Laziness is costing Aussies an average of $1100 every year, research says

There’s an easy way Aussies can pocket an extra $1140 each year, but most people are too lazy to do it.

Budgeting

Don't miss out on the headlines from Budgeting. Followed categories will be added to My News.

There’s an easy way Aussies can pocket an extra $1140 each year, but most people are too lazy to do it.

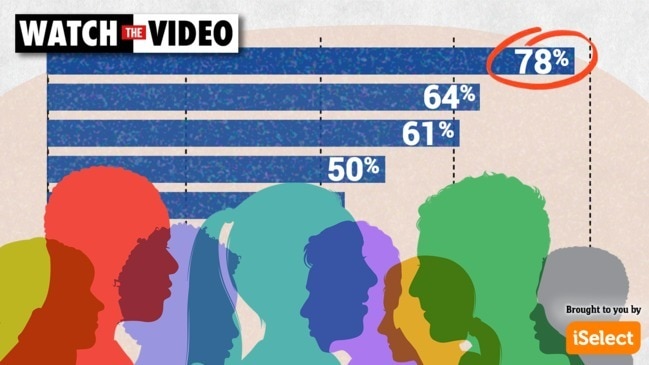

An online survey by YouGov, commissioned by iSelect, found that more than half of Australian households had not switched any products or services in the last 12 months.

iSelect spokeswoman Sophie Ryan warned that Australians may be getting stung by a “loyalty tax” as the result of sticking with their same policies and providers when, in the current inflated economic climate “every dollar counts”.

“We understand life is busy and we can easily fall victim to paying a ‘loyalty tax’ on household bills because we haven’t found time to shop around,” she said.

“But the good news is we could reclaim these lost savings by simply shopping around and comparing our options.”

The research found that the Australians that switched policies or providers in the last 12 months saved around $3.9 billion on household bills and expenses.

“This means that for each Aussie household that switched and saved last year, it’s estimated they saved an average of around $1140,” Ms Ryan said. Meanwhile, those that did not switch “lost out on around $1000 in extra savings last year”.

The survey found that changing policies or providers across a range of services – from energy bills to internet plans to insurance – in the last 12 months recouped, on average, hundreds of dollars for each change.

That included an average $1595 saved for switching home loans or mortgage plans and an average $337 for changing home and contents insurance.

More savings could be found for those that switched life insurance policies – $698, on average – or health insurance – $520, on average. Even changing pet insurance policies saved an average $416.

And those that switched internet or mobile plans found an average $587 in annual savings, the survey found.

But Aussies were losing out on an eye-watering $3.8 billion by sticking with their electricity or gas providers.

Ms Ryan said some energy retailers increase rates for existing customers more than and above those for new customers, and discounted energy plans generally expire after a year or two.

“If you’ve been on the same plan for several years, it’s possible you could have been automatically transferred onto a higher priced plan and losing out on savings,” she said.

The survey found households that switched their electricity plans saved an average $394 a year, and those that changed their gas provider saved an average $279.

“With price hikes across the board recently, many Aussie households are under extreme financial pressure and may be struggling to make ends meet,” Ms Ryan added.

“Unfortunately, more interest rate rises are predicted this year and health insurance premiums are on the rise again in 2023, so there appears to be no relief in sight.”

But, she continued, “it’s not all doom and gloom”.

“If you’ve been with the same household providers or plan for a number of years now, you could reclaim some lost savings by shopping around and comparing your options.”

Ms Ryan said Australians should take a close look at their health insurance policies this year, as private health premiums are set to rise by an average 2.90 per cent in 2023.

“This works out to an average increase of around $134 on a family policy annually, while singles will be paying around $60 a year more on average,” she said.

“This may not sound like much, but an increase is still and increase.”

But, Ms Ryan warned, this was not a sign for policyholders to cancel their health insurance, rather a warning to “explore more affordable options”.

“In these uncertain times, the peace of mind and greater choice that an appropriate level of private health insurance cover can provide is arguably more valuable than ever, especially as wait times for elective surgery continue to blow out.”

Originally published as Laziness is costing Aussies an average of $1100 every year, research says