Woman reveals $10,000 nightmare as Aussie rage over tax returns

One woman’s tax return nightmare has left others terrified of completing their own tax this year, as furious Aussies lash out at the ATO.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

As more people complete their tax returns, more horror stories are coming to light – and many Aussies are really not happy.

If you logged on to do your tax this year expecting a nice return only to discover that you actually owe the ATO money, then you are not alone.

Many Aussies have been shocked to discover they are actually facing a tax debt this year instead of the refund they expected and, as is the done thing in 2023, they have taken to social media to express their outrage.

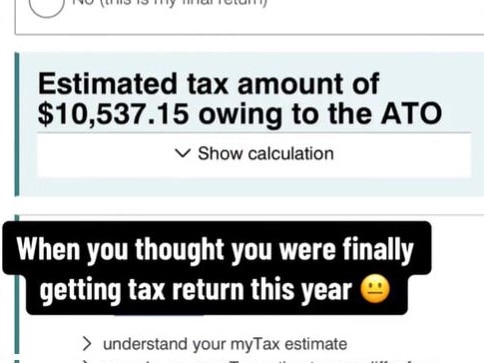

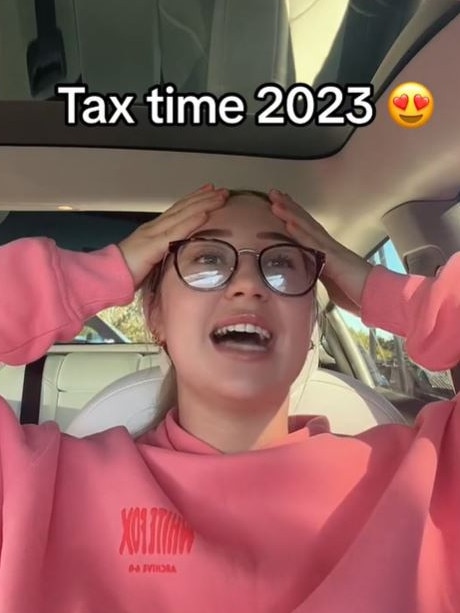

A food blogger, who goes by the name Rai foodie online, left her followers horrified when she revealed she owed an estimated $10,537 to the tax office.

“When you thought you were finally getting a tax return this year,” she captioned the TikTok video.

Her video instilled fear in the social media users who are yet to complete their returns, with one person noting, “I’m scared to do mine this year”.

“See this why im avoiding my tax bro,” another said.

Others commented that they would “die” if they got that kind of tax debt, with another branding the situation “heartbreaking”.

Cameron Smith is another Aussie facing a large tax debt this year, revealing he owes $6562 to the ATO.

“Thought I’d get a trip to Europe but NO, the government says otherwise,” the Adelaide local captioned the TikTok video.

Melbourne man Andrew Truong has found himself in a similar situation.

“I really wish this was a joke, I hate HECS,” he wrote online after finding out he owed $5018.

Another worker, who goes by Abbs on TikTok, issued a warning to other Aussies with HECS debt after receiving an unexpected bill from the ATO.

“I just did my tax return. If you work in healthcare and have a HECS debt do not, I repeat, do not get Remserv until you have f**king paid off your HECS debt. I was mortified,” she said.

Remserv is one of the top provides in Queensland for workplace benefits such as salary packaging.

However, for those still paying off a HECS or HELP loan, salary packaging can mean you may get an unexpected bill come tax time.

The 21-year-old revealed she wasn’t educated on how salary sacrificing can impact you come tax time if you have a HECS debt and now owed the ATO an extra $3249.

“Are you kidding? I actually want to cry. That is what I wanted to get back and now I am f**king paying it. I paid $18,000 in tax and I have to pay another $3000 in tax,” she said.

“F**k the tax department.”

The end of the low-and-middle income tax offset (LMITO) has undoubtedly contributed to the fury being felt by Aussies this tax time, with a lot of people now confronted with the reality of what this actually means.

Introduced as a temporary measure in the 2018/19 federal budget, the offset meant those earning between $37,000 and $126,000 were eligible for a tax cut of up $1500.

Now that it has expired, many Aussies are realising just how much they relied on that extra boost come tax time.

A recent Finder survey of more than 1000 Aussies saw one in three people reveal this year’s tax refund is very important or critical to their financial health.

The research found 15 per cent of Australians will be using their refund to pay for household bills, five per cent will be putting it towards their mortgage, and 4 per cent will use it to pay off existing credit card debt.

Alison Banney, money expert at Finder, said the current economic situation meant the reliance on tax returns has never been higher.

“Whether it’s to pay back debt, boost their savings, or help with everyday expenses, millions of Australians are relying on a refund,” she said.

“However, with the removal of the Low and Middle-Income Tax Offset (LMITO) this year, lots of Australians will likely get less money back in their tax return this year compared to the last two years.”

Ms Banney urged workers to make sure they are claiming for all eligible deductions, noting many will be able to claim working from home expenses.

“The ATO has introduced a revised fixed rate method of 67 cents per hour that you worked from home – for example, I’ve worked from home full time this past year. After removing weekends and 9 public holidays, I’ve spent 251 days working from home,” she said.

“At 8 hours a day, that’s 2,008 hours. I can claim 67 cents for each of these hours, which works out to be a deduction of $1345.36.”

Originally published as Woman reveals $10,000 nightmare as Aussie rage over tax returns