Hannah Blass was earning six figures but she was ‘burning’ through her salary because of one big reason

Hannah Blass was earning six figures and living the good life but her bank balance was also spiralling “out of control” because of one habit.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

Hannah Blass was spending $1700 a month on clothes, and her life had spiralled “out of control” by the time she finally admitted she had a problem.

The 29-year-old from Canada said her shopping addiction started out simply enough. She was working in fashion marketing and got sucked into a cycle of impulse buying.

“My debt balance fluctuated a lot through my twenties because I was stuck in a cycle of paying off a chunk and then racking it back up again,” she told news.com.au.

“I would say I paid off over $50,000 in credit card debt overall.”

Ms Blass admitted that $50,000 could even be a “modest” estimate when she considers the interest accrued.

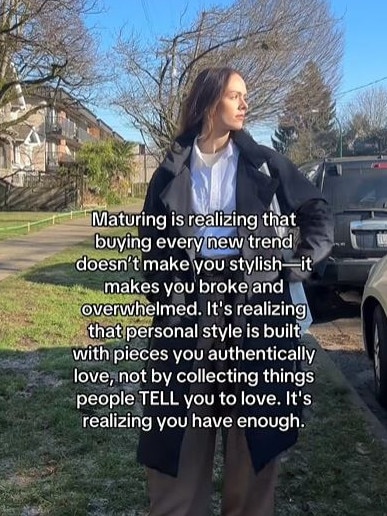

The 29-year-old, who is now an influencer online, tries to help other young women understand that being in debt is not normal or simply the price of being fashionable.

She’s amassed over 300,000 likes by sharing how she was “burning” through her six-figure salary and spending the bulk of it on clothes.

“I always felt like I needed one more piece to complete my perfect wardrobe,” she admitted.

“I left my job last August to build my online business helping others overcome impulse shopping and overspending and balance healthy spending habits with their love of getting dressed.”

Ms Blass said that at the height of her shopping addiction, she was spending $1700 per month just on clothes, and her anxiety, as a result, was spiralling out of control.

“I was anxious that impulse shopping would always be an uphill battle for me and that I would never get ahead in life financially,” she explained.

“The temporary rush I would get from making an online order would quickly descend into feelings of shame, guilt and stress.”

For Ms Blass, the turning point was getting engaged in 2023. She realised that if she wanted to achieve her dream of getting married, buying a house, and having kids, she needed to control her spending.

The impulse shopper felt that her spending habits were putting her future in “jeopardy,” and she needed to let go of her desire to constantly acquire new things to make room for achieving bigger financial goals.

The 29-year-old started reading about how habits and thoughts can create unhealthy behaviours and made a big effort to change her spending habits.

She started doing little challenges with herself, like not spending money on anything that wasn’t a necessity for 90 days, and it got her out of the cycle of constantly buying for a dopamine fix.

“It was hard at first, but after the first few weeks, I really felt my mindset and relationship with my closet shift,” she said.

It also helped her get on top of the debt that was causing her so much anxiety and stress, and by October 2024, she made the last payment on her credit card.

“It was a huge relief. It felt like I was already entering a new chapter of my life,” she said.

Ms Blass said it was nice to leave that “baggage” behind in her twenties to focus on her future.

Now, she’s created an online space where she talks to fashion lovers about clothes without focusing on always spending money to buy more.

“I’ve learned that fashion-lovers can still enjoy their love of clothes without needing new pieces all the time,” she said.

“I’ve learned that believing in yourself and your ability to grow is the single most important muscle anyone can build in their lives.”

Originally published as Hannah Blass was earning six figures but she was ‘burning’ through her salary because of one big reason