McCrann: Federal Reserve puts rate cut on table, but uncertainties remain for global economy

The Federal Reserve has put a rate cut on the table, but can the US really manage a Goldilocks world of low rates and a strong low-inflation economy?

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Whoosh!

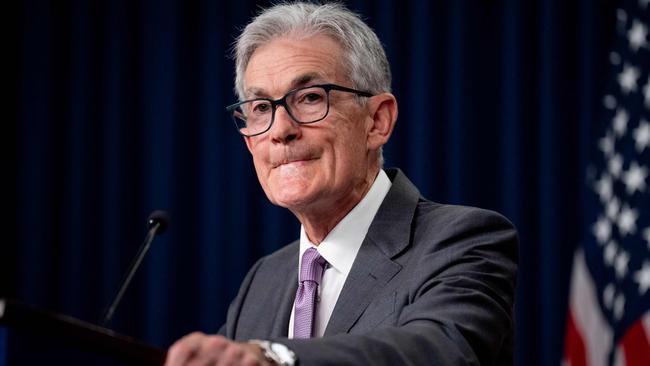

The head of the US Fed all-but announces a coming cut to its policy interest rate - the interest rate that drives all financial markets around the world - at its next meeting in September.

First Wall St reacts.

The tech-rich Nasdaq - the home of the so-called ‘Magnificent Seven’ - shot up nearly 500 points, or some 2.6 per cent.

The broader measure, the S&P 500, also leapt, but a slightly more subdued 1.5 per cent. While the Dow finished with only a small 0.2 per cent rise.

But then the Dow includes among its (only) 30 stocks the ‘Anything but Magnificent’ stocks like Boeing and the dinosaur Disney. It only has three of the Magnificent Seven - Apple, Amazon and Microsoft.

Our own main down under index also only went up 22 points through Thursday.

But that followed Wednesday’s ‘Relief Rally’ - relief that the CPI numbers took a rate rise off the RBA’s board table next week - that had sent the index rocketing up 130 points. With both days hitting new record closing highs.

As I asked a week ago, more narrowly with the Magnificent Seven, after their sudden “Whack!”, down as much as 13 per cent in a week (Tesla) - what next?

Despite the very confident bullishness displayed by Fed head Jerome Powell - that the US could have a future of low inflation, lower interest rates and a strong economy - the complex uncertainties remain.

Wall St, and so our own market, has been essentially driven for the last year or so by waxing and waning predictions of US rate cuts.

The Fed’s going to cut: Wall St - and our derivative market - surge. On second ‘thoughts’, the Fed’s not going to cut: Wall St retreats.

But then along came the Magnificent Seven and AI.

They combined to promise - at least in the eyes of the so-called ‘smartest guys’ in the Wall St greed machine - surging corporate profits that would swamp any interest rate negatives.

Until that mid-July wobble.

Only for those uncertainties to in turn be counter-swamped, at least for a few days this week so far, by that Powell-drive rate bullishness.

That America could have its lower rate cake, so to speak, and still get to eat it in a strong low-inflation economy.

In the broad, that could well prove correct.

But what has got lost is the absolute level to which Wall St has risen - the multiple of share prices to earnings, which are really being priced to three levels of perfection.

First, the traditional quibble: what happens to corporate profits if the Goldilocks world painted by Powell doesn’t emerge?

Second, what if as a consequence of the Goldilocks world, rates don’t actually fall that far through 2025?

And if they were cut sharply, it meant the US economy - and US corporate profits - had hit the wall?

The third leg is the confidence that AI will deliver. That it will deliver quickly, pervasively right across corporate America, and it will deliver only positively.

I can only look at how high those US stocks values have surged; and say again: hmmm.

Originally published as McCrann: Federal Reserve puts rate cut on table, but uncertainties remain for global economy