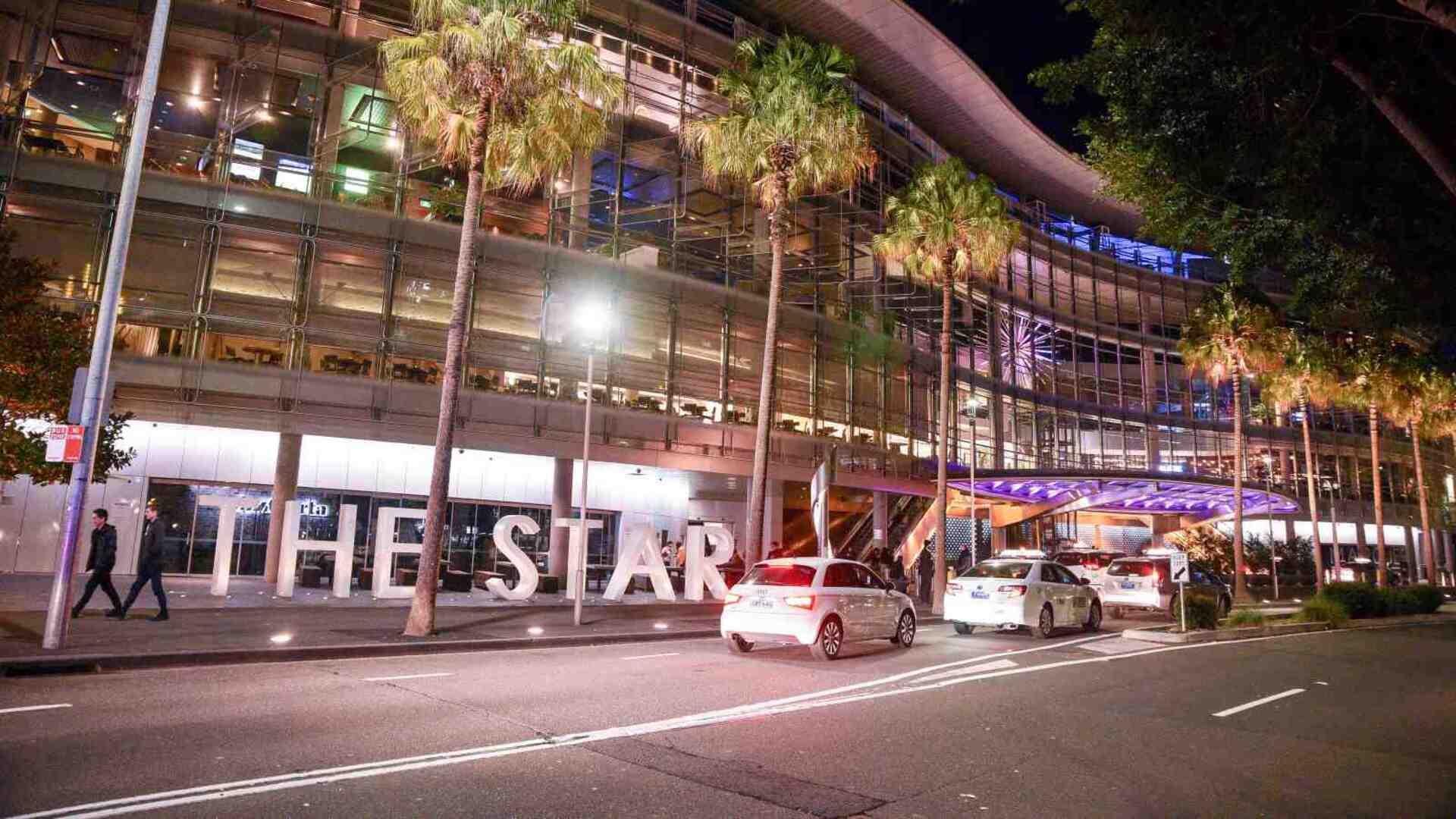

NICC in ‘regular contact’ with Star Entertainment as finances crumble

NSW’s casino regulator says it is in ‘regular contact’ with Star Entertainment as the gaming operator teeters on the brink of financial collapse.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

NSW’s casino regulator says it is in “regular contact” with Star Entertainment as the gaming operator teeters on the brink of financial collapse.

The NSW Independent Casino Commission declined to comment on whether the regulator was concerned about the sliding financial position of Star or whether there was a contingency plan if administrators were appointed to the company.

“The NICC is in regular contact with The Star,” a NICC spokesman said. “Given the current situation that The Star has outlined in announcements to the ASX, it is not appropriate to comment further at this time.”

The NICC also declined to comment on whether any administrator appointed to Star would have to pass a probity test to take control of the company.

Star on Monday warned there was “material uncertainty” over whether it could continue operating as a going concern after reporting a revenue plunge in the December quarter, rising costs at its new $3.9bn Queen’s Wharf precinct in Brisbane, as well as mounting fines from regulators.

The NICC in October last year stopped short of cancelling the licence for Star’s Sydney casino after uncovering a litany of regulatory failings flowing from the Bell II inquiry.

Star was fined $15m and its casinos in NSW and Queensland remain under the supervision of a government-appointed manager.

Star has set aside $150m in cash, in case it has to pay fines over separate action taken against it by federal money-laundering regulator Austrac. According to some analysts, that could exceed $300m.

Business Reset restructuring practitioner Jarvis Archer said regulators would significantly influence the direction of Star if it entered administrations. Mr Archer said these regulators, including the NICC and Austrac, may require fines and penalties to be paid in order for the company to maintain its licences.

Queensland Attorney-General and Justice Minister Deb Frecklington declined on Friday to comment on whether any contingency plans were in place if Star entered administration.

“Our primary focus remains on ensuring frontline jobs remain secure regardless of the ownership of the company into the future,” a spokesman for Ms Frecklington said.

NICC chairman Philip Crawford revealed in October that taking Star’s licence away “would cripple the company and have serious impacts that would ripple through the economy.”

The possible loss of 9000 jobs and the impact on business also was considered.

Star this week said it had $78m in available cash at the end of December after revealing earlier this month it had burnt through more than $100m in just three months.

Wealth Within chief analyst Dale Gillham said that, despite the turmoil at Star, some investors still saw opportunity in the company.

Star’s shares are down more than 95 per cent from their all-time high and have plummeted 37 per cent so far this year. They closed steady at 12c on Friday.

Mr Gillham said a recent 5.5 per cent stake purchase by Macau-based investor Wang Xingchun had sparked speculation about his motives.

“The key question now is whether this move represents a calculated bet on Star’s recovery or simply a short-term opportunistic play,” Mr Gillham said.

He said Blackstone’s reported interest in acquiring parts of the business could offer much-needed financial relief by reducing debt. “For aspiring investors, Star’s situation embodies a classic high-risk, high-reward scenario,” he said. “The company’s future hinges on successfully divesting assets to manage its debt while finding a sustainable path back to profitability.

“While a turnaround is possible, investors should be wary of short-term price spikes that can be tempting but often lack follow-through. Patience and discipline are crucial in navigating this part of the market so if you’re considering taking a punt on Star, prepare for a wild ride.”

More Coverage

Originally published as NICC in ‘regular contact’ with Star Entertainment as finances crumble