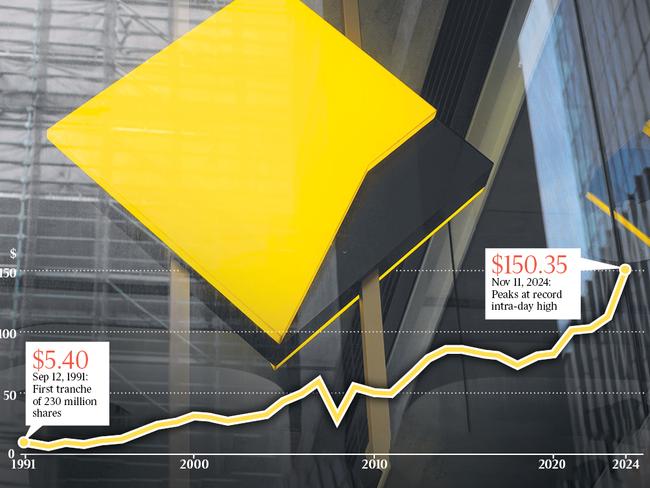

Record high for CommBank shares creates a $250bn company

In the space of minutes on Monday Commonwealth Bank shares hit $150 and its market cap reached $250bn. Where to next?

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Commonwealth Bank shares have shrugged aside ongoing “sell” recommendations from market analysts to hit $150 for the first time.

Australia’s biggest bank also has become the nation’s first company worth more than a quarter of a trillion dollars – ticking over at $250bn before 11am on Monday – and the stock has climbed almost 50 per cent in the past year.

Its stellar surge may have more room to run, analysts say.

CBA shares briefly touched $150.35 during trading but eased later in the day to close 47c higher at $149.79.

Baker Young managed portfolio analyst Toby Grimm said the bank’s share price this year had “definitely confounded many an analyst and trader”.

“The reason it’s doing well is because the macroeconomic conditions continue to favour the banks,” he said.

“House prices continue to tick along so there’s no perceived major risk to their balance sheets.”

A year ago CBA shares were trading near $101, and they have jumped more than 12 per cent in just over a month.

Banks also benefited from high interest rates, Mr Grimm said, and there were currently no other major sectors in Australia that could absorb investors’ money seeking a home.

“The mining and resources sector is the other big part of our market where money can flow, but on that front we are seeing weak fundamentals from a lacklustre Chinese economy,” he said.

Analysts have continually been slapping sell recommendations on CBA this year, not because of its performance or management but because its valuation keeps soaring.

“Analysts are in agreement that they are very expensive, certainly compared with historic valuations,” Mr Grimm said.

“CBA trading on 25 times earnings is astronomic,” he said.

“The banks have historically traded between 10 and 15 times.”

However, there was little risk to their earnings or balance sheets at the moment, and CBA’s share price could continue climbing “certainly through the end-of-year period”, Mr Grimm said.

“They have been the best-performing space,” he said.

Moomoo market strategist Jessica Amir said Australia’s banks were the most expensive banks in the world despite declining earnings over the past 10 years.

“Their shares will continue hitting all-time highs until the make-up of our Aussie market changes,” she said.

“We have this $4 trillion pool of superannuation funds and there’s only so many companies that people can put our superannuation into.”

Ms Amir said market consensus was for bank shares to decline 30 per cent eventually, but people would continue to invest in them because of their scale.

“I think CBA shares have got a little bit more puff in them, and then I think we will see a pullback,” she said.

“It’s very natural. Stocks don’t go up in a straight line, and I don’t think it will be Australia’s biggest company in five years’ time.”

That title was likely to go to a resources company or innovators, Ms Amir said.

“The new kids on the block are rising to the top of the Aussie market, like Block,” she said.

“Block makes 40 per cent of its money from bitcoin transactions.”

Mr Amir said she expected Australia’s big banks to become more involved in cryptocurrency, especially following last week’s US presidential election victory by Donald Trump and his crypto-friendly team.

CBA’s 47.9 per cent share price gain over the past 12 months is not even the best performance among the big four banks.

Westpac is up 53.9 per cent since November 23, although like CBA its shares slipped lower on Monday, while NAB shares have climbed 38.4 per cent and ANZ is up 30.1 per cent. Our fifth-biggest bank, Macquarie Group, has risen 44.3 per cent in the past year.

More Coverage

Originally published as Record high for CommBank shares creates a $250bn company