Kayla Itsines’ Sweat sale price revealed by US acquirer iFIT

The real fortunes of Sweat co-founders Kayla Itsines and Tobi Pearce have been revealed for the first time, and it appears the rumours were well off the mark.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The real fortunes of Sweat co-founders Kayla Itsines and Tobi Pearce have been revealed, in documents detailing for the first time how much the duo earned from the sale of their online fitness empire.

The documents, filed by US parent company iFIT as part of a failed initial public offering (IPO) bid last year, show that earlier reports have massively overstated how much the Adelaide entrepreneurs pocketed from the sale.

They confirm that iFIT’s purchase price was less than half the $US300m ($A400m) figure that’s been widely reported since the deal was announced in July last year, and includes a mix of cash, shares and incentive-based payments.

According to the IPO filing with the Securities and Exchange Commission in the US, iFIT has already paid Itsines, 31, and Pearce, 30, about $US40m in cash, with the promise of a further $US40m in shares were the IPO to proceed within two and half years of the sale.

With iFIT abandoning its $US600m-plus IPO plans in April, Itsines and Pearce look set to receive that sum in cash instead, in line with the terms of the agreement.

Up to $US70m in additional deferred payments were also part of the deal, including up to $US30m based on revenue and growth targets in the three years following iFIT’s acquisition, and up to $US40m in royalties on equipment sales generated by the Sweat team during the five years following the sale.

Together, the four components of the sale price equate to a maximum of $US150m ($A195m) - less than half the figure that’s been circulating since the deal was announced.

Itsines and Pearce have remained tight-lipped about how much they received from last year’s sale, with Pearce’s LinkedIn profile saying he “exited Sweat for 9 figures”.

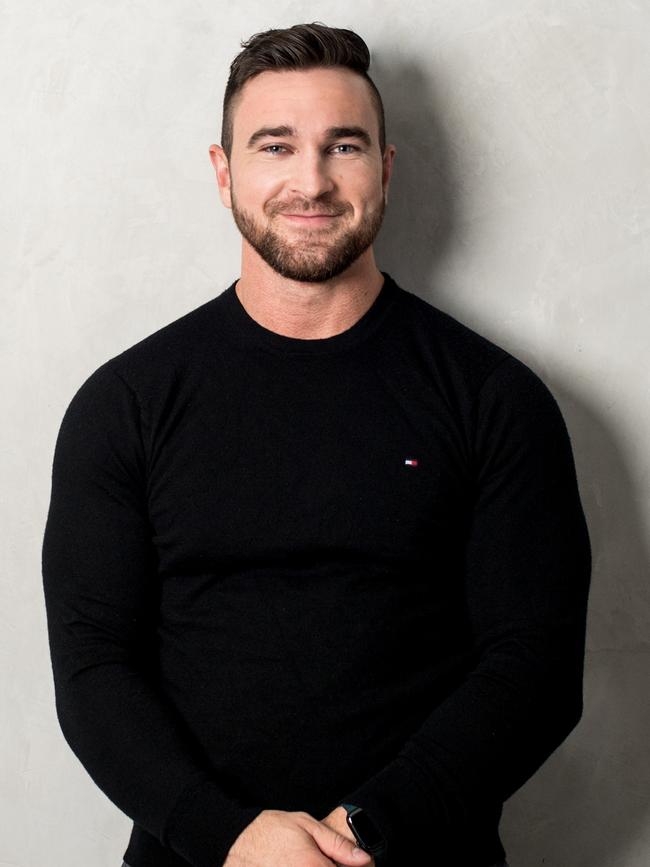

He stepped down as chief executive and departed the company in February, while Itsines remains the face of the brand and is still involved in the running of the business from Adelaide.

A Sweat spokeswoman declined to comment on how the company was tracking against its revenue and growth targets, or whether payments to Itsines and Pearce from iFIT were contingent on them remaining employed by the company.

“When Sweat and iFIT announced the acquisition in July last year we did not disclose the sale price, the price was disclosed as part of iFIT’s IPO lodgement,” the spokeswoman said.

“We will not be providing any further comment on the details of the sale price lodged by iFIT.”

It has been reported that Itsines, who split from Pearce in 2020, owned three quarters of Sweat at the time of its sale, with Pearce holding the balance.

At that split, Itsines’ stake is worth up to $US112.5m ($A146m), with Pearce to pocket up to $US37.5m ($A49m).

It appears they cashed out of Sweat at the right time, near the height of the pandemic when lockdowns and restrictions around the world forced people to exercise at home.

The home exercise boom ran out of puff once gyms reopened and health concerns eased, leading to a series of layoffs and costs cuts at Sweat and iFIT.

The two companies confirmed another round of redundancies last week, with iFIT blaming “a challenging macro-economic environment” and “increased supply chain costs”, and Sweat pointing to “changes in customer demand and the effects of gyms returning to pre-pandemic operating levels”.

The Advertiser has been told more than 30 staff will be laid off at Sweat’s Adelaide headquarters, reducing local staff numbers to 45, down from close to 100 at the company’s peak before the sale.

While the duo look set to pocket at least $US80m ($A104m) from the sale, pressure on the global home exercise market could eat into the additional $US70m ($A91m) in incentive-based payments that formed part of the deal.

iFIT, which is based in Logan, north of Salt Lake City in Utah, is one of the world’s largest players in the global “connected fitness” market, integrating digital apps like Sweat with its range of equipment including treadmills, rowers, exercise bikes and steppers.

However the company has been embroiled in a string of controversies in recent months, including a series of bitter legal disputes with arch-rival Peloton and a $US355m capital raise that led to the removal of billionaire founder Scott Watterson from his role as chief executive.

In the lead up to its failed IPO bid, iFIT spent up big on marketing, bringing in the likes of Olympic swimming legend Michael Phelps to spruik the brand.

Pearce and Itsines, both personal trainers, shot to fame after forming the Bikini Body Guide fitness program in 2015.

It evolved into Sweat, which became one of the world’s largest digital fitness training platforms for women.