ASX Trader: This asset is cheaper than 1980 and on verge of major move

It’s likely the most undervalued asset in the world right now, with prices cheaper than they were in the 1980s. But this commodity is poised for a major move in 2025, writes ASX Trader.

Silver is on the verge of a big shift.

Demand is skyrocketing, while supply is shrinking and the precious metal is so undervalued it’s currently priced cheaper than it was in the 1980s.

Experts predict there will be a shortage of around 149 million ounces of silver in 2025 - marking the fifth year in a row of supply falling short.

With total demand expected to hit 1.2 billion ounces, this could be one of the biggest years ever for silver usage.

Why is silver in short supply?

There are a few major reasons why silver is getting harder to come by:

Booming industrial use: Silver is used in electronics, solar panels, and renewable energy projects, all of which are growing fast.

Strong investor demand: Many investors buy silver during uncertain times because it’s seen as a safe asset.

Mining slowdown: Silver production is struggling due to environmental rules, geopolitical issues, and declining mine output.

Low recycling rates: Unlike gold, silver from industrial products isn’t often recycled, making it even scarcer.

When demand keeps rising but supply can’t keep up, prices usually have to adjust to reflect the shortage.

Are silver prices being manipulated?

Even though silver is in high demand, its price hasn’t reflected this reality.

Some experts believe big financial institutions are keeping prices artificially low by controlling the futures market.

The idea is that these institutions suppress silver prices so they can quietly buy more before the real supply crunch hits.

If that’s true, history suggests that once the price manipulation ends, silver could see a massive breakout - just like a beach ball that’s been held underwater and finally let go.

Money always rotates between asset classes

If you look at financial markets over the last 100 years, you’ll notice a clear pattern: When one asset class becomes overvalued, money flows into undervalued assets.

In the 1990s, tech stocks boomed before the dotcom crash, after which money flowed into commodities and gold in the 2000s.

In the 2010s, tech and growth stocks exploded again, fuelled by low interest rates and easy money.

Now, as we enter the mid-2020s, high-growth stocks and technology companies are historically expensive, while commodities like silver and gold remain undervalued.

This cycle repeats itself.

When markets shift from overvalued sectors (like tech stocks) to hard-value assets (like commodities), silver often benefits significantly.

One key metric that has historically signalled this shift is the Buffett Indicator (total market cap to GDP).

When this ratio moves two standard deviations above the historical mean, equities have typically been extremely overvalued.

In the past, this has been a great time to rotate into silver.

History suggests that when stocks peak, silver is often at the beginning of a strong bull run.

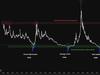

As you can see from the green and red boxes, when the S&P 500 is in a bull (upward trend) market, silver is in a bear (downward trend) market - and vice versa. The capital rotation between financial assets and commodities is a recurring theme, and understanding these cycles can provide strategic investment opportunities.

How silver historically follows gold

Silver and gold tend to move together, but silver often lags behind at first.

When financial uncertainty hits, people rush to gold first.

Then, once gold gains traction, silver starts to take off - and usually outperforms gold in the later stages of a bull market as seen in the below chart.

The Gold-to-Silver ratio: Why silver may be undervalued

The gold-to-silver ratio tells us how many ounces of silver it takes to buy one ounce of gold.

Right now, that number is around 91:1, much higher than the historical average of 40-50:1.

Historically, when this ratio is too high, silver is considered undervalued, and the market eventually corrects.

If the ratio were to return to its historical average, silver prices would need to rise significantly.

Russia’s big move: Adding silver to its reserves

In October 2024, Russia’s central bank announced it would start buying silver for the first time ever.

It’s buying to diversify reserves, counter sanctions, and capitalise on its industrial and financial value.

This is a big deal because Russia is one of the top silver-producing countries.

If other nations follow its lead, silver demand could explode even further.

A massive breakout ahead?

Silver has been stuck in a cycle of underperformance for decades, frustrating investors. However, technical charts show that silver has formed a pattern called a “cup and handle”, which often signals a major breakout is coming.

Here’s another eye-opener: Silver is the only asset still priced lower than it was in the 1980s.

It is currently priced at USD$34oz compared to USD$49oz in 1980 - 32 per cent lower than four decades ago.

If adjusted for inflation, silver would need to quadruple in price just to match its 1980s peak of $130 (inflation adjusted) per ounce.

Is silver at a tipping point?

With silver shortages becoming more severe, it’s only a matter of time before prices reflect reality.

Between supply issues, rising demand, and historical money flow trends showing that capital moves into undervalued hard assets, silver looks primed for a major move.

If you’re watching silver, this could be the beginning of something big.

DISCLAIMER: The content set out in this article provides general information only and should not be taken as professional advice from the publisher or author. The publisher does not endorse or recommend any product or investment opportunity referenced in the article. You should get advice specific to your circumstances before making any investment or other financial decisions.

More Coverage

Originally published as ASX Trader: This asset is cheaper than 1980 and on verge of major move