Where the smart money is for institutional investors as geopolitical tensions rise

Data centres, airports and commercial property are sectors which could prosper for institutional investors in a world of political uncertainty, a report by IFM says.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Data centres, airports and commercial property in Australia are among investment areas which could do well for institutional investors in a world of political uncertainty in 2025, according to a new report from the $222bn super fund investment firm IFM Investors.

Owned by most of Australia’s big industry super funds, IFM Investors warns in its inaugural Private Markets Macro Outlook that political and geopolitical risks will become increasingly important for investors in future, particularly affecting the future of listed markets.

It also says that persistently high global rates will make investing in bonds less attractive.

But it argues that there are good opportunities in unlisted markets with more long-term investments including infrastructure, private debt and private credit.

“We believe data centres will continue to experience rapid growth and ongoing investment opportunities after a number of high-profile transactions over the last two years,” the report says.

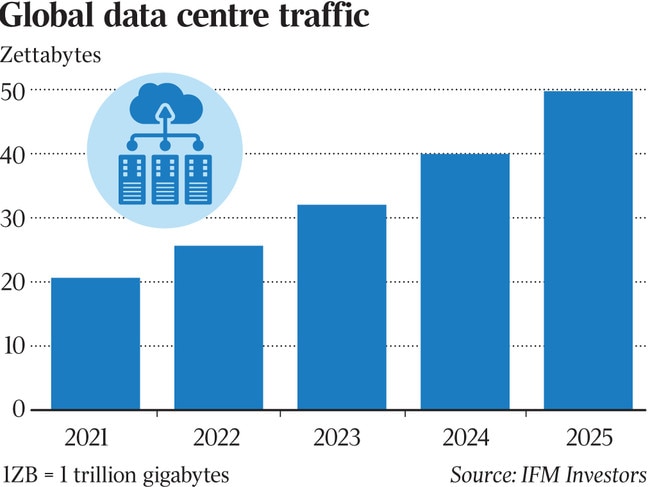

It says global data centre traffic is set to reach 49.7 zettabytes in 2025, continuing a compound annual growth rate of around 25 per cent since 2016.

The report says IFM’s survey of investors in private markets shows almost half those questioned believed digital infrastructure would be an important theme in private investing in 2025. It says there will also be “an appetite for connecting emerging renewable projects to the grid and charging infrastructure for the growing number of electric vehicles on the roads.”

The report says it believes airports could be good investment opportunities for institutional investors, given the recovery in global air travel.

“Potential upside in GDP growth will aid seaport, toll road and airport volumes,” it says.

“We believe global aviation will continue to perform strongly, benefiting airports and associated infrastructure. Despite recent high inflation, and associated cost-of-living pressures, leisure travel will drive the growth of passenger volumes.”

IFM has stakes in airports in Darwin, Brisbane and Perth as well as Manchester and Vienna.

The report says the commercial office block sector in Australia may be set for a recovery, with more deals ahead for the sector as investor sentiment improves,

“While we do not believe that the real estate market (in Australia) has fully normalised, we believe we are at or near the bottom, subject to the asset class and location,” it says. “We anticipate we will see the beginning of a recovery as commercial office assets begin to experience stabilised valuations and inflation continues to feed through contracted lease revenues.

“While the recovery in the segment may be modest, demand for real estate ... demonstrates a significant turnaround from the experience of the past few years. Greater confidence in valuations and asset prices will likely continue to lead to further transaction activity and encourage a greater number of investors to begin allocating to the sector again on a selective basis.”

Established more than 25 years ago, IFM Investors has specialised in investing in infrastructure, worth more than $110bn, mainly in infrastructure in Australia, Europe, the UK and North America. It also has an expanding interest in private debt and credit as it invests money for more than 700 global pension funds and institutional investors.

IFM is predicting that interest rates in Australia will remain “relatively high” in 2025 with the Reserve Bank not rushing to cut rates with unemployment rates low and inflation still an issue.

It says the higher interest rate regime in Australia should mean the private credit market in Australia “will potentially be able to offer returns not available in overseas jurisdictions”.

“While some financing for such growth may come in the form of equity and a larger number of IPOs or capital raises, a significant proportion of it will be funded through debt,” it says.

But it says that it will continue to be cautious about investing in companies which have staff shortages “as Australia continues to see peak employment”.

“As the tight labour market will continue to cause inflationary pressures, this will also impact the financial health of companies within the services sector and act as a key impediment to growth and investment.”

It says a key focus of infrastructure investment will be linked with the current trends of digitisation and decarbonisation.

“2025 will likely see political and geopolitical risk awarded equal importance, as the world weighs up the impact of the incoming US administration on trade policy, but also the ongoing wars in Ukraine and the Middle East,” IFM Investors chief economist Alex Joiner said.

“How the US administration deals with actual, as opposed to economic, conflicts – notably Russia-Ukraine and in the Middle East – will also inject uncertainty into the outlook.”

Mr Joiner said investors in 2025 would need to consider the growth and inflationary implications of the policies of the Trump administration.

He said expected tailwinds for investors included improving economic conditions, robust government spending and support for infrastructure, decarbonisation efforts, rapidly expanding electricity demand, and the need for more and improved digital infrastructure: “These projects often remain resilient during economic cycles due to their essential nature.”

IFM sees the US to be one of the strongest developed economies globally with the outlook “slightly above trend”. Growth in Japan, UK and the eurozone are expected to be “at trend”, while China is expected to grow slightly below its current target.

It predicts equities exposure will remain preferable to bonds, despite an expectation that gains in equity markets will be far more measured in 2025.

“Equities have seemingly priced in many of the pro-growth economic initiatives from the incoming administration, largely tax cuts, and less of those impeding it,” Mr Joiner said.

“This has resulted in US markets in particular having stretched valuations against most metrics and against current economic performance.

“At least to some degree earnings and economic performance will need to come through in 2025 to justify markets moving higher again.”

Originally published as Where the smart money is for institutional investors as geopolitical tensions rise