Treasury Wine Estates acts to counter China hit

Treasury Wine Estates reveals it stopped shipping wine to China a month before Beijing’s tariff hit, which has forced a pivot to new markets.

SA Business

Don't miss out on the headlines from SA Business. Followed categories will be added to My News.

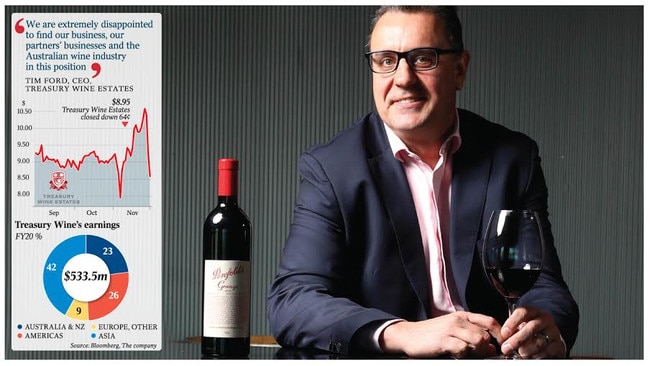

Treasury Wine Estates chief executive Tim Ford has revealed the nation’s biggest winemaker stopped shipping wine to China a month before Beijing imposed punishing 200 per cent-plus tariffs on Saturday, commencing a company-wide pivot to send his premium wines to new drinkers from London to Taipei.

Mr Ford told The Australian after he unveiled his strategy to investors to respond to the shut out from his most profitable market that accounts for around $500 million in sales a year that Treasury Wine had already begun to prepare for the worst when China launched its anti-dumping investigation into Australia’s wine industry in August.

“We had actually got ahead of it I suppose in terms of our shipments which were replenishing into China when the initial announcement was made back in August, we at that point shifted our model to replenishing the inventory into our warehouse in China and then shipping customer orders direct out of our warehouse,” Mr Ford said.

“We have had nothing new arrive into China for a couple of weeks now.”

Mr Ford, who was only appointed CEO of Treasury Wine in July, concedes the company whose iconic brands include Penfolds, Wolf Blass and Wynns is facing the biggest challenge of its recent history as it and Australia’s wine sector is frozen out of the Chinese market through a new brutal tariff regime.

His comments came as shares in Treasury Wine fell another 7 per cent on top of the 11 per cent slide on Friday and closed down 64 cents at $8.59.

“I think this is certainly over the time of the organisation the biggest change that has happened through not on our own doing, so I think from a significance of implications for the business and plans we will need to put in place around it I would put that certainly as a big one.”

The federal government has opened the door to making a formal complaint to the WTO over the communist superpower’s decision early this year to target Australia barley farmers – among the first of many anti-Australian trade actions Beijing has launched in the past year.

Senator Birmingham said on Monday that dialogue was still the preferred option, even if a WTO challenge against China is ignited.

“We actually had a WTO case against Canada over the last couple of years. We challenged Canada. It also revolved around getting market access,” Mr

“We didn’t get to the point of a final WTO ruling. Countries came to the table and worked it out.

“That is the ideal situation we would like to repeat with China. Even if we ignite those formal WTO challenges there is always an off-ramp, always a pathway, and that’s called dialogue and discussion.”

Treasury’s Mr Ford will pin his hopes on redirecting his premium and luxury wines once destined for China to sell in developed markets in Asia region such as Taiwan, South Korea and Japan as well pouring more into emerging economies including Vietnam and Thailand.

Mr Ford told investors on Monday his long term plans will see Treasury Wine build a business “outside of China” and develop its global credentials while also refusing to get into a damaging price war as Australia and other markets are flooded with wine once destined for China.

He believes Treasury Wine, which was carved out of Foster’s almost a decade ago, can reroute as much as 25 per cent of its premium wine sold into China to other countries, while Treasury Wine will also take on large volumes of higher priced wines to its balance sheet to cellar the wine for the long term.

Mr Ford’s new ex-China strategy will also wrap around a pledge not to trigger a price war by dumping his excess wine supplies on to the market to quickly clear its supplies, with Treasury Wine not walking away from its margins and remaining what Mr Ford has termed the “price integrity” of his premium wine brands.

The Penfolds brand, the winemaker’s most valuable business, will still have a life in China but a much smaller one, Mr Ford said, however Treasury Wine might have to restructure its supply chain in China as well as search for new ways to get its wine on the tables of Chinese restaurants, bars and banquet tables.

“If I step around the globe we have opportunities further here in Australia, we have opportunity within Asia and not just south east Asia but also into the north Asian markets whether that be Hong Kong, Korea, Taiwan and a number of other markets, and specifically within south east Asia, Thailand, Malaysia the Indo-China region,” Mr Ford said.

There were hopeful opportunities in Hong Kong but it was unclear at this stage if some Treasury Wine could still find its way on to banquet tables and restaurants in China through cross border trade, online or via personal shoppers.

Mr Ford unveiled his game-plan on Monday to investors and analysts on how the nation’s biggest winemaker will cope with last week’s shock news that China has imposed tariffs of more than 200 per cent on Australian wine, and 169.3 per cent on Treasury Wine, with the winemaker redirecting premium wine to other markets within Asia and elsewhere.

He said Treasury Wine will also have some wine inventory it will hold on its balance sheet that will be redeployed in later years, with that wine maturing and growing in value.

Under Mr Ford’s initial strategy to deal with the new China trade war there will be a reallocation of Penfolds Bin and icon range from China – which represent 25 per cent of Treasury Wine’s annual global Penfolds allocation volumes - to other key luxury growth markets where there is unsatisfied demand, including Asian markets outside of China, Australia, the US, and Europe.

There will also be an accelerated investment in sales and marketing resources and capability across these other luxury growth markets to drive incremental demand and expand the distribution footprint of Penfolds.

Mr Ford said he was disappointed with the tariffs placed on Treasury Wine and the rest of the Australian wine industry and called on the government to help the sector through this difficult time.

“We are extremely disappointed to find our business, our partners’ businesses and the Australian wine industry in this position. We will continue to engage with MOFCOM (China’s Ministry of Commerce) as the investigation proceeds to ensure our position is understood. We call for strong leadership from governments to find a pathway forward.”

But Mr Ford said Treasury Wine had the balance sheet strength and brand strength to defend its business, restructure and grow outside of China. But he warned there would be job losses across the industry, and likely at Treasury Wine.

“However, there is no doubt this will have a significant impact on many across the industry, costing jobs and hurting regional communities and economies which are the lifeblood of the wine sector. “

Originally published as Treasury Wine Estates acts to counter China hit