‘Uncharted territory’: Gold price surges towards record high of $US3000

The price of gold is surging as billions of dollars worth of bars fly across the Atlantic - and this underground vault in London is at the centre of a wild conspiracy.

Markets

Don't miss out on the headlines from Markets. Followed categories will be added to My News.

Big banks are flying billions of dollars worth of gold bars on commercial planes across the Atlantic.

Vaults in New York are filling up to record levels as physical gold buying goes “apocalyptic”.

Long delays retrieving gold from the Bank of England are sparking conspiracy theories about missing bullion — fuelled by Elon Musk’s hints of auditing America’s Fort Knox.

“I don’t get very excited about all that stuff — I tend to regard it as a bit in the realm of crackpot theories,” said Shane Oliver, head of investment strategy and chief economist at AMP.

“I suspect the Bank of England still has lots of gold.”

The gold market has witnessed unprecedented moves in recent months as the price of the precious metal continues to break record highs, sparking frenzied speculation in a market prone to fringe ideas at the best of times.

So what exactly is going on?

Gold price nears $US3000

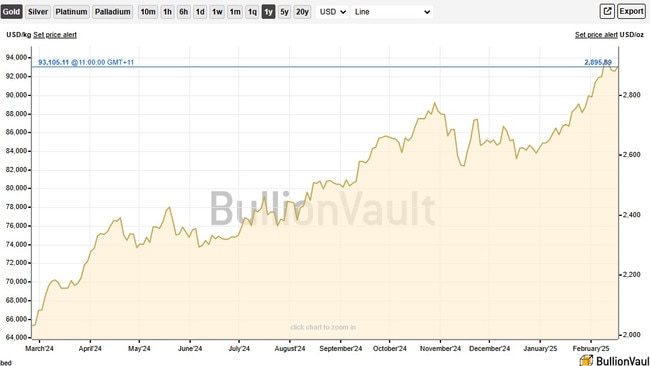

The price of gold hit a record of $US2946 per troy ounce in London on Wednesday, its 11th record in 2025 and the latest milestone in a years-long rally since the Covid pandemic in 2020, when it crossed $US2000 for the first time.

Gold has risen 44 per cent over the past 12 months and is up 11 per cent this year alone, smashing share market gains. The ASX200 is up 5 per cent this year, while the S&P500 is up 4 per cent.

The remarkable performance of gold even as stocks rallied strongly is unusual for a traditional hedge asset.

“The expectation is gold could not only be punching over $US3000 but closer to $US3500 and there’s bets on for it to be $US4000,” said Jessica Amir, market strategist at Moomoo.

Dr Oliver said those predictions were possible.

“It’s been making record highs — we’re sort of in uncharted territory,” he said. “I would probably say it’s got more upside but predicting [the price] gets a bit harder.”

What’s driving the surge?

Global gold demand is being driven by a range of factors including tariffs, inflation, US interest rate cuts, geopolitical tensions, credit crunch fears and expectations of a share market correction.

Central banks have been on a gold buying spree to boost their reserves, with institutional and retail investors also getting in on the action.

“There’s about eight different factors supporting the case for gold,” said Ms Amir, adding history shows there is likely more upside after recent US Federal Reserve rate cuts.

Over the last three Fed rate cutting cycles in 2002, 2007 and 2019 gold has rallied on average 100 per cent, but is only up 13 per cent since the latest cutting cycle started in September.

“History never does repeat but it always rhymes,” said Ms Amir. “We might expect gold to rally another 80 per cent.”

Central banks ‘hoover up’ gold

Total gold demand rose 1 per cent year-on-year in the last three months of 2024 to reach a new quarterly high and contribute to a record annual total of 4974 tonnes, according to the World Gold Council.

“Central banks continued to hoover up gold at an eye-watering pace — buying exceeded 1000 tonnes for the third year in a row, accelerating sharply in Q4 to 333 tonnes,” the body notes.

National reserves of gold held by central banks account for around one fifth of all the gold mined throughout history, and the pace has picked up in recent years.

China, the biggest central bank buyer, went on an 18-month buying spree up until May last year, and recently restarted after a six-month halt.

“I think the main things driving it higher have been central bank buying [which] started after 2022, when some central banks saw what happened to Russia with the sanctions and concluded they should diversify away from holding US dollar assets,” said Dr Oliver.

Moreover, China has just instructed its 10 largest insurance groups to start buying gold and hold 1 per cent of assets in gold.

“They’re moving money away from bonds into gold,” said Ms Amir. “That is likely to be to the tune of $US30 billion, but once the pilot program is up and running it means about $US43 billion.”

Sucked across the Atlantic

Then there are fears that President Donald Trump could impose tariffs on movements of precious metals into the US.

Billions of dollars worth of physical gold bars are being moved from London, the world’s leading gold market, into New York as investors seek to get ahead of any potential tariffs.

The record outflows have put unprecedented strain on London’s gold market, with delays in physical gold deliveries blowing out to four to eight weeks, compared with the typical two to three days promised by the London Bullion Market Association (LBMA).

“This disruption stems from a rapid outflow of gold to US COMEX [Commodity Exchange] warehouses, with 12.2 million ounces shipped over two months,” USA Gold said in a note last month.

“While LBMA data shows 279 million ounces stored in London vaults as of December 2024, only 36 million ounces (the ‘float’) are theoretically available for immediate market use, revealing a critical liquidity shortfall against an estimated 380 million ounces of outstanding spot/cash contracts. The delays effectively constitute technical defaults on these contracts, as sellers cannot meet delivery timelines.”

Long delays spark conspiracies

The logistical hurdles have forced the Bank of England to assure the market that it is not running out of gold.

“There’s still plenty of gold,” BoE governor Andrew Bailey told Sky News earlier this month.

Adrian Ash, director of research at BullionVault, said there was a “shortage in London’s bullion market, but it’s a shortage of manpower and trucks”.

“Longer-term however, the Bank of England’s role as a custody for foreign central banks wanting to tap the London market may be dented,” he told the broadcaster.

“It’s already seen stockpiles edge lower in recent years, even amid a surge of emerging-market central bank buying, as reserves managers worry over sanctions and other political risks vis-a-vis the west versus the rest.”

Mr Bailey downplayed the gold exodus and shipping delays in testimony before the UK Treasury Committee on January 29.

“Please, this is a not a big thing, really,” he said.

“Gold doesn’t play the role it used to play. So if we’d been having this discussion 100 years ago we’d have been in some very different world because we were on the gold standard.”

He insisted London “remains the major gold market in the world”. “If you’re involved in that market and you want to trade or use your gold you really need to have it in London,” he said.

The Reserve Bank of Australia (RBA), for its part, stores its 80 tonnes of gold with the BoE, despite occasional calls for repatriation over the years. Audits in 2022, 2019 and 2013 have confirmed the “existence and accuracy” of the RBA’s gold holdings.

Gold buying ‘has gone apocalyptic’

The Kobeissi Letter, run by financial analyst Adam Kobeissi, highlighted the scale of inflows into New York COMEX vaults that have put physical gold holdings above 2020 pandemic levels.

“Physical gold buying has gone apocalyptic,” the outlet wrote in a viral X thread.

“Gold inventories in the three largest COMEX gold vaults just surged by 15 million ounces in two months. January alone saw 19-plus thousand contracts delivered. Never in history have we seen buying like this. Meanwhile, the US has switched from being a net gold exporter to a net gold importer in November 2024.”

Big banks like JP Morgan are driving a large part of these flows.

In another strange and unintended consequence of Mr Trump’s tariff threats, they are being forced to transport billions of dollars worth of gold via commercial planes from London to New York, The Wall Street Journal reported last week.

That’s because the price of gold in London, which typically moves in sync with New York, has traded about $US20 lower since early December.

Banks that sold gold futures in New York now face losses if they buy back those contracts at the higher prices — so are opting instead to ship their physical gold from London to fulfil their contracts.

Not your typical gold rush

The Kobeissi Letter said a number of “strange” macro trends — including gold’s strength over the past year despite higher US interest rates and the rising US dollar — suggested a “major pivot from the norm”.

“We expect gold to continue to serve as the global hedge against inflation and uncertainty,” it said.

“And this is particularly the case as US deficit spending is out of control. The US has borrowed $US838 billion in the first four months of FY 2025. This is crushing bond prices as treasury yields are driven higher. Gold’s position as the global hedge has only grown as a result.”

It added, “To top it off, the US money supply grew 3.9 per cent year-on-year, its biggest increase since 2022. After reaching its deepest contraction in 65 years, money printing is back.”

Ms Amir agreed fears of a global debt-to-GDP ratios, recently flagged as a serious concern by the International Monetary Fund (IMF), were a major factor.

“The US has a record deficit and record debt and they haven’t yet resolved how they’re going to repay,” she said.

“Only two months ago [former Treasury Secretary] Janet Yellen said the US was in serious trouble about not being able to meet their repayments. Everyone’s turned a blind eye to that. Every time the world or indeed the US is experiencing unresolved credit crunch issues gold has hit a record high.”

Stocks overdue for correction

The global scramble by all sundry to seemingly get their hands on as much gold as possible might lead many to ask — do they know something we don’t?

“The short answer would be yes,” said Ms Amir.

In addition to credit crunch fears, “there are serious worries about overvaluations of global stock markets”.

“Many people believe stock markets globally are due for a mean reversion, a serious pullback, so that’s another factor why institutions including investment managers and ETFs, indeed central banks, are buying gold,” she said.

But Dr Oliver cautioned that “historically I wouldn’t regard gold as a good predictor of what the share market does”.

“There are geopolitical fears which are playing a part, so there is some safe haven demand,” he said.

“It may be the case that on top of this, because gold has this upwards momentum and shares have some issues particularly in the US regarding valuations, some investors are saying gold might be a better bet because it’s got better technicals.”

It may “also be a signal that the US dollar is topping”, Dr Oliver added.

“It looks to have peaked in mid-January, since then the trend has been down. Because gold is priced in US dollars, whenever the US dollar goes down it makes it easier for gold to go up.”

Is the gold still in Fort Knox?

Mr Musk, meanwhile, threw a hand grenade into the online gold chatter this week by suggesting his Department of Government Efficiency (DOGE) may look into Fort Knox, a heavily secured gold reserve in Kentucky.

Official Treasury Department data shows there are more than 147 million troy ounces of gold stored at the US Army facility, more than any other location in the US.

But Fort Knox has a strict no-visitors policy, and Mr Musk on Monday expressed surprise that there was no annual review of the stash.

“Who is confirming that gold wasn’t stolen from Fort Knox? Maybe it’s there, maybe it’s not,” he wrote on X in response to a post by Texas Senator Mike Lee saying he had repeatedly been denied access.

“That gold is owned by the American public! We want to know if it’s still there.”

Kentucky Senator Rand Paul, who also raised the issue with Mr Musk, told Fox News he had also tried for a decade to see the gold for himself “to make sure it’s all there”.

“I think some of them may not think it needs to be audited all the time, but I think the more sunlight, the better, more transparency, the better,” he said.

Originally published as ‘Uncharted territory’: Gold price surges towards record high of $US3000