So which is better: super investing or house buying?

Working off the raw numbers – when you compare long term super investing or putting the cash in the family home – the answer may surprise you.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The Coalition’s plan to allow superannuation money to be used in purchasing a home has set off a furious debate with supporters and critics shouting from the rooftops.

But which is better – more lucrative, more profitable – to take a lump of money out of superannuation and buy a home or to leave it in there ticking away until retirement?

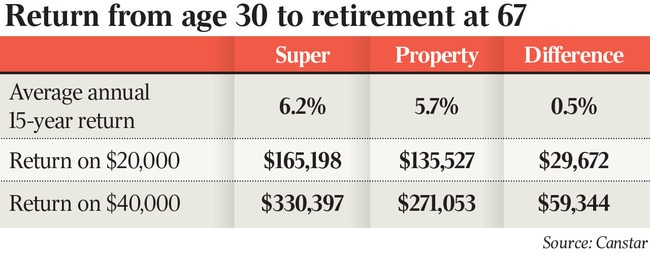

We’ve run the numbers and it is a close run thing: Super, wins by a nose, a fractional 0.5 per cent.

And that’s assuming future super returns are as good in the future as they were in the past: It means you don’t mind renting in a very tight market where the landlord now has the upper hand.

Oh yes, it also assumes that you never do anything whatsoever to improve your house.

“It so close you can’t really call it, using your super money to finance your home is going to be up to the individual and their assessment of the deal,” says Steve Mickenbecker of the Canstar research group.

Anyone making a final call on whether to take up the new scheme would also have to include all the fees charged by big super funds now totalling around $30bn a year. Not to mention the different tax arrangements on houses and superannuation.

With such a range of variables, ‘the decider’ for many investors will most likely be the price they may put on the security of living in a house they own (with a mortgage and long term obligations to their own super) versus renting (while waiting for super to compound into an attractive lump sum).

The Australian modelled the potential returns from super investing versus home investing in conjunction Canstar – we imagined a 30 year old weighing up whether to leave $20,000 in super or to take it out and to use it in a deposit for a home under the proposed scheme. We used average super returns and average house price returns and mapped them over the 37 years the 30 year old applicant today would have until they reached retirement.

The difference over the long term to retirement age was less than one per cent – $29,672.

We also did a variation on the exercise which added in rental costs when comparing the two outcomes. (For rent costs we used the rental yield average in the local market). Subtracting rental costs from the long term calculation shrinks the dollar difference in favour of superannuation investing for a single applicant to just $5,252.

But Mr Mickenbecker says to offer a comprehensive comparison you would also have to factor in mortgage repayments – a monumental exercise with so many different loan products in the market.

Nonetheless, the issue of rents may be underplayed, the current market dynamics weigh heavily against renters: The national vacancy rate released Monday is 1.1 per cent – a situation which means there are long queues for rental properties and rental costs are rising strongly. In fact, nationwide ‘asking rents’ for houses are up 14 per cent year on year according to SQM Research.

Analysts suggest any incentive to make it easier to buy houses will push up house prices – there is also widespread resistance to using superannuation policy to solve what are housing policy challenges. Critics such as independent economist Saul Eslake suggests the move will be: ‘Greeted with despair by first home buyers who will see it rightly as pushing their dreams further out of reach’.

There are also concerns the policy is based on a number of assumptions that are contestable.

First, the policy assumes home buyers are bidding in a hot market where prices are rising, but the residential market is turning down quickly. Auction clearance rates are now down near 60 per cent nationwide and have dropped for four weeks in a row. Economists expect to see house prices fall between 5 and 15 per cent by the end of next year.

Second, the policy assumes there is a shortage of new housing stock: However, recent figures from the National Housing Finance and Investment Corporation indicate there will actually be an accumulated surplus of housing of more than 200,000 homes until the end of 2024.

The surge in new homes becoming available follows a ‘pull forward’ of building approvals on the back of the Coalition’s Covid crisis policy to stimulate construction. The sector does not face shortages until after 2024 and that will depend on immigration levels.

If we put the policy debate to one side – the scheme as an autonomous program is cleverly designed. It requires the applicant to put the relevant capital gain and original withdrawn sum back into retirement savings when the house is sold. The most one individual can access from their super is 40 per cent or $50,000

The scheme is unusual among housing schemes in that it has no places ‘cap’ – any amount of applications will be considered if it comes to pass – depending on who wins the election this weekend.

Under the terms of the scheme – due to begin in July 2023 – applicants must be first home buyers and they will have to already have built up a 5 per cent deposit for the property they wish to buy – they can then add the money withdrawn from super.

Working off recent ATO data the average 30 year old would have $51,175 in super opening up the possibility of taking out around $20,000 to invest in a home or $40,000 for a couple on the same terms – this would allow must applicant couples to apply for a house close to today’s nationwide average price which is near $720,000.

More Coverage

Originally published as So which is better: super investing or house buying?