Why NAB’s profit strength is also its biggest weakness

More than any other bank, NAB needs the economy to stay on track. And boss Ross McEwan knows it.

One of National Australia Bank’s biggest strengths is also its vulnerability. And seasoned chief executive Ross McEwan is acutely aware of this.

Since taking charge of NAB in late 2019, the former Royal Bank of Scotland boss has been doubling down on lending to business: be it the top end of town or to the smallest corner shop.

And coming out of the Covid-19 pandemic as interest rates have been pushing sky high, business lending has been the area that’s shown surprising resilience.

All businesses have been borrowing up big to build out more capacity, even as higher rates have squeezed the pace of home lending.

Now for the first time, NAB’s $256bn small to mid-sized business lending book has overtaken NAB’s home-lending book ($240bn).

There’s good reason for McEwan’s chase for business.

Business lending delivers thicker margins and this means the returns are higher, albeit generally more volatile.

Every dollar of invested capital in NAB’s business book on average delivers a return 2.25 per cent, compared with the retail bank of 1.8 per cent.

It’s this simple equation that has been the reason NAB has commanded a hefty share premium over rivals ANZ and Westpac. In recent years NAB has overtaken Westpac as the second-biggest bank by market capitalisation, at $92bn.

Underweight retail

NAB has traditionally had a grip on business, particularly in the small and mid-sized market, where it dominates with a 22 per cent share. However, the bank’s Achilles heel has long been its relative small position in retail banking. This means NAB doesn’t have access to the big licks of cheap deposits like Commonwealth Bank or Westpac have, that comes along with mortgage customers or cashed-up retirees.

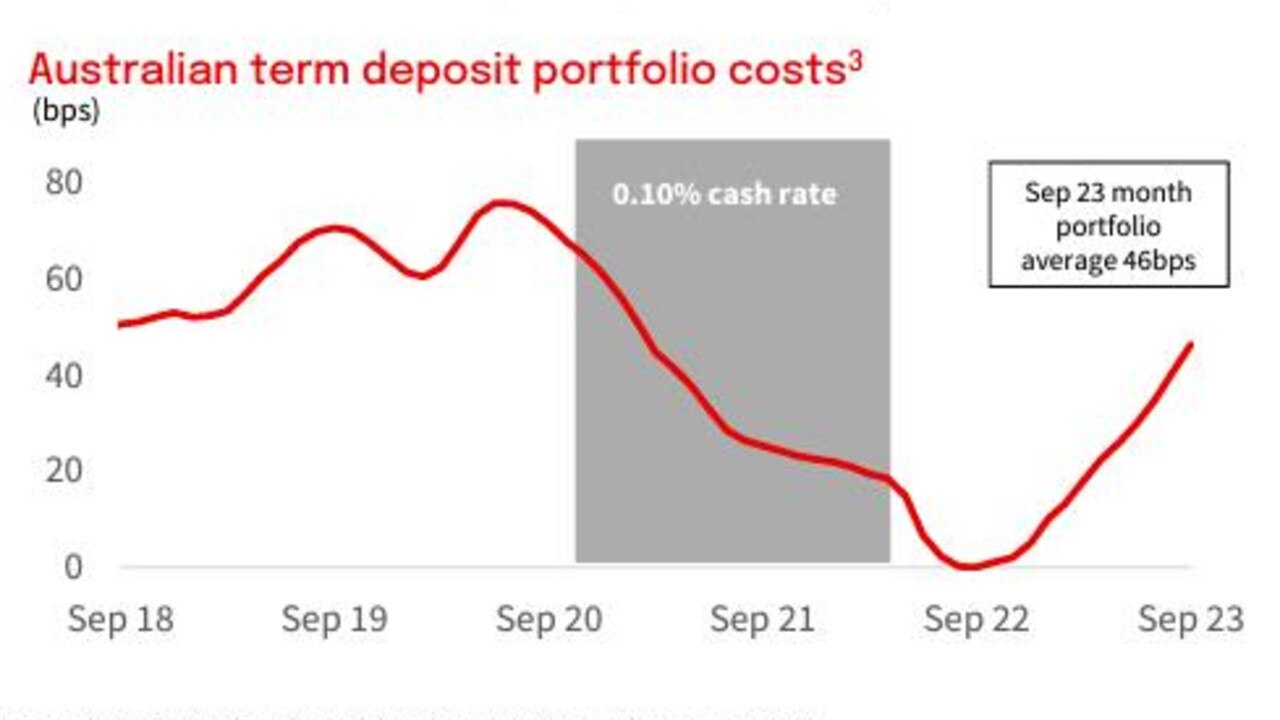

NAB has to rely more on expensive term deposits to fund its lending book and that comes at a cost to profit margins. McEwan tells The Australian he is now attempting to counter this by using his business franchise to generate more deposits.

But this will take time. Businesses don’t like to sit on cash piles and usually they don’t like locking their cash away in term deposits.

And being so closely tied to broader business confidence means the bank itself is more sensitive to economic cycles.

Indeed before Covid-19, and for much of the time since the global financial crisis, business borrowing in Australia had been anaemic, coming in at barely low single digit growth.

During this period NAB responded by trying to find growth by chasing a booming home market and this has often had mixed results.

Growing faster then anyone else in a fiercely contested mortgage market usually meant that price was the only real lever that could be used. And undercutting rivals on price was part of the reason NAB had been a perennial profit underperformer.

Down to business

But McEwan chose to push NAB back to business given this represents the profit engine room.

He’s been directing more funding into business lending and putting on more bankers where relationships are important. Additional capital means more lending capacity, and so far NAB has added nearly $34bn in loans – up 31 per cent – over the past three years, helping to keep profits booming. By comparison, NAB’s mortgage book expanded 14 per cent over the same period.

McEwan says the strategy is all about making “deliberate choices about where we want to invest and grow”.

“It goes back to the fundamentals of running a business. There are two scarce resources in banking: capital and liquidity. And if you’ve got options, put them to work on behalf of customers and shareholders,” he says.

“When I’m getting what I’d consider to be a sub-optimal return out of a mortgage”.

This doesn’t mean NAB was out of home loans: “We’re in the mortgage market we’re just not growing as we used to do, we will grow when the time is suitable.”

Comes with risk

McEwan knows the strategy also comes with risk.

Australia’s home lending market has been a constant – even though it has slowed sharply in the past year. And despite all the noise, lending losses in Australian mortgages have been historically very, very low for banks. Businesses more likely to lead bad debts during an economic downturn. And the business losses tend to be higher.

Over the past year NAB’s bad-debt charges in business have jumped at a faster pace than home lending, although they continue to be at a historically low level.

McEwan was speaking as NAB delivered a solid 8.8 per cent jump in cash earnings to $7.1bn.

The result shows the business push including fast-paced long growth, is delivering on earnings. NAB’s full year dividends were up 16c a share to $1.67, making them the highest since McEwan took charge.

Still, the results showed NAB is feeling the squeeze on interest margins more so than its bigger rivals Commonwealth Bank and Westpac.

Indeed, heavy competition across mortgages and higher deposit costs meant margins were off seven basis points on the March half. Westpac by comparison was off two points.

McEwan says there’s been “very, very good growth” in business banking over the past 36 months and he sees more coming.

The higher returns generated from business have also allowed him to invest money into other parts of NAB’s operations, he says. This includes building out the retail business after buying US bank Citi’s Australian arm last year for $1.2bn. That deal has given NAB a big boost in credit cards.

However, with the official cash rate now likely to be higher for longer he knows future growth hinges entirely on the health of his customers.

“We are reliant on our customers growing. If they slow down, our growth will slow down,” he says.

Optus ‘failure’

First half numbers released by Optus owner Singapore Telecommunications show this week’s massive network outage is likely to compound financial pressures already building in the Australian offshoot.

Optus’ enterprise business, that sells telco services to corporate clients and is overseen by former NSW Premier Gladys Berejiklian, remains a weak spot for Optus.

As the Australian telco got its network up and running again after Wednesday’s 10-hour outage of mobile and broadband, it’s a matter of counting the cost. With network reliability such a key selling point among telcos, brokerage UBS believes fallout from the outage could be worse than last year’s ransomware attack against Optus. There Optus lost more than 65,000 customers at the peak, but the telco returned to net subscriber growth within three months time.

Business however will be less forgiving and the idea that hospital networks or transport operations were also thrown into chaos from the outage will mean Optus faces a battle keeping big clients onside, likely to lead to share losses.

For mobile the outage weakens Optus’ ability to raise prices. Telstra is widely expected to be the biggest winner of the Optus drama.

The latest accounts showed Optus got a revenue bump from new subscriptions to Optus Sport due to the Women’s World Cup where it had the local broadcast rights. Mobile customer numbers were up, adding 167,000 in the first half, with most of these going to its discount prepaid brand amaysim.

Optus boss Kelly Bayer Rosmarin last Thursday pointed to an unnamed “network event” that triggered a “cascading failure” of equipment which resulted in the shutdown of services. Even so, customers were still in the dark over why it happened and whether it will happen again. Offers of free data from Optus is unlikely to win back the big data users.

Optus’ revenue was up 1 per cent to $4.02bn, for the six months to end-September, but pre-tax earnings were down 14 per cent to $141m with enterprise earnings hit. Optus saw a drop in business customers.

Singtel has outlined a program to drive a 15 per cent reduction in core costs over the next three year’s and Optus is expected to be part of this. Even so, Optus will receive the lions share of Singtel’s planned $2.4bn capex spend in the coming year, with $1.6bn of this earmarked for Australia as part of the 5G network upgrade in Australia as well as bolstering cybersecurity.

Singtel too revealed a 26 per cent hit to free cashflow due to a one-off payment to Optus insurance during the first half. This suggests the company was self insured and carried much of the exposure to last year’s cyber attack. Singtel did not respond to requests to comment.

At a group level, Singtel posted flat earnings of $667m for the September half, while revenue rose 2 per cent.

johnstone@theaustralian.com.au

More Coverage

Originally published as Why NAB’s profit strength is also its biggest weakness