Payroll tax is crippling but can be fixed in four steps, says industry lobby group Business SA

SOUTH Australian’s current payroll tax has been slammed as a “tax on success”, but the next state government has the chance to fix it in four steps, according to industry lobby group Business SA.

SA Business

Don't miss out on the headlines from SA Business. Followed categories will be added to My News.

- Business SA column: Why do we tax success in SA?

- Steven Marshall pledges to scrap payroll tax under $1.5m

THE levy imposed on payrolls in South Australia is a crippling “tax on success”, but the next state government has the chance to fix it in just four steps, industry lobby group Business SA says.

As part of its call to political parties and leaders today, Business SA has released a Payroll Tax Policy document outlining key recommendations.

These include abolishing the tax or at least increasing the threshold at which the tax kicks in, from $600,000 to $1.5 million.

Business SA’s industry and government executive director Anthony Penney said the state had the lowest tax threshold nationally. “We want to make more businesses competitive, and that also means lowering our rate of 4.95 per cent to 4.5 per cent (by July 2020), to ensure South Australia has most supportive payroll tax rate in the nation.”

That move alone would help small businesses to create sustainable jobs, Mr Penney said, but there were three more recommendations to support further growth.

These included ensuring the lower rate was available only to companies moving to or headquartered in SA, introducing a tax incentive for Science, Technology, Engineering & Maths PhD graduates and reintroducing exemption on wages for trainees and apprentices.

Mr Penney said the cost of doing business in SA was “disadvantageous” given rising power and water bills.

While Business SA recognised the need for the government to collect adequate revenue to fund high-quality, essential services, “revenue must be collected in a manner which has the least impact on jobs and economic growth”, he said.

“Payroll tax penalises businesses which employ more people compared to those employing fewer, and further hurts businesses which take on more staff when economic opportunities arise or conditions improve.”

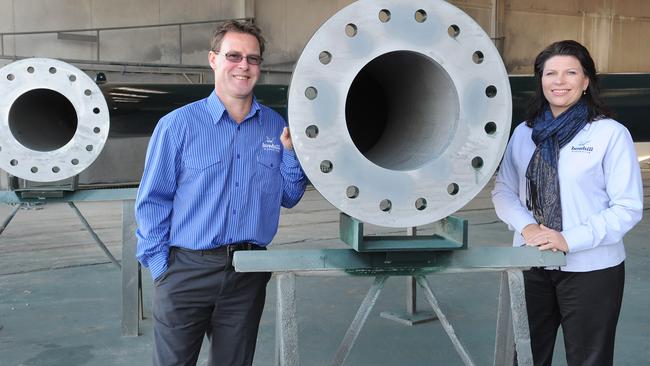

Mid Murray business Bowhill Engineering’s co-owner and chief financial officer Jodie Hawkes said the state needed to promote growth, not inhibit it. “We do not want businesses close to the line not employing more staff because it will make them subject to payroll tax,” Ms Hawkes said,.

The firm employs 32 full-time workers, including three apprentices and three staff who started last month, and has an annual wage bill of $1.8 million. “Our current payroll tax bill is $90,000,” she said.

“We’re always trying to take on new apprentices but we end up paying more taxes. We are at a point where we could strategically decide not to grow by not putting on more staff but we don’t want to do that.”

Bowhill Engineering is a specialist heavy and complex steel fabrication supplier which fabricated bridges for the Darlington upgrade and the Keswick railbridge.