Mayur Resources aims to be an alternative lime and cement supplier for PNG and Australia

Mayur Resources is looking to soon break ground on a project in Papua New Guinea, after raising $100m in an expanded capital raising which brought on high-profile investors.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Mayur Resources is looking to break ground shortly on a transformative lime project in Papua New Guinea, after raising $100m in an expanded capital raising that brought on high-profile investors including retail icon Gerry Harvey and a major London-based fund.

Mr Harvey has picked up slightly more than $10m worth of Mayur stock for a 6.7 per cent stake, investing via a vehicle named after one of his former racehorses, Velrosso.

London-based Polus Capital Management, which has about $12bn in funds under management, now has an 11.7 per cent stake, documents lodged with the ASX in recent days show.

Mayur is also putting the finishing touches to a $US115m debt financing package with Appian, which, in combination with the $100m capital raise, will fully fund stages one and two of its PNG project.

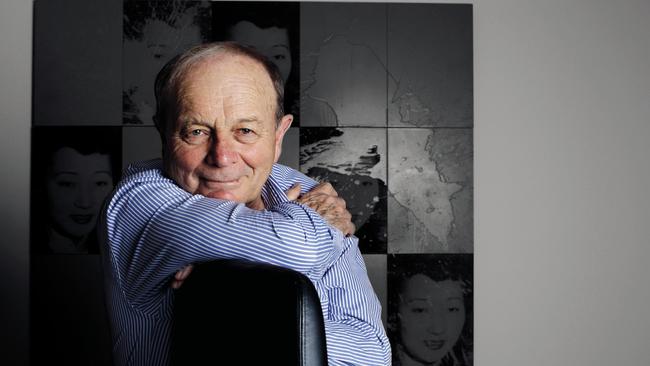

Mayur managing director Paul Mulder, a former Hancock Prospecting and BHP executive who is also a significant shareholder of the company, said Mayur had a vision over the next five years or so to be operating a quicklime, cement and clinker business supplying the needs of PNG and Australian customers.

The plan in the short term was to generate early cashflow in the current half year via the export of aggregates from the project on the PNG coast, where construction of the port is under way.

Once offtake agreements have been signed, satisfying the conditions precedent of the Appian debt financing, the lime production facility will be built, with first revenue from that expected to come in the second half of calendar 2026.

Mr Mulder said PNG had a need for lime and cementitious materials, and the Australian market was currently heavily reliant on imports.

Mayur, he said, would be able to supply a better quality product, closer to market, with customers in the mining sector in their sights.

“Customers in the gold and alumina sector but also those in the critical minerals space will form a big part of the book,’’ Mr Mulder said.

“It’s very difficult to produce critical minerals if you’re not using quicklime as the input reagent commodity.’’

Mr Mulder said lime supply from traditional sources such as the formerly ASX-listed Adbri had been eroded in recent years by imports from Malaysia and Thailand, although Mayur had advantages over these producers.

“They don’t have the same efficient supply chain,’’ he said.

“We’re 800m from the production site to our own private wharf. We will displace everything coming into PNG, supplying all the major gold and nickel miners.”

Mr Mulder said there had been a consolidation in the market via deals such as the $2bn takeover of Adbri last year, and Mayur was being seen as a strategic entrant into the market.

“We’re not just going to be a quicklime producer, we’re also gong to be a cement and clinker producer,’’ he said.

“Fifty per cent of Australia’s cementitious material is being imported from northern Asia and we’re three days’ sail versus 21 days’ sail.’’

Mayur is currently in the second phase of its wharf construction in PNG, which Mr Mulder said was expected to be completed in coming months, allowing for early limestone aggregate sales.

Once the debt funding had been finalised, which was expected to happen in the next few months, there was an 18-month build time for the quicklime facility.

Following that, Mayur plans to construct a clinker and cement production facility, with the aim for first revenue from that in calendar 2027.

Stage one of the Central Lime Project, which will build two kilns, is expected to cost $US35m to build, and generate $US34.5m in EBITDA annually.

Stage two would involve building another two kilns to double these numbers.

“You’ve got capital now in order to see a run rate over time of $US70m EBITDA and be a significant player in both the Australian and PNG and Pacific Area in quicklime,’’ Mr Mulder said.

“But it sets the foundation also for doing a brownfields expansion into clinker and cement.

“As an aside, the PNG government doesn’t have any cement in-country, and they’re pushing very hard to set up a national cement trading corporation so they can buy cement locally.

“Our view is when we’re up and running we’ll be the closest major importer of cement into Australia as well.’’

Barrenjoey was lead manager and underwriter on the capital raise.

Originally published as Mayur Resources aims to be an alternative lime and cement supplier for PNG and Australia