Aussie economy ‘rarely been more gloomy’ amid fears dollar will sink to 50 cents

Australian economic prospects have rarely been more bleak – and fears are growing that the dollar is headed for an almighty fall.

Australian Dollar

Don't miss out on the headlines from Australian Dollar. Followed categories will be added to My News.

The year 2001 called. It wants its 0.5 cent Australian dollar back.

In that year, the Aussie dollar fell below half-parity as a US tech boom collided with smashed commodity prices.

The relative prospects for growth in the United States versus Australia were enough to crunch the currency to record post-float lows.

Similar dynamics are playing out today.

Sagging Australia

Australian economic prospects have rarely been more gloomy.

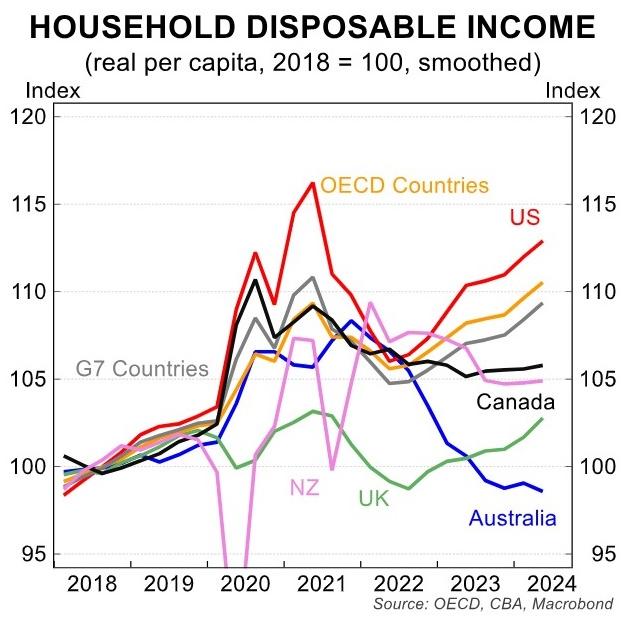

We’ve been in a private sector recession for two years while the US boomed out of Covid.

MORE: Sign RBA is creating ticking time bomb

This is despite commodity prices being very high, thanks to the war in Ukraine.

But ahead, the secular slowdown in the Chinese economy will keep dropping critical bulk commodities.

The two coals and iron ore are fatally dependent on the Chinese construction booms of yesteryear.

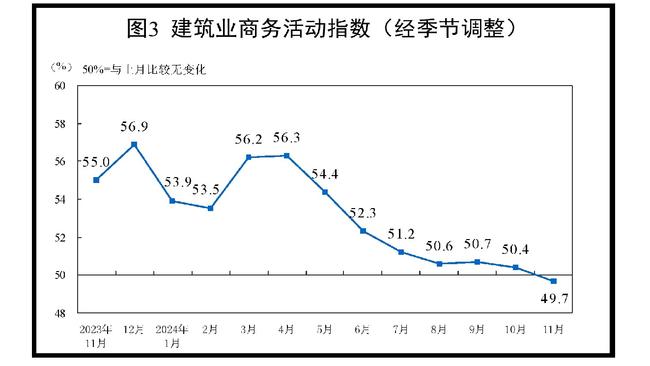

This week, the Chinese Construction purchasing managers index (PMI) fell into contraction for the first time ever as its immense property bust continues.

Ahead is more supply and falling demand for years that will sap Aussie national income and trigger rate cuts.

Booming US

On the other hand, the US economy is in rude health.

Its household sector is deleveraged. Its corporate sector is posting record profits and margins.

Ahead is an intoxicating cocktail of productivity-boosting AI, weight-loss drugs and automated cars to drive boom productivity.

That’s before we throw in Donald Trump’s tax cuts and tariffs to keep domestic demand and interest rates firm.

China and tariffs

Nowhere do booming US prospects versus sagging Australian ones play out more importantly than in China.

Incoming President Donald Trump is already taking tariff potshots from his armchair.

This is part of his “art of the deal” approach to transactional international relations.

Go in hard, then negotiate backwards with cowed counterparties.

Therefore, we can expect Mr Trump to apply the maximum mooted Chinese tariff of 60 per cent early in 2025.

This will hit Chinese exports to the US hard. Some estimates are that as many as 80 per cent of Chinese exports will be priced out overnight.

China will respond with its currency, which is already weak following years of deflation.

To fully offset the tariffs, it will need to fall 20 per cent. But even a 10-15 per cent fall would be very large.

Such a fall would drag the Australian dollar into the 0.50s versus the US dollar.

AUD and CNY

For the past decade, the Australian dollar has tended to move in tandem with the Chinese yuan.

If the yuan falls substantially versus the US Dollar Index, the great likelihood is that the Australian dollar will follow it.

There will be some offsets to this, notably in Chinese (and European) stimulus which will aid commodity prices at the margin amid Mr Trump’s tariffs.

But, before then, as the Chinese yuan enters Mr Trump’s trade war, the Australian dollar is on a hiding to nothing.

The Australian dollar appears headed for a re-run of the Millennium bust when the Japanese housing crash had killed iron ore and American technology was triumphant.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review.

More Coverage

Originally published as Aussie economy ‘rarely been more gloomy’ amid fears dollar will sink to 50 cents