Two Adelaide office towers fetch $84m as investors shrug off Covid concerns

Two office towers in the Adelaide CBD have sold for a combined $84m as investors shrug off concerns about the long-lasting impact of Covid-19.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Investors appear to be shrugging off concerns about post-Covid demand for office space, with buyers splashing out more than $80 million on two towers in Adelaide’s CBD.

Boutique investment house TAMIM Asset Management has paid $41 million for the home of Australian Red Cross at 30 Currie St, while a local private investor has snapped up the BankSA headquarters on King William St for $43 million.

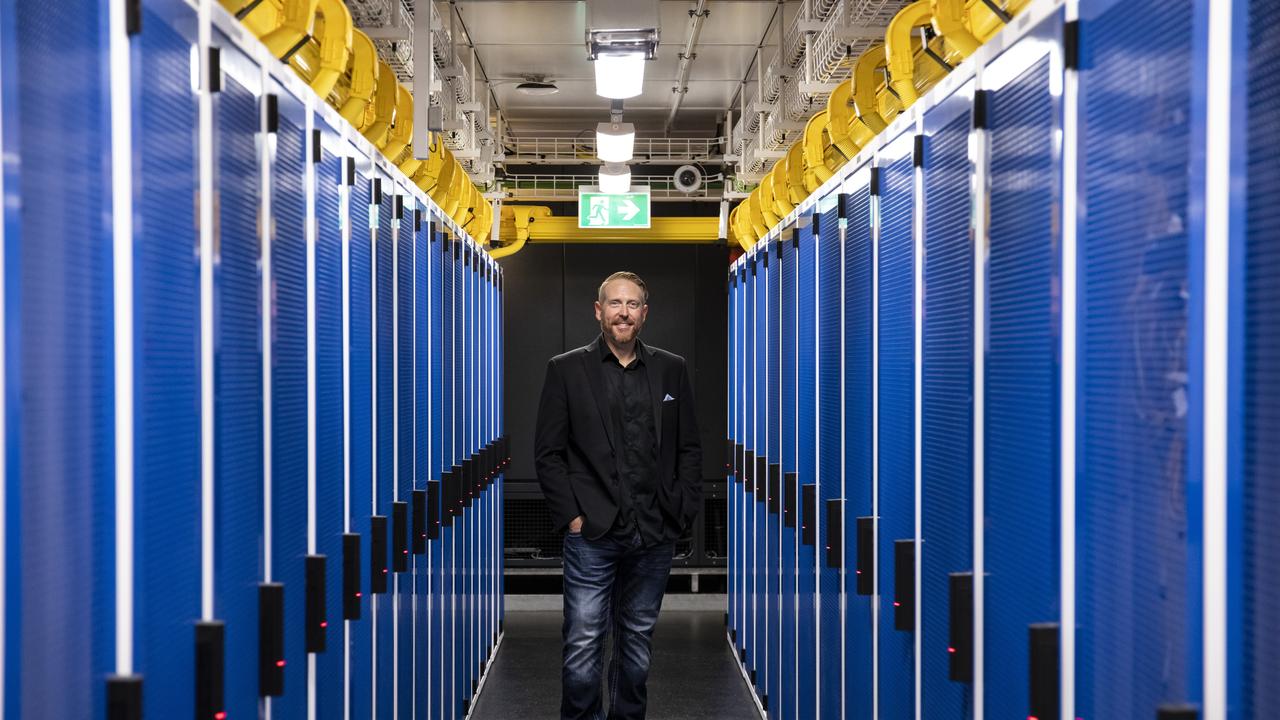

The acquisition by Sydney-based TAMIM represents its maiden investment in Adelaide, with joint managing director Jeff Taitz describing the city’s stable property market and higher yields when compared to the eastern seaboard as key reasons behind the purchase.

“We looked across the whole of Australia for assets and I just found Adelaide was making sense compared to Sydney where you’re buying at a sub 4 per cent yield,” he said.

“There’s a lot of space coming onto the Sydney market in 2022, 2023, 2024 - it’s got to have an impact, and so I’ve stayed away from the Sydney market knowing it’s overpriced.

“Adelaide hasn’t really been impacted by Covid much and it’s more of a steady market. You’re not having this huge fluctuation in vacancies - it’s steady as she goes.”

TAMIM expects to deliver to its investors annual returns starting from 8 per cent, after raising more than $20 million to fund the acquisition.

About 35 per cent of the building’s 9215sq m of lettable space is currently vacant, but Mr Taitz said TAMIM would undertake a refurbishment to attract new tenants.

“We’re going to upgrade the asset a little bit and make it more appealing to smaller tenants as opposed to larger corporate offices,” he said.

“We try and find assets that are a little bit different to the norm, and we don’t mind assets that are a little bit harder to manage and operate than what the instos (institutional investors) might like.

“We generally look for undervalued assets where we can bring something to the table as a value add to enhance the yield.”

Knight Frank’s Guy Bennett and Oliver Totani managed the sale.

Meanwhile, Centennial’s sale of the BankSA headquarters at 97 King William St represented a 4.67 per cent yield and a 48.3 per cent increase on the investment group’s purchase price of $29 million in 2016.

The State Heritage-listed building is fully leased to the bank, which recently agreed to a five-year lease renewal.

At 11 storeys, the art deco building comprises of 15,115sq m of space, and was completed in 1943 for the Savings Bank of South Australia, a forerunner of BankSA. It includes one of Adelaide’s grandest banking chambers.

Mr Bennett and CBRE’s Ian Thomas and Alistair Laycock brokered the deal.

Mr Taitz said he was unfazed by concerns around ongoing demand for office space, predicting a shift back to the office for white collar workers who’ve spent much of the last two years working from home.

“People are social creatures - you’re happy to work from home for a month or two or three or six, but eventually the novelty wears off and you want to be in the office, socialising and interacting,” he said.

“I think the office will revitalise and come back again, and what you’re finding is corporate businesses, to me, are saying the work from home is not working for us anymore. You’re far more productive in the office environment.”