Trading card investing: Pokemon, Michael Jordan cards perform better than S&P500

Over crypto? Trading in Pokemon and basketball cards is the next big investment opportunity as nostalgia and celebs send prices soaring.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Fuelled by nostalgia – and the potential to make thousands in profit – trading cards are making a comeback, with basketball cards, baseball cards and Pokemon cards all soaring in market volume and valuations, as millennial investors move to diversify their portfolios and own a piece of their childhood.

Trading cards have been identified as the next biggest investment opportunity and are one of the highest performing verticals on collectibles trading platform StockX in Australia, according to its senior economist Jesse Einhorn. StockX launched in Australia five months ago, allowing local users to buy and sell cards on the secondary market.

StockX was started as a “stock market for sneakers” platform and quickly expanded into trading cards, streetwear, collectibles and designer handbags.

All four of the StockX indexes – basketball trading cards, Nike Air Max 1 and Air Jordan 4 sneakers, and KAWS figurines – have outperformed the S&P 500 over the past 18 months.

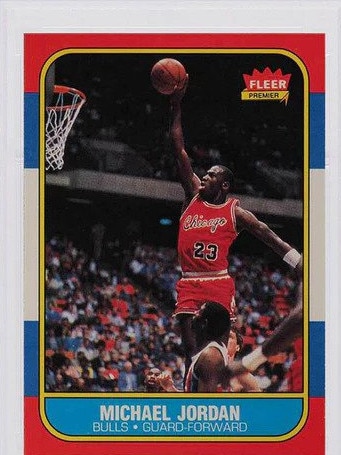

Trading in Pokemon trading cards were up 59,900 per cent year-on-year in July, while Panini basketball, baseball and football cards are up 1580 per cent on the same time a year ago. Valuations are soaring too, with a Michael Jordan rookie card recently selling for $US50,000 ($68,5000), while a rookie card for US baseball player Mike Trout sold for $US75,000.

“I remember being a kid in the ‘90s, trading cards were a widespread hobby, and that obviously died down. But now it’s seeing a real resurgence,” Mr Einhorn said in an interview.

“Young people are entering the hobby for the first time and you’ve also got people my age who are late Millennials, Gen Z and Gen X who are buying vintage cards that they coveted in their youth. It’s propelled the market forward, particularly amid lockdowns where we’ve seen this real current in the culture of nostalgia, and a desire to connect with our childhood hobbies. And prices have never been higher.”

Celebrities like Justin Bieber and Mark Wahlberg have entered the trading card fray and are helping fuel its popularity among young people, Mr Einhorn said, as well as an overall broader push towards alternative asset classes.

Young people want to build wealth but are looking at non-traditional options, outside the stock exchange, to offerings like cryptocurrency, and trading cards.

The typical trading card investor on StockX has seen a 200 per cent return on their portfolio of PSA 10 (top graded) basketball cards since January 2020, and on average an investor with a 10 top-selling PSA 10 basketball card would have seen a $US13,000 gain on their investment.

“It makes a lot of sense. Is it more interesting to buy a corporate bund, or some stock, or do you want to own a piece of your childhood?,” Mr Einhorn said.

“You might want to own that rookie card you always coveted, knowing it may well be worth much more 10 years down the line. These assets are appreciating in value and that‘s creating a flywheel effect, and as more people see the investment potential of trading products, they’re entering the hobby and that’s pushing demand and pushing prices forward.

“It‘s a real virtuous cycle right now with this new investor paradigm taking hold. And that’s just growing everything overall.”

Gold Coast pair Blake Johnson and Ben Toa have set up a trading card shop on the Gold Coast, and they say the popularity of trading cards is back in full swing with a massive boom happening during the pandemic.

“People are wanting a new fun way to invest and have seen the opportunity in trading cards due to the increase in a lot of prices over the past three years,” Mr Johnson said.

“As the momentum increases so do the prices and in many cases it is forcing some collectors to try alternate ways to collect by diversifying across genres. You see a lot of NBA and NFL collectors now diversifying into Dragon Ball Z and Marvel. This is helping them build a solid collection with different genres similar to different stocks on the sharemarket.”

While not everyone will have an ultra-rare Pokemon card sitting in an old drawer at home, Mr Einhord said, it is not a rare occurrence for people to forget about collectables from decades ago that are worth real money.

“To be realistic, you should obviously take a breath and realise that you’re not necessarily going to have a fortune stacked away in your attack. But I do encourage people to use StockX as a tool, we have an incredible amount of transparency and data on our platform to look at the price history of individual cards, and you can make informed buying and selling decisions just like you would with any other investment.

“The growth of trading cards really is global, and in Australia specifically we find that the trading card market is about two-times larger per capita than compared to the global average. So trading cards are obviously a huge hobby blowing up everywhere, but I think Australia is a special story.”

Originally published as Trading card investing: Pokemon, Michael Jordan cards perform better than S&P500