Tech billionaire Mike Cannon-Brookes sparks AGL Energy’s green reboot

Energy politics is as tough as it comes and AGL’s renewables reset is designed to serve two purposes. Saving the planet is a distant third.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

AGL Energy has taken the big ideas from tech billionaire Mike Cannon-Brookes since shelved takeover bid and run with them with a plan to spend $20bn on renewables and pump even more green energy into the grid as it fast tracks an exit from coal.

It’s a stunning turnaround from the significant resistance Cannon-Brookes and his bidding partner Canada’s Brookfield encountered from AGL’s former board earlier when they were pushing to keep one of Australia’s biggest carbon emitters intact and put it on a greener path.

Energy politics is as brutal as it comes and the reset outlined by AGL was designed to serve two key purposes. The primary objective in using Cannon-Brookes’ own blueprint is to blunten the line of attack from the billionaire who is AGL’s single biggest and potentially troublesome shareholder.

The second aim is about becoming a loved company and tapping the tsunami of cash starting to flow which is aimed at funding the shift to renewables. Somewhere in a distant third is saving the planet.

Now the ‘new AGL’ is all about looking forward, not back.

But after the circus of recent years surrounding the executive exodus and determination until the very last minute to continue with a deeply unpopular demerger, the question is whether the energy major is seen as a credible force to deliver such an ambitious greening plan and not slip up in the process.

New AGL chairman Patricia McKenzie said: “I have no doubt we have a team in place that will deliver this plan”.

“We’ve been doing this a long time. We have already built 4.8 gigawatts of renewables over the last 10-15 years, we’ve raised the capital to do so,” she said in an interview. “Its what we do best”.

New deal

The message though it seems from AGL is: “Trust us, this time it is different” as it looks for outside partners including banks and co-investors from big super funds to private equity to help fund the $20bn capital expenditure needed to keep the lights on.

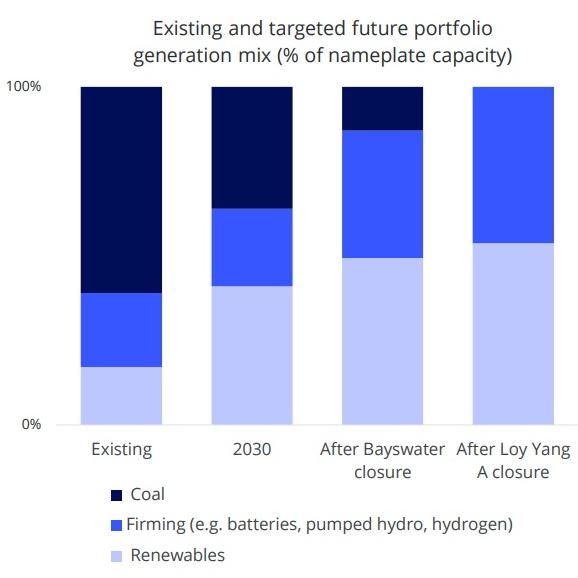

A lot needs to go right for the accident-prone AGL to make a smooth transition based around closing Victoria’s biggest coal-fired power generator in a little over 12 years from now and adding an ambitious 12,000MW, or 12GW, of new generation and energy firming – mostly batteries – by the closure date.

The Cannon-Brookes plan pitched between 7,000MW to 9000MW of additional renewables capacity, although the tech billionaire floated bringing the Loy Yang A plant off as early as 2030.

Until Cannon-Brookes turned up on the share register, AGL had been targeting 2045 as the year of the closure of Loy Yang A in Victoria’s La Trobe Valley.

AGL is keeping its flexibility for the previously announced 2,640MW coal-fired Bayswater plant in NSW between 2030-33, as it assesses the cashflows and how the grid can handle the shutdown.

In addition, AGL has set an interim target of 5,000MW of new renewable capacity and firming in place by the end of this decade, upping from the current 3,200MW plan already in place.

As a rough rule of thumb to ensure energy stability between two and three megawatts of renewables is needed to replace one megawatt of baseload generation. So with Loy Yang A’s nameplate capacity of 2,210MW this should see AGL at least replace what it is taking out without significantly increasing capacity in the grid.

AGL acting chief executive Damien Nicks said he is confident significant funding exists in the markets to help bring the renewables plan to life.

“What’s important that working with AGL brings to the party is the infrastructure, the technology and the customer base that helps bring capital in,” Nicks said. “I have no doubt that capital exists”.

Cannon-Brookes

While Cannon-Brookes wasn’t in the room, AGL’s McKenzie acknowledged the new energy reset recognises “the increasing ESG pressure from investors and consumers that has been affecting our business”.

She also noted banks and private equity funds were willing to provide funding for renewable transition plans, while super funds which have previously shunned AGL for its carbon footprint could take another look. This will ultimately result in a lower cost of capital for the business.

Cannon-Brookes earlier Thursday said the plan was a “step in the right direction” but the company needed to bolster its leadership skills in getting there.

His comments were more constructive over agitating although he continues to push for his four nominated directors to join the AGL board in addition to the current five. The four include former PacBrands and Fosters Group boss John Pollaers and former Energy Security Board boss Kerry Schott.

McKenzie said the board has not made a decision will make a recommendation on the names in due course, although there is a “bit of work to do” in getting to a view. With a sweeping green agenda in her back pocket, this reduces the chances of Cannon-Brookes drumming up support from other big investors compared to his success in having the demerger shelved. At the same time four board seats linked to Cannon-Brookes’ 11 per cent holding is seen by many investors as a takeover by stealth.

‘Stranded’

For AGL the reset means it won’t be left with a stranded asset in the form of an uneconomical coal-fired power plant for the next two decades. With the wave of renewables investment planned for the Australian market, including rooftop solar which is not traded through the national electricity market, stands to undermine the daytime pricing model of the coal-fired plants. As a result of high rooftop solar output over the December quarter in Victoria last year, spot wholesale power prices were negative 22 per cent of the time. This figure will get bigger as well as starting to move into the September quarter shoulder.

Coal plants as old as Loy Yang A are not engineered to run at low levels of output during the daytime, and the stop-start cycling dynamic which is expected to come as renewables flood the market risks more unplanned outages.

As more of the 16 remaining coal-fired plants exit the network, it will become harder for those remaining to close. Just this week, Queensland Premier Annastacia Palaszczuk said her state-owned coal generators would also exit the market by 2035.

The real test of Australia’s renewables readiness will come within the next seven years with, 8000MW of coal generation capacity slated to close – including rival Origin Energy’s giant Eraring plant in the NSW Hunter within the next three years.

Nicks acknowledged all parts of the market from generators, regulators and all governments needed to set aside differences and work together to manage the renewables shift over such a short period of time.

“I think the importance of having laid out this pathway now over the next 10 to 15 years is an important part of is to get it right to get it as smooth as we possibly can as an industry and for AGL,” Nicks said.

Gas plan

To show just how finely balanced Australia’s energy markets are right now, in the shadow of AGL’s announcement was an Albanese Government brokered deal which will see gas exporters, including Origin, Shell and Santos, direct an extra 157 petajoules into the east coast gas market next year to head off a forecast domestic supply shortfall.

Following long talks, the heads of agreement keeps Canberra and gas exporters on the same page and talking over time and removes fears among producers that they will be forced to divert some of their production back into the domestic market through legislation. Producers have strongly argued that such a reservation policy would undermine future output because it is the long term offshore contracts that fund the projects.

Santos boss Kevin Gallagher says Thursday’s agreement is a better outcome and won’t impact exports or long term supply deals. The new LNG deal will also see uncontracted export gas being offered into the domestic market first. While the gas deal unlikely to make any difference on pricing, it will at least help an energy rich country like Australia head off a home made European-style crisis.

johnstone@theaustralian.com.au

Originally published as Tech billionaire Mike Cannon-Brookes sparks AGL Energy’s green reboot