Beach Energy gears for growth after record results

Adelaide-based oil and gas company Beach Energy has capped off a substantial year with some strong gains, including a 190 per cent surge in profit.

SA oil and gas company Beach Energy is accelerating its growth plans armed with a 190 per cent lift in full year net profit after tax to $577 million.

Underlying NPAT also rose 86 per cent to a record $560 million with Beach looking to increase investment as it lifted its five-year outlook.

The company also said it had achieved record production of 29.4 million barrels of oil equivalent (Mmboe), which exceeded its forecast and reached a net cash position two years ahead of schedule while delivering its best safety and environmental performance on record.

Cash flow now sits at $559 million.

Underlying earnings before interest tax and other items increased 80 per cent to a record $1.375 billion — well above its initial guidance of $1.1—1.2 billion.

“To say that I am proud of what the Beach team has achieved would be a gross understatement,” said managing director Matt Kay, who took home $2.9 million at the end of June, including entitlements and incentives.

“We have delivered on every promise we made at last year’s investor briefing and the focus is now about investing in the company’s high value growth assets,” Mr Kay said.

The strong results led to Mr Kay outlining a refreshed five-year production outlook, forecasting an increased 34-40 Mmboe target, up from 30-36 Mmboe.

He also projected cumulative free cash flow of $2.7 billion over the next five years.

Beach is gearing up to invest an additional $1.5 billion over five years, starting this financial year, he said.

“This means the drill-bit will see even more activity with participation in up to 196 wells, up from 134 in FY19 and utilising 10 rigs, up from 5.”

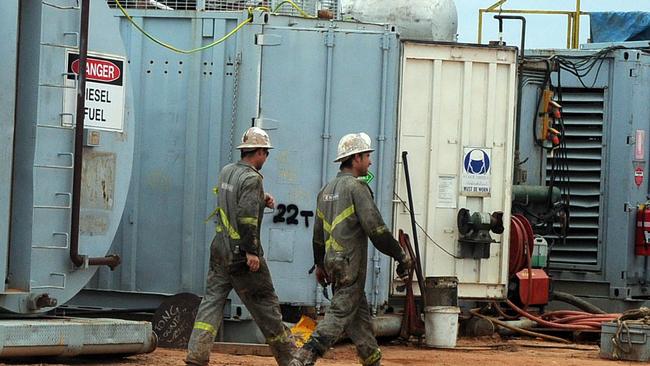

Founded in 1961, Beach is active in onshore and offshore oil and gas production in five producing basins across Australia and New Zealand.

With its Cooper Basin, offshore Otway Basin and Bass Basin producing assets, Beach supplied approximately 15 per cent of Australian east coast domestic gas demand in FY19.

It will invest up to $200 million in Western Flank oil in the Cooper Basin with up to 16 horizontal wells and further appraisal of the high producing Bauer field.

“Our Victorian Otway Basin campaign will get underway in FY20 with the Black Watch onshore-to-offshore well, the first of as many as 10 drilling opportunities in the next few years ensuring continued supply to the Otway Gas Plant.

Chairman Glenn Davis told investors the business was entering an important year for reinvestment into its core business.

“We believe this investment will continue to drive superior returns on shareholders equity noting total shareholder return over the last three years has been 270 per cent.”

The company’s net cash position, after it repaid $950 million in debt to the end of June, comes two years earlier than originally anticipated when it announced the $1.6 billion acquisition of Lattice Energy in January 2018.

Shares in Beach Energy, which will pay a 1c dividend on September 30, closed more than 11 per cent higher at $2.01