

Cleo, Cosmopolitan and Dolly are just some of the premium brands that have been axed, along with Madison and Grazia.

“Brands we thought would never go away have gone by the wayside, particularly in women and teen demographics,” Kelly said.

It has also centralised its digital teams to reduce costs, as well as merging functions across its print workforce, axing jobs in the process.

“There’s speculation that that model could (be expanded), where they could have one celebrity newsroom that does everything across titles,” Kelly said.

“Rather than being a NW journo or a New Idea journo or a Woman’s Day journo, you’re a celeb writer in a silo that shares content and resources.”

It hasn’t been all cuts and consolidation at Bauer, with the company also investing in magazines that are performing in recent times, including expanding the TV WEEK brand and purchasing a number of specialty titles from News Corp Australia, which publishes this website.

In the latest financial year, Bauer Media’s books were back in the black, with the German-owned company posting a modest $6.3 million profit for 2018-19.

That gives the operation some much-needed breathing room to focus on its core business, although advertising revenue is down sharply.

With yesterday’s confirmed acquisition, Bauer Media also purchases a company that’s in a much better position than it was just a few years ago, thanks to the shuttering of underperforming titles.

Manning said current Pacific Magazines boss Gereurd Roberts “has done a good job” in cutting costs and consolidating operations.

“Pacific is in a state where Bauer wanted all the brands — they didn’t come in and pick and choose,” he said.

The new mega-publisher is now in a stronger position to weather the storms on the horizon, he said.

But publishing in general remains a tough sector, Manning said, with the long-term trend line for magazines “not looking good”.

Professional services firm PwC released its Australian Entertainment and Media Outlook report earlier this year, forecasting likely growth trends through to 2023.

In it, it described the “scale and frequency of titles (as being) unsustainable in an era of ubiquitous access to similar content at zero cost”.

“The dominant Australian publishers, Pacific Magazines, Bauer Media and News Corp, have had to diversify their revenue streams so much that the masthead brand is the core product, and the medium by which it reaches consumers, be it social media, events and activations, website or the traditional magazine product, is very much secondary,” the report said.

Bauer Media was approached for comment.

The acquisition of Pacific Magazines is likely to be finalised at the end of this year or in early 2020, pending regulatory approval.

Originally published as Speculation mounts some of Australia’s most iconic magazine brands are at threat of closure