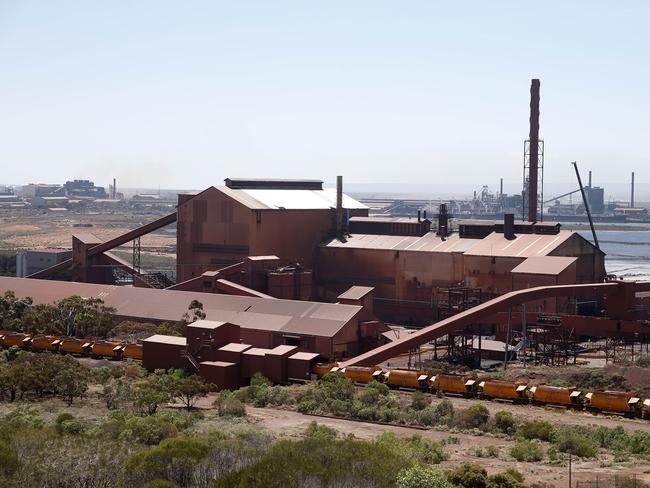

Whyalla steelmaker Arrium needs bailout after $1 billion deal collapses

A COLLAPSED $US927 million lifeline has left beleaguered miner and steelmaker Arrium — and by implication Whyalla — in desperate need of a “white knight” to ensure its survival.

SA Business

Don't miss out on the headlines from SA Business. Followed categories will be added to My News.

- Arrium’s lenders reject $1bn lifeline

- Workers to debate proposed pay cut to keep Whyalla steelworks open

- Arrium negotiates $1bn debt lifeline with US private equity interests

- NSW railway snub derails Whyalla steel

- Rail upgrade ‘win-win’ for Whyalla steel

A COLLAPSED $US927 million lifeline has left beleaguered miner and steelmaker Arrium — and by implication, the city of Whyalla — in desperate need of a “white knight” to ensure its survival.

IG market strategist Evan Lucas said such a saviour — if one is to emerge — would be in the form of a government buyout, given the current volatility in the sector due to a worldwide steel glut and low prices, combined with broader global economic uncertainty.

“The collapse of the debt restructure is unsurprising. And the question now becomes one of: do you strip the company right back and sell out the most profitable areas of the business? That’s probably the most likely outcome,” he said.

“In this current environment, particularly in resources, it’s incredibly difficult to get a bank to back you. Just look at the industries Arrium is in — the banks would put a massive risk premium and a negative interest watch before they even started evaluating a (debt restructure) program.

“They’re in deep, deep water.”

Mr Lucas said one possible situation, albeit unlikely, is that the State Government steps in as a “white knight” by turning the Whyalla steel plant into a public asset.

“There would be quite an interesting fight about that, given Premier Jay Weatherill has spent a huge amount of money on sports revitalisation (Adelaide Oval), the new hospital, and then to bail out Whyalla, that would be huge,” he said.

“I could maybe understand why he would do it, but it’s just so inefficient and the benefits to the state would be hard to argue, other than the jobs that would be saved in Whyalla.”

He said the Whyalla steelworks operation was a “millstone” due to its uncompetitiveness, inefficiency and high running costs.

The government indicated it knew of the rejection by Arrium’s bankers before Premier Jay Weatherill — and three other ministers — left on Monday on a trade mission to China.

“At the weekend, the Premier spoke with the Prime Minister to update him on the situation.

They agreed that the principal objective is the continuity of the business operations at Whyalla,”

SA Treasurer Tom Koutsantonis said.

“There is a lot at stake here for SA and indeed the nation. The workforce at Arrium and their wellbeing is our number one priority,” he said.

“This is a complicated situation and there is no simple answer to the challenges that need to be resolved.”

A pay vote conducted on Monday exposed the deep division among Whyalla workers on a temporary 10 per cent cut to find savings.

Australian Workers’ Union organiser Scott Martin said one group voted in favour (55-24) while the mining side voted against it (47-34) under two different industrial agreements.

Workers had already sacrificed rostered days off and public holiday shifts, he said.

Mr Martin said it made things “more complicated” but the union will seek to meet Arrium to “discuss a way forward” after a planned rally on Tuesday.

A number of unions are participating and Senator Nick Xenophon is also due to attend.

CFMEU state secretary Aaron Cartledge said the event had been planned to coincide with the funding announcement.

“With what’s happened, it’ll probably have a different spin, but there will be the same message — our workers need certainty,” he said.

Shares in Arrium are in a trading halt with the miner talking to its financiers after they rejected the debt deal offered by global equity firm GSO Capital, part of the Blackstone group.

The GSO offer, announced on February 22 and due to expire at midnight today, was to provide up to $US927 million to Arrium.

Arrium’s financiers would have to accept losses on the debt they are owed, which was to be bought out by GSO.

In return, GSO was to receive share warrants, which would be equivalent to 15 per cent of the company, and security over the assets of Arrium.

It could further increase its stake by underwriting a $US262 million share rights issue, which would have handed a huge, and controlling, stake in Arrium, if existing shareholders or other parties don’t offer to buy the new shares.

An added carrot was GSO getting the right to place two people on Arrium’s board.

A failure to strike a deal with GSO does not necessarily signal the end of the Whyalla operations, but Arrium has said it will consider mothballing it if adequate savings are not found.

Arrium has been struggling under a massive debt load — $2.076 billion at the end of December — while trying to prop up its loss-making Whyalla steelworks and mining operations.

Arrium sacked 30 staff in February, on top of almost 900 last year at Whyalla, where it still employs 3000 people.

Separate reports also emerged on Monday of the lenders — about 24, including the big four banks — potentially considering legal action against the board and appointing external advisers to consider alternative funding proposals.

One of those advisers is believed to be McGrath Nicol chairman Peter Anderson, who declined to comment on his involvement.