Real estate boss wants doors opened for foreign investors despite public’s home ownership fears

THREE quarters of South Australians want foreign real estate investment restricted for fear future generations will not be able to afford to buy homes. The real estate lobby sees it differently.

- FULL RESULTS: See all the findings from Your Say SA 2018

READ BELOW: Next generation will struggle to buy

- YOUR SAY SA: Canberra chaos boosts both SA leaders

- YOUR SAY SA: Public wants power price probe

- YOUR SAY SA: SA finally looking on the bright side

THE Government should scrap surcharges that restrict foreign investment in South Australian residential property, the Real Estate Institute of South Australia says, despite nearly three-quarters of South Australians opposing foreign buyers buying homes here.

REISA chief executive officer Greg Troughton said our government should be attracting foreign investment into residential real estate, rather than discouraging it.

“Every other state has this bump or discouragement, I say get rid of it straight away — it was a flight of fancy when it was introduced and it needs to be removed forthwith because we are open for business and that shouldn’t carry an asterisk and an explainer saying ‘unless you’re a foreigner’,” Mr Troughton said.

“The key to the success of South Australia is getting more people employed for longer, spending more money growing the economy.”

According to the Foreign Investment Review Board 2016/17 annual report, just three per cent of all residential real estate approvals for foreign buyers across Australia for the financial year occurred in South Australia. The report shows 337 approvals were granted in South Australia for the financial year, however, the number of approvals acted on and properties actually purchased is likely significantly fewer, a spokesman said.

“There are less than 300 homes a year being sold to foreigners, out of some 28,000 homes sold each year,” Mr Troughton said.

“The Foreign Investment Review Board has enough protections in place that we’re not going to be overrun and anyone who suggests otherwise needs to look at the statistics.”

Of the 4341 people who responded to the Sunday Mail Your Say SA survey, 74 per cent felt said foreigners should not be able to purchase residential real estate.

Social commentator David Chalke said the fear of overseas investment in residential real estate was deeply rooted in society, and that a lot of people feared it would drive up house prices.

“Anything that’s going to affect the ability of young people to get their first home is considered to be disadvantageous,” Mr Chalke said.

“Public opinion is rarely based on fact, it’s based on belief, and if the belief is that foreigners are coming over here and buying up houses and artificially inflating house prices, then belief becomes the reality.

“People are hyper sensitive to housing cost increases because of the effects of cost increases on inescapable items like electricity, gas, water, council rates, government charges and so forth.

“Those have been going up ahead of CPI and people feel trapped.

“Will it make them more conscious of other threats to housing prices — you bet it will.”

Next generation will struggle to buy

BUYING a home today is difficult enough, and it seems South Australians have all but given up hope of their children being able to afford to do it without some assistance.

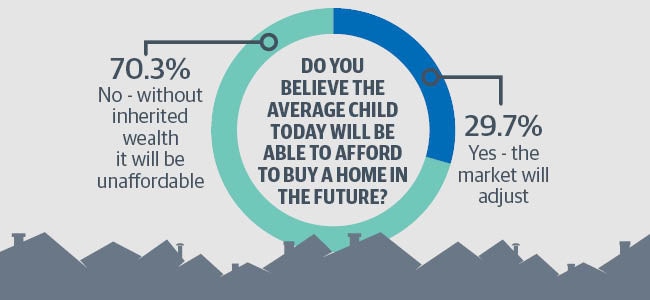

Of the 4341 South Australians who took part in the Sunday Mail’s Your Say SA survey, more than 70 per cent said they didn’t feel their children would be able to afford to buy their own home without inherited wealth.

Housing Industry Association SA executive director Stephen Knight said this was extremely disappointing.

“That’s deeply sad and a poor outcome and the government should be doing everything they can to change that,” Mr Knight said.

Almost 85 per cent of respondents would like to see stamp duty abolished.

Mr Knight said stamp duty costs were excessive and that South Australia was one of only three states that doesn’t offer a concession to first homebuyers.

“There was absolutely nothing in the State Budget in the way of incentives to building or buying a house and that’s disappointing,” he said.

Jesse and Amy Sumner recently purchased a home in Mount Barker and Mr Sumner echoed calls to have stamp duty abolished.

“Most young people come up with a $30,000 to $40,000 deposit and most of that is eaten up in stamp duty,” Mr Sumner said.

Mr Sumner said he would like some incentives or grants to be in place when his children are looking to buy.

“I think our kids will be able to buy their own house — how convenient it is to where they want to live and work remains to be seen — but I don’t think they’d be able to do it without help from us as parents.”