Scentre, Vicinity slash $5.5bn from value of shopping centres

Shopping centre giants Scentre Group and Vicinity Centres have stripped more than $5.5bn from the value of their 102 properties amid the coronavirus crisis and Victoria’s crippling stage four restrictions.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Australia’s two biggest shopping centre owners have stripped more than $5.5bn from the value of their properties as the coronavirus crisis up-ends the retail sector.

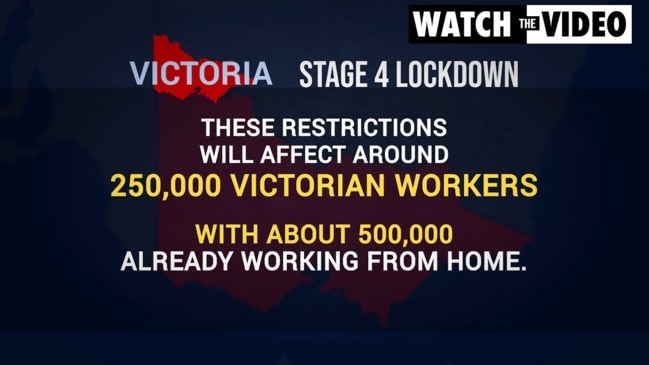

And smaller centres in Melbourne’s middle to outer suburbs are feeling the biggest coronavirus squeeze amid rising vacancies, falling rents and a surge in online shopping.

Scentre Group and Vicinity Centres, which control 102 shopping centres across the nation, have both announced major writedowns on the value of their high-profile portfolios in recent weeks.

Scentre controls the nation’s Westfield empire while Vicinity owns half of the nation’s biggest centre, Melbourne’s Chadstone, as well as the Emporium, DFO outlets and suburban malls such as Bayside in Frankston, Northland in Preston and The Glen at Glen Waverley.

Scentre this week warned it would cut the value of its 42 centres, which includes Westfield malls at Fountain Gate, Doncaster, Southland and Knox, by 10 per cent.

That adds up to $3.8bn, reducing the book value of its portfolio to $34.4bn.

Rival Vicinity late last month slashed the value of its portfolio of 60 malls by 11.3 per cent, or $1.8bn, taking the book value to $14.1bn.

The loss in actual value would be substantially higher, however, given the accounts reflect each landlord’s ownership stakes in the centres.

They do not own all the centres outright.

The headline revaluations also smooth out considerable differences between various centres.

Vicinity’s more detailed update shows that, proportionally, the valuation declines at a string of second-tier centres was double that of its flagship asset.

The company has cut the book value of its half stake in Chadstone by 7.5 per cent — equivalent to a whopping $508.8m cut to the value of the entire centre which is now $6.2bn.

While the size of Chadstone means the writedown is the biggest in dollar terms for any shopping centre nationally, the value of Vicinity’s 16 “regional” centres has been slashed by a deep 15.6 per cent.

This group includes Bayside, Northland, Broadmeadows Central and Cranbourne Park Shopping Centre.

Vicinity did not provide a breakdown of individual assets beyond Chadstone but, applying the average regional writedown to the centres within that category indicates the value of Northland has been slashed by $150m to $811m.

Bayside has absorbed an $86.4m writedown to $467.5m while the value of Broadmeadows Central has been cut by $48.5m to $262.8m and Cranbourne Park by $46.2m to $249.8m.

Vicinity only has 50 per cent stakes in Northland and Cranbourne Park.

Shares in both Vicinity and Scentre has almost halved over the past six months as the coronavirus pandemic raises long-term questions over how lucrative bricks-and-mortar retail will be going forward.

Foot traffic at Vicinity’s malls across the nation in late July was down 32 per cent from a year earlier, while commercial real estate agency Jones Lang LaSalle has estimated the vacancy rate at shopping centres is the highest in more than two decades.

Meanwhile, Morgan Stanley expects shopping centre rents to drop 15 per cent to 18 per cent compared with pre-pandemic levels.

“If all department stores and discount department stores chains rationalise their footprints concurrently, there could be a flood of vacant retail space,” the investment bank said in a research report last month.

SCENTRE SCRAPS FIRST-HALF DIVIDEND

VICINITY PULLS PIN ON ASSET SALE

Originally published as Scentre, Vicinity slash $5.5bn from value of shopping centres