Schneider Electric chief executive Jean-Pascal Tricoire: Climate change is ‘biggest challenge of our generation’

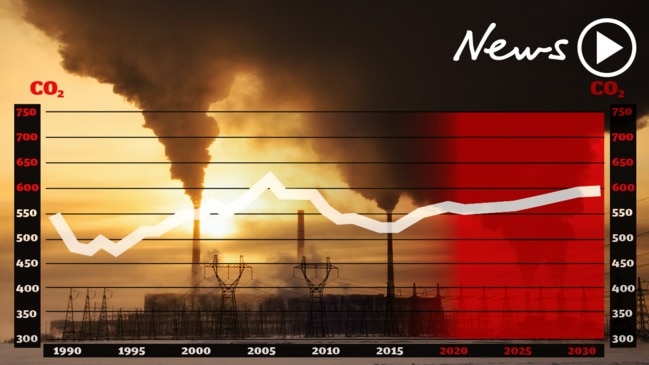

The chief executive of Schneider Electric, which owns iconic SA brand Clipsal, has warned the world is “seriously on the wrong trajectory” in terms of carbon emissions.

SA Business

Don't miss out on the headlines from SA Business. Followed categories will be added to My News.

- Future Submarines: Schneider Electric wins major contract

- Climate change emergency declared by SA Upper House

- How to get more from your The Advertiser digital subscription

The world is “seriously on the wrong trajectory” in terms of carbon emissions, Schneider Electric chief executive Jean-Pascal Tricoire says, and has labelled the issue the “biggest challenge of our generation”.

Speaking at the company’s global Innovation Summit in Barcelona this week, Mr Tricoire said following generations would hold us accountable for current responses to the emissions issue, but said there were two major disruptions which boded well for the future.

These were the transition of energy away from fossil fuels towards renewable-produced electricity, and a rapid transition to digital systems which allow for much more efficient energy use.

“Why is there so much focus on this at the moment?” he said.

“The bad news is, we are seriously on the wrong trajectory. This is today why we see our kids, and many other people on the planet going on strike, to demonstrate, and you see more green vote taking ground in our countries.’’

Mr Tricoire said 80 per cent of emissions were due to energy consumption, which had increased 10 fold in the past century, and if nothing was done, that would increase another fourfold this century.

“This in a world where 60 per cent of the way we manage energy is inefficient,’’ he said.

“So today, even after the Paris agreement, and all the pledges of our companies so far, we are on a trajectory of 3.5 degrees (increase in global temperature).’’

The good news was that business and government were aware of it and reacting to the issue.

“This is probably the big challenge of our generation and the other generations will hold us accountable if we don’t do anything.’’

Mr Tricoire said the two “major disruptions’’ meant that emissions could be managed while developed and developing nations both continued to boost economic output.

Schneider announced this week it had calculated that “50 per cent of global CO2 emissions could be eliminated by 2040 if digitally-enabled energy saving measures were implemented in just half of existing buildings, in tandem with existing global electrification and decarbonisation initiatives’’.

“Buildings, data centres, infrastructure and industry are responsible for around 70 per cent of the world’s energy use,’’ the company said.

Mr Tricoire said the efficiency of buildings could be boosted by 30-50 per cent, using smart building management and technology such as real-time internet of things monitoring.

He said electricity use was expected to increase from 20 per cent to 40 per cent of the energy mix, which was good news, because renewable energy allowed for the “decarbonisation’’ of that power.

Mr Tricoire said Schneider itself was committed to be carbon neutral by 2025. It also aims to have its whole supply chain net emissions free over the next 30 years.

This reflects similar commitments made recently by Australian companies such as BHP, which announced a $500 million plan in July to cut its own emissions and move to tackle emissions from its supply chain.

BHP intends to achieve net zero emissions in the second half of this century consistent with the Paris Agreement, and will in future set public goals around so-called Scope 3 emissions, or those from its supply chain.

Mr Tricoire said following his address that “investors will flee” companies who do not look to address emissions issues.

He said “coal will be marginalised” and that in terms of electricity storage “cost is going down the tube as fast as it did with renewables’’.

Mr Tricoire said that over the longer-term view, it was very clear that countries and companies had fundamentally changed their approach to climate change, and “the largest companies in the world are all going in that direction’’.

His comments came as Investment funds representing more than $US35 trillion ($52.2 trillion) this week warned Australia’s largest companies they would be held to account on climate change.

The global cohort of investors, which includes Australia’s largest super funds, warned business leaders they must do more to mitigate climate change investment risk and cautioned on the threat posed by industry associations whose climate views are inconsistent with the companies they represent.

Climate Action 100+, an investor-led initiative formed to pressure the world’s largest corporate greenhouse gas emitters to take more action on climate change, in its inaugural progress report released on Wednesday, revealed that of 161 target companies — 13 of which are Australian — 70 per cent have set long-term emissions reduction targets but just 9 per cent have emissions targets in line with or better than the minimum goal outlined in the Paris Agreement that seeks to keep the rise in global temperatures to below 2 degrees Celsius.

The 13 Australian companies targeted by the global network are Adelaide Brighton, AGL Energy, BHP, BlueScope Steel, Boral, Origin Energy, Qantas Airways, Rio Tinto, Santos, South32, Wesfarmers, Woodside Petroleum and Woolworths.

Climate Action 100+ praised companies that it said have shown “first-wave leadership”, including BHP.

The report pointed out that there was often also an inconsistency between companies’ stated aims and those of lobbying groups they were members of.

It showed that although 77 per cent of companies have clear board responsibility for climate, less than 8 per cent have alignment between the lobbying undertaken by their industry associations and their stated policy position.

Australia’s major emitters and resources companies now regularly face shareholder scrutiny and grilling at annual meetings over their emissions performance, with many now dedicating considerable resources to developing strategies and reports on their targets and mitigation programs.

Schneider bought Adelaide-based electrical products company Clipsal in 2003 for $750 million and process automation company SolveIt Software in 2012. This week it was announced that Schneider had won the subcontract to supply the main direct current switchboards for the $50 billion Future Submarines project.

-with The Australian

The author travelled to Barcelona as a guest of Schneider Electric.