ASX Trader: policy tailwinds, surging demand prime previously ‘unloved’ uranium for breakout run

Uranium’s breakout is undeniable. Fuelled by a mix of policy tailwinds, surging demand and decades of neglect, it is no longer the unloved asset of the past, writes ASX Trader.

SA Business

Don't miss out on the headlines from SA Business. Followed categories will be added to My News.

A month ago, I spoke about energy bottoming. Back then, uranium was already breaking out on the charts even before the headlines or Trump’s new nuclear orders.

On my social posts, I said it best as seen below: there’s an old saying ’the chart often leads the news.’ And sure enough, uranium has rocketed since, proving once again that the charts don’t lie.

Today, uranium’s breakout is undeniable. Fuelled by a potent mix of policy tailwinds, surging demand, and decades of neglect, uranium is no longer the “unloved” asset of the past. It’s emerging as the quiet giant of the coming commodity/energy bull market front and centre in the global energy narrative.

Trump’s bold push for American uranium

Last week, President Trump announced sweeping executive orders aimed at revitalising America’s nuclear sector. These orders will:

– Fast-track new reactor licenses, cutting timelines from a decade to just 18 months.

– Restructure the nuclear regulatory commission to reduce red tape.

– Encourage the departments of Energy and Defence to build new nuclear plants on federal lands, including military bases.

– Expedite environmental reviews for domestic uranium mining projects — like Anfield Energy’s Velvet-Wood mine in Utah.

Analysts believe these moves will supercharge uranium prices, boost investor confidence, and catalyse a wave of long-term contracting and investment in Small Modular Reactors (SMRs) and plant life extensions.

The market has already responded: uranium prices, which had recently dipped to $64.30/lb amid recession fears, are bouncing back. Nuclear energy stocks like Uranium Energy, Centrus Energy, Constellation Energy, and GE Vernova have surged in response to this historic policy shift.

The macro picture: Uranium’s bull cycle unfolds

For me, investing starts with the big picture, not daily noise. On monthly charts, uranium shows the classic three-phase cycle: a downtrend, a sideways base, and now a powerful new uptrend. This cycle is the same one that plays out time and again in commodities, an asset left for dead becomes the next market leader when the macro tide turns.

Here’s why I remain ultra-bullish on uranium:

– It’s the only scalable zero-carbon baseload energy source that can realistically

meet exploding global demand.

– Production costs are around $30–35/lb, while spot prices are now well above

$70/lb, giving miners exceptional margins.

– 57 per cent of global supply comes from just 10 producers, many in unstable

regions — any disruption there can send prices skyrocketing.

– Decades of under-investment in new capacity have created a structural supply

crunch just as demand surges.

The historical pattern: Uranium lags gold, then leads

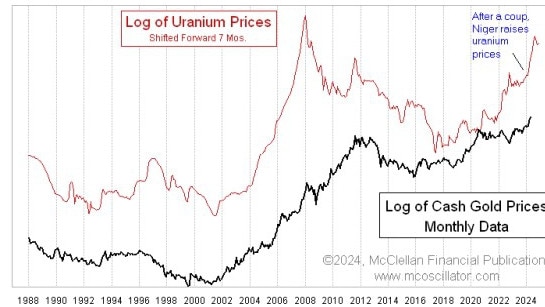

Historically, uranium has lagged gold by several months in commodity cycles. Gold acts as the early signal for macro stress, currency debasement, inflation, or geopolitical risk. Uranium typically follows, with even greater percentage gains once the trend is confirmed. With gold breaking out to new highs, uranium’s breakout today is right on schedule.

Asia’s Lead and the Global Shift

While the US is finally waking up to uranium’s role, Asia is already years ahead.

China and India alone account for over 70 per cent of new nuclear capacity under construction today. Japan is restarting reactors, Germany is debating bringing back its nuclear plants, and the Middle East is rapidly investing in nuclear power to secure its energy future.

Nuclear energy isn’t just a climate solution — it’s the only realistic option for energy security in a geo-politically fracturing world.

Investment takeaways: Asymmetric opportunity

For investors, uranium is the definition of an asymmetric opportunity:

– Large producers like Paladin and Boss Energy provide stability.

– Junior miners and uranium ETFs like URNM and URA offer high-octane upside.

-Corrections are opportunities: historically, energy corrections are shallow compared to tech or crypto’s 80 per cent plunges.

The real edge? Understanding that the public participation phase is just getting started. The smart money has already positioned itself — now the broader public and institutional capital are beginning to see what the charts have been telling us for months.

Uranium’s moment has arrived

As I said a month ago and as the charts confirmed uranium was the leader in the energy space long before the headlines caught up. From Asia’s reactor build out to Trump’s new orders, the case for uranium has never been stronger. It’s not just part of the next energy bull market; it’s leading the charge.

Originally published as ASX Trader: policy tailwinds, surging demand prime previously ‘unloved’ uranium for breakout run