‘Near-impossible task’: House deposits double in past 12 years

Australians wanting the security of home ownership will be rocked by these figures showing just how easier it was a decade ago.

Generations

Don't miss out on the headlines from Generations. Followed categories will be added to My News.

The deposit an Australian homebuyer needs has essentially doubled in the space of 12 years.

Money.com.au analysis shows the required house deposit in this country has risen 99 per cent since 2012, while wages have only gone up 42 per cent.

That 99 per cent rise in the cost of a house deposit is also well over double the rate of inflation.

“The affordability gap for first-home buyers has widened dramatically, making saving for a deposit a near-impossible task,” Money.com.au home loans analyst Mansour Soltani said.

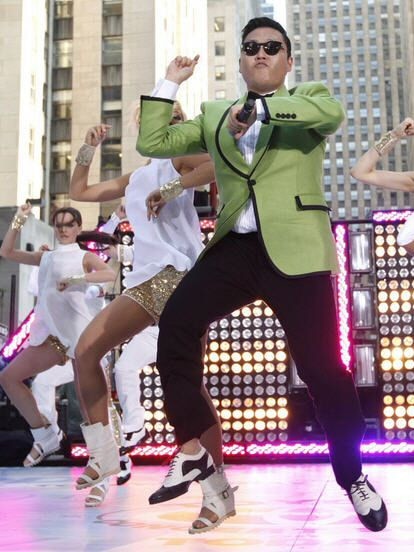

The Australian Bureau of Statistics began measuring dwelling values in 2012 when Julia Gillard was prime minister, and PSY’s Gangnam Style was top of the music charts.

In 2012, a first-home buyer putting together a 10 per cent deposit needed $48,990 – now they need $97,330, a 99 per cent increase.

The Reserve Bank inflation calculator, which is a general guide, shows that a $48,000, 2012 deposit is barely two-thirds of the 2024 requisite deposit.

Avoiding lender’s mortgage insurance with a 20 per cent deposit has compounded at the same 99 per cent rate. To bypass the insurance a 20 per cent deposit in 2012 required $97,980 (for the average priced house), now it’s $194,660.

The requisite deposit for a middle-of-the-road average home has increased on another metric too; loan size compared with the average house price.

Twelve years ago the average first-home buyer loan covered 73 per cent of the average Australian property price. Now the average loan equals 65 per cent.

“This tells us the average Australian first-home buyer either needs to come up with a larger deposit or settle for a cheaper property – both of which are increasingly difficult to do in 2024,” Money.com.au researcher Peter Drennan said.

The median house price in Adelaide and Perth has now overtaken Melbourne.

In the Victorian capital, the value of residential properties fell in nearly 80 per cent of the suburbs analysed by CoreLogic between June and August.

House values decreased in 25 per cent of Sydney suburbs for the latest quarter as well.

Originally published as ‘Near-impossible task’: House deposits double in past 12 years