AML3D to list on ASX next month

A 3D metal printing start-up that has quietly gone about its business in Adelaide’s northern suburbs has firmed up plans for an ASX-listing, which would value the company at close to $26.5 million.

SA Business

Don't miss out on the headlines from SA Business. Followed categories will be added to My News.

A 3D metal printing company operating in Adelaide’s north has firmed up plans for a listing on the Australian Securities Exchange, which would value the company at close to $26.5 million.

AML3D, which operates from a manufacturing facility in Salisbury South, hopes to raise $9 million through the issue of 45 million shares at 20c each.

A prospectus detailing the company’s capital raising has been released, with applications from interested investors closing on March 9, ahead of a planned listing on March 26.

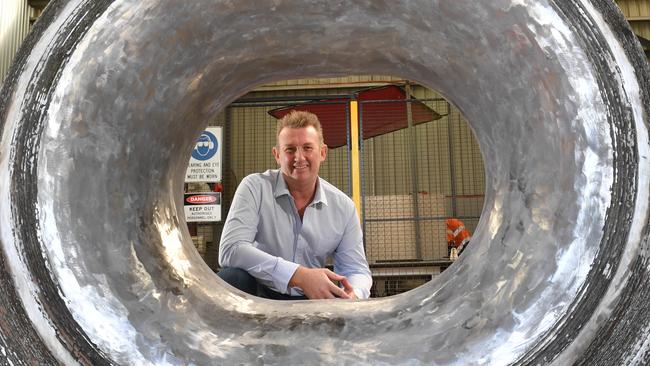

AML3D was established by welding and mechanical engineer Andrew Sales in 2014.

The company’s innovative manufacturing process combines welding, robotics, metallurgy and 3D computer-aided drawings to produce metal components and structures for the defence, maritime, aerospace and resources sectors.

In a letter accompanying the prospectus, AML3D chairman Stephen Mr Gerlach says part of the money raised will be used to establish a manufacturing facility in Singapore.

“AML3D has commercialised its wire arc additive manufacturing technology, an innovative metal additive manufacturing technology for the cost-effective production of large, high-performance metal components and structures,” he says.

“Funds raised will be used to increase our production capacity, enabling us to service significant new interest from customers without compromising our ability to deliver under current contracts.”

The company has commenced a search for a suitable site in Singapore, for which it has set aside $4.27 million.

A further $2.84 million will be used to relocate its Salisbury South facility to an expanded site in Adelaide’s northern suburbs, with discussions underway with a potential lessor.

The remaining funds will be used for development of the company’s technology, patent and trademark fees and working capital.

Mr Sales, who will retain a 30.14 per cent stake in the company, will be paid an annual base salary of $220,000.

Global Asset Solutions, controlled by Juhee Seo, will be the other substantial shareholder at the time of listing, with a 5.28 per cent interest.

AML3D has generated combined losses of $1.1 million in the past three financial years as it has continued to invest in development and commercialisation of its technology.

It has not provide financial forecasts in its prospectus “given the stage of commercial development”.

Sydney firm Foster Stockbroking is managing AML3D’s capital raising, while local firm Adelaide Equity Partners is acting as corporate adviser.

The offer is not underwritten, and a minimum investment of $2000 applies.

AML3D recently completed construction of a 1.4 tonne “panama chock”, which it believes is the heaviest 3D printed metal component ever manufactured.

Used to guide mooring ropes on ships and other marine vessels, the component was dispatched to a customer in Singapore last month.

At the time Mr Sales told The Advertiser the company’s vision was to “capture what we have here in Adelaide and to go global”.

“3D printing technology moves pretty fast, and to have a 3D printing business on a normal organic growth path, you can be taken out and it can be like a tortoise racing against a hare,” he said.