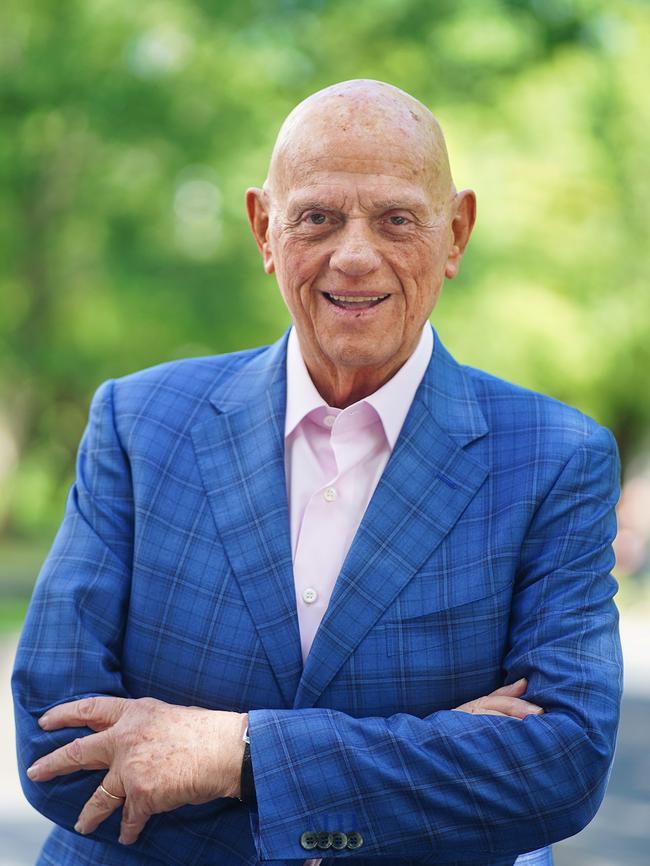

The day Donald Trump took an Aussie billionaire to Tokyo

Australian retail supremo Solomon Lew had a first-hand view of how the now two-time US President tackled business deals and it offers plenty of lessons for leaders.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Retail billionaire Solomon Lew was among the first Australians to send Donald Trump a note congratulating him on this week’s inauguration.

Lew has known Trump for years and became close after the two stitched together a major hotel deal in Hawaii.

This gave Lew a front-row seat as to how Trump operated at his peak – even when it was all about business not politics.

It was early 2006 and Lew, through his Californian property links, became a foundation backer of a new 465-room hotel and resort on Waikiki Beach. The other partner was Los Angeles resort developer Irongate.

To give the project momentum they licensed the Trump name, and so the hotel was to be called Trump International Hotel and Tower Waikiki.

Trump made a splash through a big announcement on the new Trump Hotel. The next step was to get smaller investors aboard by using the pre-sales of apartments to lock in the funding.

Lew travelled with Trump to Tokyo, and there they rented the huge ballroom at the ultra-exclusive Imperial Hotel in Ginza in order to impress the locals.

Lew recalls that Trump worked the room and the Japanese couldn’t get enough of him. To add to the sizzle, Trump had the American flag and Japanese flag hanging side by side on the walls of the room.

“We broke the record for selling 465 apartments in eight hours and 30 minutes,” Lew tells The Weekend Australian. “Everyone was lining up to have their photograph taken – it was all smiles.”

They returned to Waikiki to start selling the rest of the project, where they also took the ballroom at the nearby Hilton Hawaiian Village. Again, with Trump taking the lead, everything was sold in a single day, says Lew. The approach was all about moving at high speed to get an outcome.

The two day roadshow raised an exceptional $US700m ($1.1bn) to fund the massive development that ultimately took three years to build and open. Lew says the timing just missed the GFC.

Trump got a big payday for lending his branding and his marketing pitch. Lew is no longer involved with the resort, which is now part of the Hilton group and a few years ago was rebranded from Trump to Ka La’i Waikiki Beach.

It’s that same energy and intensity after being been sworn as President this week that Lew saw first hand all those years ago in Tokyo.

In four days Trump has delivered a whirlwind of announcements, and signed nearly 30 executive orders – more than any other modern day president.

“He’s got a very good commercial brain, and obviously he’s putting that together with running the country,” Lew says.

The retailing boss who heads up Premier Investments and is now the biggest shareholder in Myer, believes the big mistakes the Biden Administration made all came to taking their eye off the ball with inflation.

This meant the cost of living hit right across the political divide. The Democrats “never had a chance” with these pressures and this added to Trump’s momentum, Lew says.

The week one blitz by the new President has delivered a wake-up call for business. It’s also a new model for political leaders.

For better or worse, Trump knows how to shift the mood. He can deliver a message and keep it simple, and this cuts through. This is the art of the sale in appealing to busy people who are not engaged in day-to-day politics.

Even the idea of tariffs, which by design are inflationary and has the potential to hurt growth, is being sold by Trump as a nation-building tool.

This was on display this week during the monster announcement to launch what is essentially a private-backed fund to build out a network of data centres to power AI. Trump has reached for the sky by pushing the three backers – Larry Ellison of Oracle, Softbank’s Masayoshi Son and OpenAI’s Sam Altman – higher by targeting $US500bn within four years. And he called the project Stargate. Trump says the project will ensure the future of the technology and, importantly, it will keep it in the US.

Son told Trump at the announcement: “Last month I came to celebrate your winning and promised that we would invest $100bn.

“And you told me: ‘Oh, Masa, go for $US200bn. Now I came back with $500bn. Because this is – as you told me – the beginning of the golden age of America’.”

Wilson Asset Management chairman Geoff Wilson says Trump’s experience as a president counts for everything this second time around.

“Last time it was all new for him, and this time he’s moved incredibly quickly,” Wilson says.

“He’s been seen to be doing something. Whether you like him or hate him, people like to see – see some action, see progress. Whether it’s a new CEO of a company or new chair; you actually want to see change.”

Trump addressed business figures at the World Economic Forum via video during the week and declared he will push Saudi Arabia to increase its promised investment in the US from $US600bn to $US1 trillion. He also said the only way for businesses to escape tariffs was to build it in America.

Like the Hawaiian deal, they are all about big numbers flying around. As Wilson notes, some of the initiatives and announcements may never get off the ground, due to among other things, legal challenges. But these numbers are designed to push and generate excitement in a massive economy.

And that’s the stuff that’s hardest build.

Forager finds

There was one fund which stood out in the quarterly Mercer fund manager tables this week.

While average returns for all tracked Australian share funds were minus 1 per cent in the December quarter, small to mid-cap manager Forager returned a whopping 12 per cent for its value-focused Australian share fund, the Mercer figures show.

The stellar quarterly returns delivered Forger annual returns of 28.8 per cent for the year, sending it close to the top of the table. Its annual effort was only eclipsed by Hyperion’s Australian Growth Fund (30 per cent) and QVB’s hedge fund (29 per cent). The average return for long Australian share funds for the year was 11.2 per cent.

Forager’s Alex Shevelev tells The Weekend Australian much of the lift during the quarter was from long-term bets on two Australian tech names: The $800m fitness wearables player Catapult and $1bn enterprise software player Bravura Solutions.

For both, it was a matter of each tech player starting to show real development in their business models. In the case of Catapult – which rallied 50 per cent during the December quarter – it moved into a position where it is now spinning off cash. Catapult’s transition from illiquid small cap to a widely held growth stock is well under way and the company now generates free cashflow, Shevelev says.

For Bravura, which jumped 55 per cent in the quarter, the shares are benefiting from a new management team which is driving costs lower while working on boosting revenue.

Shevelev says while value is a big part of Forager’s stock-picking approach, the stock has to also have a growth element with it. The fund’s other top five holdings are HR management Readytech, wealth platform Praemium, and payments player Tyro.

The focus too comes back to cashflow and companies holding strong position in their respective markets. The trick is to not approach sectors as investment blocks.

“We look at all these stocks individually, we don’t look at them as just tech businesses as the drivers are quite different,” he says.

“Some are generating more cash, some have free cash, some have revenue that flows down to free cash.”

Even within the Australian market there are wide differences in valuations between businesses operating in the same space, he says. This means it’s better to be picky.

The Mercer figures show that despite the fight over diversity and equity, sustainable investment-themed funds beat the market and returned on average 14.4 per cent for last year.

Hedge funds averaged 13.5 per cent, while income-style funds returned 8.3 per cent.

eric.johnston@news.com.au

Originally published as The day Donald Trump took an Aussie billionaire to Tokyo