The last line of the bank defence is yet to be fully tested

The US banking crisis will become the first major test for the firewall the global banking system has been building since the collapse of Lehman Brothers. But no one knows if the wall will hold.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

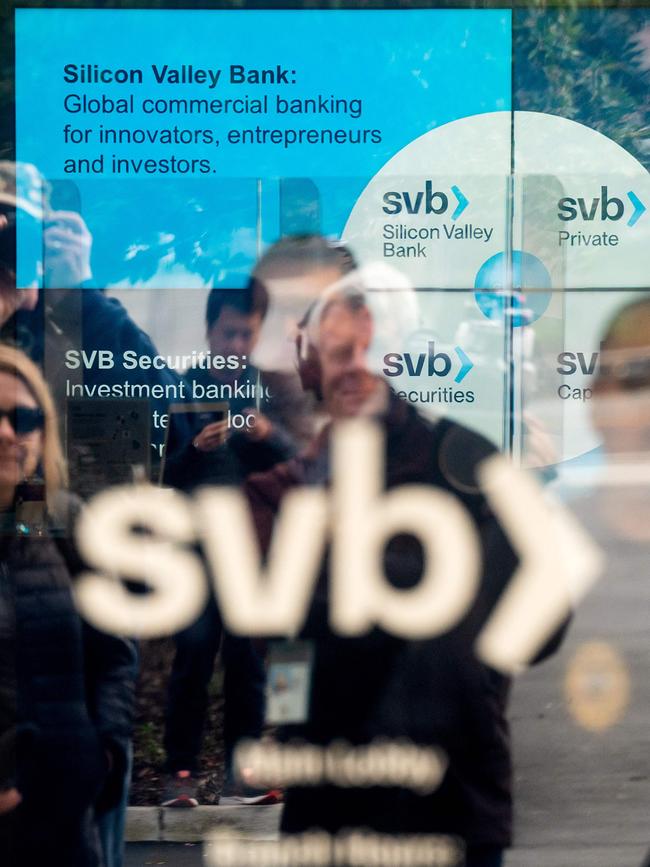

The fast-evolving US banking crisis will become the first major test for the firewall the global banking system has been building since the collapse of Lehman Brothers spurred on by the global financial crisis.

And while these new protections were designed for a different type of banking crisis - mostly bad debts - this is the moment of truth. And no one really knows if the wall will hold.

The Basel III standards - named after the Swiss city where the international rule setting body Bank of International Settlements is based - were the answer to a banking crisis that exposed massive weaknesses following the collapse of Lehman Brothers. The event went for years and verged on a full blown sovereign crisis as it tested European regulators to the limit. Despite the bland name, the new rules set aggressive targets for strength and forced banks to reinvent how they operated – mostly by cutting back risky trading businesses.

Simply, Basel III is a set of compulsory standards aimed at making banks more resilient. The rules increase the quantity and importantly the quality of capital on the balance sheet. It also forces banks to hold more forms of liquid assets such as government bonds and deepen deposit bases to secure more stable forms of funding.

Credit Suisse hit

For all the hard work, Basel III still needs to prove itself. Swiss investment bank Credit Suisse was operating under the new regime, yet its shares suffered a white-knuckled dive setting off new fears for markets.

Credit Suisse was already under intense pressure from multi-billion dollars in losses racked up from its exposure to Anglo Australian financier Greensill Capital and a collapsed fund Archegos Capital. Like Silicon Valley bank and indeed many others, Credit Suisse is sitting on a massive holding of government bonds that have slid in value following a year’s long bond market rout.

Major Credit Suisse shareholder, Saudi National Bank this week baulked at pouring any more capital into the European investment bank, sparking a share slide to a record low. Swiss regulators later issued a statement saying they would offer backstop funding support if needed. And this followed the US Federal Reserve earlier this week offering funding support to any US bank that needed it. Now it’s a game of confidence.

In a statement released at 2AM in Switzerland and in the middle of the Asian trading session, Credit Suisse declared it planned to take full advantage of the backstop by borrowing a massive $US54bn ($80bn) and in the process buying back $US3.2bn of its own deeply discounted debt to save on interest costs and pump up liquidity.

It has worked for now, with the futures market pointed to a rebound in Europe’s share market. The firewall - reinforced by the Swiss central bank - is holding for now.

In theory the tougher Basel rules put banks in a better position to absorb shocks coming out of financial and economic stress and this is aimed at protecting banks and reducing the hit to the broader economy from a collapse. But like squeezing a balloon, the risks are just pushed into another area. One of the big requirements under the rules was for banks to hold more high quality instruments such as government bonds or low risk mortgage-backed securities - both of these were a major factor in the rapid downfall of Silicon Valley Bank.

‘Unquestionably strong’

Indeed just in December the Bank of International Settlements warned of the risks building in the massive holdings of government bonds through the financial system as rising interest rate expectations was forcing a sharp fall in the value of their longer duration assets. And as rising interest rates cause excess liquidity to dry up this can prompt bond and mortgage security sales into a falling market.

“When these risks materialise and the attendant economic costs are substantial, there will be pressure on central banks to provide backstops – as market-makers of last resort. While justified, this can contrast with the monetary policy stance and encourage risk-taking in the longer run,” the Bank of International Settlements says.

Blackrock chairman Larry Fink, in his annual letter sent to CEO’s this week, says that the US could be on the cusp of a regional banking crisis with three banks down already including Silicon Valley Bank. All have come undone from a mismatch in assets against liabilities.

“It’s too early to know how widespread the damage is. The regulatory response has so far been swift, and decisive actions have helped stave off contagion risks. But markets remain on edge. Will asset-liability mismatches be the second domino to fall?,” Fink says.

Australia was one of the first jurisdictions to move to Basel III progressively rolling out the new standards over almost a decade. Despite some initial grumblings from banks who argued it would crimp mortgage lending – the rules first applied to the big four banks and then moved right down to the local credit union. Australia also went a step further following the review of the financial system by David Murray who declared banks must be “unquestionably strong” and forced them to pump up their capital holdings even higher than the new standards.

Regulatory gaps

And while Australia was a form of a testing ground for the Basel rules, the rest of the world – including Europe where the GFC showed the rules were needed most – has been slower to adopt the standards. Indeed Europe and the US have delayed their full implementation date until January 2025. However Europe is far more advanced than the US, with international focussed banks meeting the standards and widely seen to be well capitalised. In the US the standards only really apply to the biggest of banks and during the Covid pandemic regulators there felt many banks were too small to meet the Basel III standards.

The rapid implosion of Silicon Valley Bank which set off a round of tremors through global markets exposes the regulatory patchwork of the US banking market, where state-based authorities are overseeing banks which have national significance. This was the case for Silicon Valley Bank whose oversight fell between the Federal Reserve and California’s Department of Financial Protection and Innovation. As a member of the Federal Deposit Insurance Scheme that agency also had additional oversight. But this allowed a holistic view of the health of the Silicon Valley Bank to fall through the regulatory cracks.

One of the senior panel members on the Murray inquiry, Professor Kevin Davis says banks now are holding much more in the way of government bonds than they did in the past under the Basel rules which means they are exposed to losses on those assets like, Silicon Valley Bank. However he says Australian banks have sophisticated interest rate risk management which is also highly regulated. Banks here are domestic focussed and are “very good at passing off risks onto customers and markets,” through things such as variable mortgages, which makes them low risk, he says.

Silicon Valley Bank was in the process of becoming Basel III compliant but was still years off. Key calculations around expected credit losses and operational risk capital requirements still didn’t even have a deadline for introduction from US regulators. It’s like building the firewall but leaving a big space for the door and roof to come.

johnstone@theaustralian.com.au

Originally published as The last line of the bank defence is yet to be fully tested