More than 1.6 million Australian households struggling with home insurance cost

The number of Aussie households struggling to pay for home insurance has jumped by more than 30 per cent as premiums spike due to the risk of natural disasters.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

More than one in seven Australian households are struggling to pay for home insurance as premiums surge in regions threatened with increased risk of natural disasters.

A new report to be released on Monday by the Actuaries Institute has sounded the alarm on insurance affordability, warning increasing costs will pose a risk to households, lenders and governments.

The report found households spending more than a month’s income on home insurance rose to 15 per cent, up from 12 per cent in 2024 and 10 per cent the year prior.

The rise saw the number of affected dwellings jump by 30 per cent to 1.61 million, with those paying the highest 5 per cent of premiums suffering a more than 30 per cent increase.

The average premium, by contrast, rose by a median of nine per cent in the year to March 2024.

“While insurance remains generally affordable for 85 per cent of households, it’s concerning that there’s now 1.6 million households struggling to afford to insure their homes,” lead author Sharanjit Paddam said.

“Increases in premiums are outpacing wages growth. Unfortunately, we expect this will continue because of the overall increasing risk of natural disasters associated with climate change, which will continue to put upward pressure on premiums.”

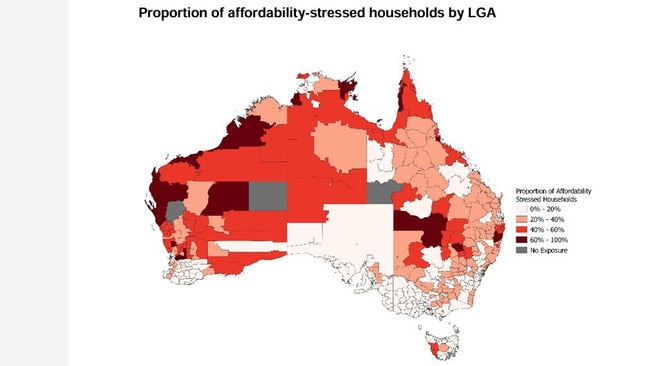

The rise in households experiencing home insurance affordability stress is significantly higher in regional areas across Western Australia, the Northern Territory, southwestern Queensland and the Northern Rivers region of NSW.

In these areas, households spend an average of 9.6 weeks of their gross income on home insurance, compared to the Australia-wide mean of 1.4 weeks.

The report largely attributed the jump to the increased risk of natural perils, such as cyclone and flood, where the impact of climate change will be three times worse for already affordability-stressed households.

The report said there were “early indications” the Cyclone Reinsurance Pool, introduced in 2022, was beginning to bring down the cost of insurance across northern Australia.

The Actuaries Institute is encouraging governments, insurers, lenders and investors to collaborate on sustainable finance measures such as resilience loans and bonds.

“We know as a country we need to manage the risk of the changing climate,” Actuaries Institute CEO Elayne Grace said.

“Sustainable finance should be part of the solution. It creates a path forward for households, investors, insurers and lenders, and allows government to focus on households in most need and community-level measures.”

Originally published as More than 1.6 million Australian households struggling with home insurance cost