IGO says there’s a large looming supply deficit in lithium, but price volatility will persist

The miner says 80 new lithium projects need to be funded to meet the tripling in demand over the next decade, as the sector surges on Chinese production cuts.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

About 80 new, currently unfunded, 20,000 tonne per year lithium projects will need to be developed in the next decade, IGO managing director Ian Vella says, while warning that pricing would remain “very volatile”.

IGO shares jumped more than 5 per cent on Thursday as Mr Vella delivered a strategy outlook to shareholders and analysts, as the lithium sector surged on reports a major Chinese producer was cutting production.

UBS said on Thursday that its China analyst Sky Han was reporting that integrated Chinese battery manufacturer and lithium miner CATL had decided to suspend production from its Jioangxi lepidolite mine, with that mine alone accounting for 5 per cent of global primary supply and 20 per cent of China’s supply.

UBS had forecast the Jiangxi operation to grow from production of 60kt of lithium carbonate equivalent to 95kt next year, to be the fifth largest in the world by volume behind IGO’s 24.99 per cent-owned Greenbushes mine in Western Australia.

“While CATL out of the market still has the 2025 market in surplus, we could see a much tighter scenario emerge should CATL have read-throughs for the broader China lepidolite thematic,’’ UBS said.

The broker said the news was positive for lithium prices, and could result in the spodumene price jumping from the current spot price of $US730t up to as high as $US1000t.

“Today’s news was positive, but we will need to see more supply come out to solve our 2025 surplus; key will be how the broader China lepidolite supply story evolves,’’ UBS said.

“We are still wary of additional Africa supply growth following our recent visit. We remain underweight the sector and look to for more supply exits to turn positive.”

Mineral Resources shares were up another 8.1 per cent on Thursday to $37.98 after piling on more than 15 per cent on Wednesday after it announcement cost-cutting measures across its lithium operations, and Pilbara Minerals stock was up 4.8 per cent.

Mr Vella on Thursday laid out a vision for the company to grow its suite of assets across lithium, copper and nickel over the next decade, but warned the lithium sector was not for the faint-hearted.

He said the fundamentals for lithium were strong longer-term, with China already entering the phase where electric vehicle take-up was outstripping internal combustion engine vehicles, but the rest of the world was yet to reach that point.

This trend would translate into strong demand for lithium, with new mines needing to be brought into production, he said.

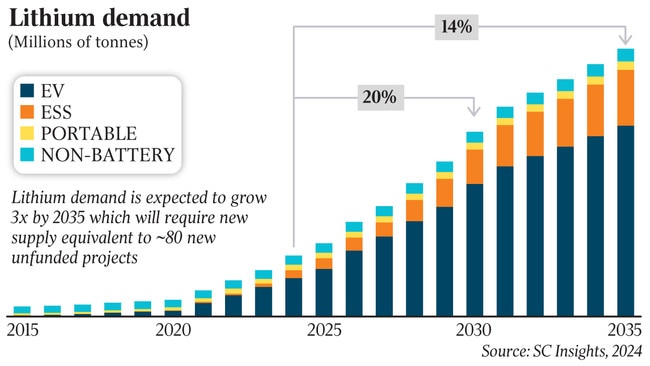

“The industry we expect will scale three times in the next decade or so,’’ Mr Vella said.

“What’s more important is how that’s supplied and how the industry steps up to meet that demand.

“That translates roughly to 80 new projects, unfunded, each of 20,000 tonnes (lithium carbonate equivalent), which is significant, and while lithium might be quicker and easier to develop than copper, for example, there’s still a lot to it.

“And I suspect that some of those supply side challenges are underappreciated.’’

Mr Vella said at current prices “there’s not a lot of incentive for anyone to be building any projects’’.

Given those two competing thematics, lithium companies needed to be ready and able to ride out some turbulent times, Mr Vella said.

“We believe that lithium is going to be highly volatile through that cycle,’’ he said.

“There isn’t another commodity that I can think of that’s growing at double-digit compound annual growth rates, whether it’s 12 per cent or 18 per cent it doesn’t really matter.

“It’s enormous growth, and the demand/supply imbalances will play out and create volatility. “And so we need to recognise and embrace that that will be the nature of the business that we’re in for at least the next decade.’’

Despite the risk inherent in developing projects, Mr Vella said “we think there is a great window to create value ... but we believe cost competitiveness is absolutely key”.

Mr Vella said IGO’s Greenbushes mine was “a reference point of what good looks like”, while recognising it was a world-leading deposit which would be difficult to replicate.

He also said companies needed to be agile.

“Lithium is highly ubiquitous in the world,’’ he said.

“It comes in a number of different forms, and there is ample lithium to meet the market demand well into the future.

“So time is of the essence, getting to the right resource, the right cost-positioning in a rapid manner, linked well with the market is fundamental. If you turn up too late, it’s probably not going to be that attractive.’’

IGO owns a 49 per cent stake in joint venture company Tianqi Lithium Energy Australia, which in turn owns a 51 per cent stake in the Greenbushes lithium mine in Western Australia, which the company says is the highest grade hard rock lithium resource globally.

This translates into a low cost mining operation, with the TLEA joint venture also owning a lithium refinery at Kwinana.

Originally published as IGO says there’s a large looming supply deficit in lithium, but price volatility will persist