Westpac again raises fixed mortgage rates

Westpac has lifted its fixed rates for the third time in four weeks as the major banks retreat from record low lending rates.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Westpac has lifted its fixed rates for the third time in four weeks as the major banks retreat from record low lending rates eagerly snapped up by borrowers.

The big bank moved to hike its owner-occupier and investor rates, leaving no loan package on offer for less than 2.24 per cent.

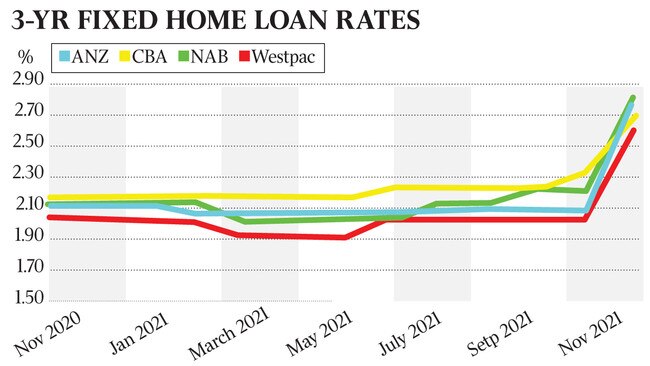

Westpac’s three-year fixed rate loan saw the largest lift in borrowing costs, up 0.3 per cent.

The increase, while small, pushes the potential monthly repayments on a $500,000 loan up by $78 per month.

The changes affect both owner-occupier and investor rates across the Westpac Group including St George, Bank of Melbourne and BankSA.

The hike comes as the Reserve Bank of Australia on Tuesday said a cash rate rise in 2024 remained its “central scenario”.

“The economy and inflation would have to turn out very differently from our central scenario for the board to consider an increase in interest rates next year,” Governor Philip Lowe said.

Meanwhile, Westpac’s rush illustrates the rapid pace at which banks are rethinking their lending rates as they look to backstop margins in the face of offshore funding cost hikes.

Westpac joins a throng of other lenders, with 16 banks pushing up fixed rates at least twice in the last month.

Westpac first increased two- to five-year rates by 0.10 per cent on October 19, before upping three- to five-year rates by between 0.10 per cent to 0.21 per cent on November 4.

RateCity research director Sally Tindall said banks had “hit the accelerator on fixed rates”, with many moving to raise rates faster and more often.

“At first, the fixed rate hikes were isolated to longer-term rates, but now banks are lifting across the board at an extraordinary pace,” she said.

“These fixed rate hikes are more than speculation the cash rate could rise earlier than expected. The cost of wholesale funding is increasing, and the banks have decided it’s not sustainable to keep fixed rates at ultra-low levels.”

Ms Tindall said although the cash rate had not yet moved, the cost of wholesale funding was rising and banks were being forced to respond.

“The cost of wholesale funding is increasing, and the banks have decided it’s not sustainable to keep fixed rates at ultra-low levels,” she said.

“Customers waiting in the queue for their fixed loans to settle will be rightly frustrated at these rapid rate rises, unless they had locked in their rate.

RateCity data shows there are now just under 100 fixed rate loan available on the market with an interest rate under 2 per cent, compared to 180 in April 2021.

Like Commonwealth Bank and ANZ, Westpac now has no advertised fixed home loan rates under 2 per cent. Only NAB has one fixed rate starting with a ‘1’.

Originally published as Westpac again raises fixed mortgage rates