Woman loses $35k to scammer using Westpac’s phone number

A scammer using Westpac’s real phone number has conned a woman out of almost $35,000 and she doesn’t want it to happen to you.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

An Australian journalist has become a victim of an elaborate scam that used legitimate Westpac bank phone numbers to steal almost $35,000.

It all started when Jessica Ridley received what appeared to be an automated text about a suspicious transaction on her account. In response, the 33-year-old immediately called Westpac but the line was busy.

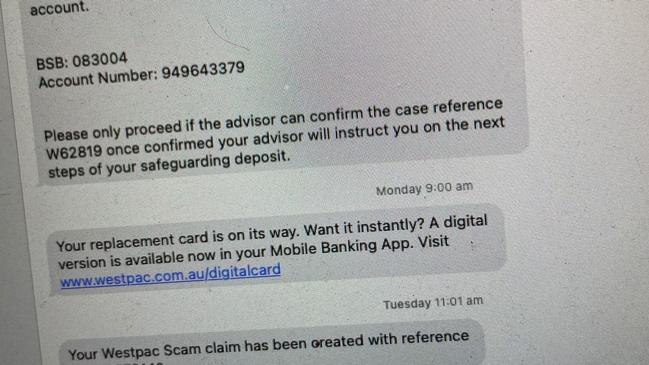

Only minutes later she received another text saying she would receive a call from the “fraud department” and that she would need quote the reference number in the message.

The most shocking part was, the messages and calls that would follow came from legitimate Westpac numbers.

“I got legitimate messages from Westpac on the same message thread as these fake ones, so I couldn’t distinguish the difference,” Ridley, a small-business owner and television presenter, told news.com.au.

A man posing as a Westpac employee named Owen Clancy then called Ridley and cited the case number she had received via text and went through other checks and balances, before informing her the bank had picked up suspicious activity on her account.

The account in question was used for her small business, By The Way Media.

She was told her MasterCard would be cancelled. He then wanted to check she had not been a victim of identity theft due to “a lot of scams around” and ran through some popular scams.

An Australia Post scam he mentioned was familiar to Ridley and he could detail a scam email she had received previously.

After running further “checks” it was determined her account had been accessed by another phone and Westpac needed to move her to a “level three safeguarding plan”.

“Over the space of an hour he took me through the steps of setting up new accounts,” Ridley explained, during which money was shifted between accounts.

She lost $33,771 in two transactions.

“He called me later in the afternoon to confirm all my accounts had been set up … it was not one call it was numerous calls on this Westpac number,” Ridley said.

During this time, the mother of one had ended up in hospital with her young son after he broke his arm at daycare.

“(The fake Westpac employee) was empathising with me and saying ‘it sounds like you’re having a really hard time, I don’t want to bother you. We just want to check you’re happy with the same pin code. We’ll have the internet banking team call you tomorrow at 2pm,” she said, explaining how organised the bank appeared.

This unfolded on Friday and it wasn’t until Monday that Ridley realised what had actually happened.

“My heart just stopped and I felt sick,” she said.

When Ridley couldn’t get into her account she called the same number the scammer had called her on and she reached the real Westpac – which had absolutely no idea about the case number she was quoting or any new accounts.

“I became paranoid I was speaking to the bank because I said ‘I’m calling you on the number that has kept calling me’. How does this happen?”

Communication between Ridley and Westpac, seen by news.com.au, confirmed the bank would reimburse her the money she had lost out of “goodwill”.

It also confirmed the SMS and phone calls received were not from Westpac and were in fact a third party imitating the bank using a method called caller ID spoofing.

According to the Australian Communications and Media Authority, call line identification overstamping, where person calling you displays a different number from the one they are calling from, is legal unless it is being done for unlawful or malicious purposes. This is called caller ID spoofing.

ACMA advises hanging up and calling the actual organisation if you are suspicious of this.

Westpac told news.com.au it was unable to comment on individual matters but there had been a rise in reported scam activity.

“Westpac invests heavily in scam prevention and has robust processes in place to alert and protect customers. We work hard to recover money for customers where possible,” a spokeswoman said.

“Customers should be wary of any unexpected calls, text messages or emails claiming to be from their bank or other reputable organisation, and always stop to consider what they are asking for.

“If in doubt, ask for a reference number, and call back on a publicly listed number to confirm if the call was genuine. Your bank will never ask you to click a link to log into your banking or make a payment.

“If you think you may have been scammed, contact your bank immediately. Westpac customers can call 132 032 to seek assistance or report suspicious activity.”

Originally published as Woman loses $35k to scammer using Westpac’s phone number