Santos shares jump after the company announces a $2 billion gas buy up in the Northern Territory

Santos continues to cement its position in the Australian gas market with a $2 billion deal to take control of the Darwin LNG plant.

SA Business

Don't miss out on the headlines from SA Business. Followed categories will be added to My News.

SANTOS has made its second major acquisition in as many years, splashing out $2 billion on ConocoPhillips’ Northern Australia business.

The $US1.39 billion purchase will result in the Adelaide company taking over the operatorship of the Darwin LNG plant, with a stake of 68.4 per cent, the same stake in the Bayu-Undan field which feeds into it, and a 62.5 per cent stake in the offshore Barossa field which will come up for a final investment decision next year.

Santos shares jumped strongly on the news, up 6.8 per cent to $7.93.

It follows Santos paying US$1.93 billion for Quadrant Energy, which owned Western Australian gas assets, last year.

Santos will fund the new deal with cash and US$750 million in new debt.

But Santos has already signed a letter of intent with SK E&S, a partner in the Barossa project, for that company to acquire a 25 per cent interest in Bayu-Undan and Darwin LNG, which will reduce the balance sheet pressure.

SK E&S currently has a 37.5 per cent stake in the Barossa project.

“Santos is also in discussions with existing Darwin LNG joint-venture partners for equity in Barossa and in advanced discussions with LNG buyers for Barossa offtake volumes, including with an existing partner in Darwin LNG,’’ the company said.

Managing director Kevin Gallagher said the company was comfortable with its debts levels and the ASX announcement says “net gearing is expected to decline to about 30 per cent by the end of 2020’’.

The deal will increase Santos’ production by about 25 per cent.

Santos’s current market capitalisation is $15.48 billion.

“Santos was a founding partner with ConocoPhillips in Darwin LNG, which has been operating since 2006,’’ Mr Gallagher said.

“This acquisition delivers operatorship and control of strategic LNG infrastructure at Darwin, with approvals in place supporting expansion to 10 mtpa, and the low cost, long life Barossa gas project.

“These assets are well known to Santos. It also continues to strengthen our offshore operating and development expertise and capabilities to drive growth in offshore northern and Western Australia.

“Santos intends to manage gearing within our stated operating range and is targeting to selldown equity in Darwin LNG and Barossa to 40-50 per cent in order to create alignment between joint venture participants as well as by optimising equity levels in our Western Australia assets.”

Mr Gallagher said the purchase would reduce Santos’s free cash flow break-even price per barrel of oil equivalent by $US4 by 2020.

A decision on whether to go ahead with the Barossa project, which will “backfill” Darwin LNG as Bayu-Undan winds down, is expected next year.

That project is expected to cost $US4.7 billion.

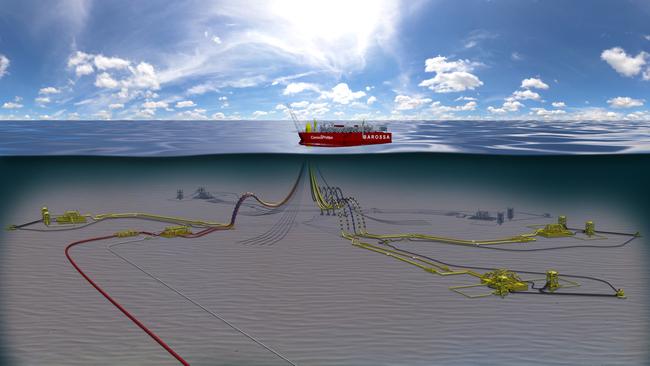

“Barossa is intended to be developed using subsea wells tied back to an FPSO (floating production, storage and offloading vessel) for gas processing and condensate export,’’ Santos said.

“A 260km gas export pipeline will transport gas to the existing Bayu-Undan pipeline for onwards transport to Darwin LNG.’’

That project would produce gas in 2024 if investment is approved.

“Barossa is expected to extend the operating life of Darwin LNG by more than 20 years,’’ Santos said.

“Life extension capex at Darwin LNG of approximately US$600 million (2019 real) is expected to be incurred between Bayu-Undan end of field life and the commencement of production at Barossa.’’