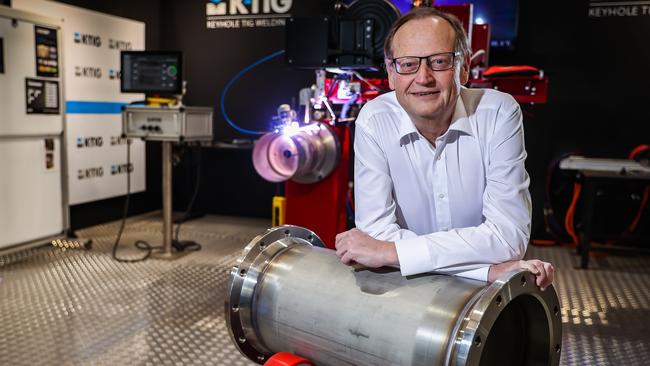

Listed welder K-TIG wins approval from creditors for survival plan

Directors of hi-tech welding company K-TIG will contribute to a $1m injection of capital after securing approval for a last-ditch plan for survival.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The directors of listed hi-tech welding company K-TIG will contribute to a $1m injection of capital into the business after securing approval from creditors for a last-ditch plan for survival.

Adelaide-based K-TIG and its subsidiary Keyhole TIG called in administrators in February following a failed deal to take over UK advanced manufacturing company Graham Engineering.

Administrators confirmed to the ASX on Wednesday that creditors had approved a deed of company arrangement proposal, which would return control of the companies to its directors.

As part of the terms of the agreement, a group of directors and existing shareholders will provide $500,000 in working capital to the companies before the deed of arrangement comes into effect. The group will then contribute $1m into a deed fund which will be used to repay creditors via a creditors’ trust.

According to the latest report to creditors from administrator John Bumbak at Korda Mentha, unsecured creditors are owed close to $3.9m. Creditors of the parent company owed less than $5000 are expected to recover their debts in full, while other creditors are estimated to receive up to 50 cents in the dollar.

The employment of around four staff members has been terminated. According to a statement issued to the ASX, the administrators noted that under the terms of the DOCA, all staff will be paid their entitlements in full.

“The completion of the deed of company arrangement made possible by the support of the companies’ directors together with the companies’ noteholders is a good outcome for the companies, their employees, creditors and shareholders,” Mr Bumbak said.

“The companies are now restructured with a reduced cost base, reduced and restructured debt profile and material additional working capital. We thank employees and creditors for their support through this process.”

A condition of the DOCA is that convertible noteholders convert their debt to equity within a 24 month period, once the business has “stabilised”. K-TIG was originally spun out of the CSIRO, having developed a precision welding technology used in industries including defence, aerospace, maritime and oil & gas.

The company’s fall into administration came less than five years after its listing, and less than a week after it revealed it was abandoning the $32m acquisition of Graham Engineering. At the time, the failure of the deal was blamed on “market volatility caused by underlying macro events and the underlying trading performance” of the UK company.

Mr Bumbak said the acquisition would have provided the revenue growth needed to offset the company’s high overhead costs, and its failure led to the need for a restructure. “The group pursued the acquisition of GEL (Graham Engineering) through late FY23 and H1 FY24 which was anticipated to bring scale and cost synergies, while simultaneously considering various cost reductions,” the report says.

“Ultimately, the group could not raise sufficient funding to complete the acquisition.”

K-TIG made a loss of $1.8m in the six months to December 2023. Adrian Smith has stepped down as managing director but remains a director of the company.

More Coverage

Originally published as Listed welder K-TIG wins approval from creditors for survival plan