Monash IVF cuts profit guidance after embryo mix up

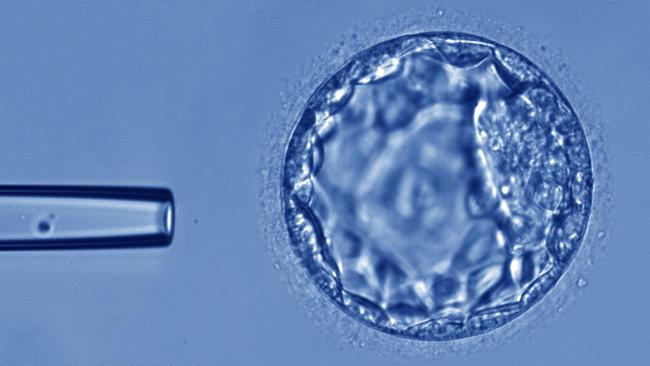

Monash IVF has downgraded its forecast annual profit, as the company battles the fallout from having mistakenly implanted a woman with the wrong embryo.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Monash IVF downgraded its profit guidance as the listed fertility services company adds financial consequences to the reputational toll of mistakenly implanting an Australian woman with the wrong embryo.

Forecast underlying annual profit was reduced to $27.5m for the year to June 30, 2025, compared to guidance issued in February of between $30m and $31m.

The profit update released to the market on Tuesday said Monash IVF is continuing to watch for fallout from its admission that a Brisbane patient was implanted with another donor couple’s embryo and gave birth to the child, in what was believed to be the first incident of its kind in Australia.

“The company continues to monitor key indicators and any implications that may arise from the Brisbane incident announced on 11 April 2025, including Queensland and Australian new IVF patient registrations, returning IVF patients for stimulated cycles and frozen embryo transfers, and transfer of medical records and human material to alternative IVF providers,” the statement said.

“These indicators are currently consistent with the performance levels observed in the months leading up to the announcement of the Brisbane incident.”

The latest guidance reflected the company’s “assessment of softer market and operating conditions in March 2025 that worsened in April 2025 across all of the company’s geographic markets”, the statement said.

Operating conditions improved in May, but “not sufficiently” to offset the hit from March and April.

Monash IVF was forced to apologise in April after news about the embryo mix-up was reported first by the Herald Sun, which said the parents were considering their legal options.

“The human error was identified … following the birth parents requesting the transfer of their remaining embryos to another IVF provider. Instead of finding the expected number of embryos, an additional embryo remained in storage for the birth parents,” a statement released by Monash IVF at the time said.

“The investigation confirmed that an embryo from a different patient had previously been incorrectly thawed and transferred to the birth parents, which resulted in the birth of a child. The investigation also found that despite strict laboratory safety protocols being in place, including multi-step identification processes being conducted, a human error was made.”

As well, Monash IVF last year settled a class action for $54m after using a faulty genetic test on embryos.

One lead class action plaintiff, Michelle Pedersen, said the settlement, which was approved by the Victorian Supreme Court in December, would not change patient outcomes or “remove the heartbreak” but hoped it might give closure to patients caught up in the so-called NiPGT testing debacle.

Monash IVF shares tumbled 12.4 per cent to 74.5c.

The company’s definition of underlying net profit excludes things like property costs, the class action settlement and, as of Tuesday’s update, the fee for an independent expert report into the embryo error.

That report will be authored by Fiona McLeod SC.

It determined at the time its embryo error came to light that the incident was immaterial in terms of its financial forecasts, and notified its insurers accordingly. It later told the market operator that it became aware of the mix-up on February 10 and confirmed that it was down to human error on February 12. The Herald Sun report “meant that confidentiality had been lost” and Monash IVF proceeded with its market announcement.

The company reported an interim net profit of $15.8m and had net debt of $72.5m as of December 31.

Monash IVF booked a 2024 net profit of $29.9m, implying that its 2024-25 result will be down 8 per cent year-on-year before the one-off items hit the bottom line.

More Coverage

Originally published as Monash IVF cuts profit guidance after embryo mix up