Sanjeev Gupta plots great escape as legal action over OneSteel and Tahmoor Coal delayed

Sanjeev Gupta has appointed new restructuring specialists to navigate the collapse of its biggest lender Greensill.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

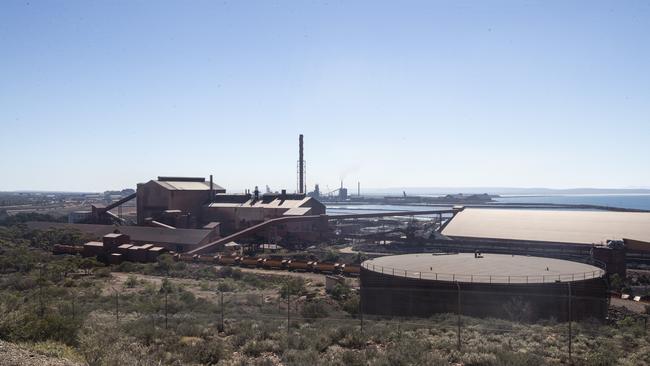

Court action to wind up Sanjeev Gupta’s Whyalla steelworks has been postponed until early July as the industrialist builds on an Australian refinancing deal by appointing new restructuring specialists to navigate the collapse of its biggest lender Greensill.

Credit Suisse had filed a winding up in insolvency application for Mr Gupta’s OneSteel Manufacturing and Tahmoor Coal but the NSW Supreme Court agreed on Thursday to a request from the pair to revisit the legal action on July 5 amid efforts to refinance Greensill debt.

The UK-based conglomerate, under pressure to refinance $US5bn ($6.5bn) in debt globally to the failed supply chain financing company Greensill, struck a deal on Wednesday with White Oak Global Advisors for the $430m owed by Liberty Primary Metals Australia.

Attention will now shift to how quickly Mr Gupta can refinance other parts of his global operations and return money to both Credit Suisse and Greensill with a new group of advisers hired to restructure Liberty Steel, which houses Whyalla and steel plants across Europe and the US.

Underperforming units will be fixed or sold as the industrialist strives on profitable operations, signalling a frenzy of deal-making in the last few years may have left Mr Gupta with some undesirable assets.

A newly formed restructuring and transformation committee “will be given full autonomy to restructure Liberty’s operations to focus on core profitable units, and either fix or sell underperforming units,” the company said.

It aims to “negotiate an amicable solution with Greensill’s administrators and other stakeholders which protects value and provides the best outcome for all stakeholders.”

Mr Gupta made his name in Australia rescuing Whyalla from administration as part of a rapid fire $20bn global acquisition spree, buying struggling steel and aluminium assets from industrial giants including Eiro Tinto, Tata and ArcelorMittal.

Liberty appointed four specialist board directors to “lead and accelerate the restructuring and refinancing of Liberty in order to protect and maximise creditor and stakeholder value,” the company said in a statement on Wednesday.

Mr Gupta’s privately held GFG Alliance, which includes the Liberty steel business, said its global chief financial officer V Ashok will leave at the end of May after joining the company in October 2019.

Former Essar Capital and Jindal Steel executive Deepak Sogani will replace him as GFG’s interim CFO and also Liberty’s CFO with his role based in Dubai.

Iain Hunter, a former boss of GFG’s financial services arm Wyelands Bank, was named Liberty’s chief governance officer in Dubai with Jeff Kabel chief transformation officer in London. Mr Kabel was most recently chairman of the International Steel Trade Association where he worked with the UK government to boost the cost competitiveness of UK producers against their European rivals.

Jeffrey Stein, a former Whiting Petroleum Corporation executive, will be based in the US as Liberty’s chief restructuring officer where he will lead Liberty’s restructuring and transformation committee.

GFG employs about 35,000 people globally and more than 2000 people in Australia.

The company bought the Whyalla assets, formerly owned by listed company Arrium, out of administration in 2017 and Mr Gupta soon set about announcing ambitious investment plans for the steel mill as well as sweeping renewable energy plans, most of which are yet to be realised.

Originally published as Sanjeev Gupta plots great escape as legal action over OneSteel and Tahmoor Coal delayed