Fears over spread of ‘view tax’ for units as council brings in new rates calculation

Some high-rise apartments are having their rates calculated in a new way – with massive hikes of up to 50 per cent.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

High-rise apartment owners are being hit with huge rate hikes with those above the 40th floor facing an up to 50 per cent increase in one city — and there are fears it could be taken up by others.

The move for apartment owners on the Gold Coast to increase rates depending on what floor a unit is on has been slammed by critics and dubbed a “view tax”.

The council believes the change “ensures unit owners are charged fairly” as floor level can affect a property’s value.

The change was adopted by council on June 7, and came into effect on July 1, but the first rate notices only went out to residents last week, causing a stir among the community.

Information sent out with their rates bill explained the new method and what it would cost them.

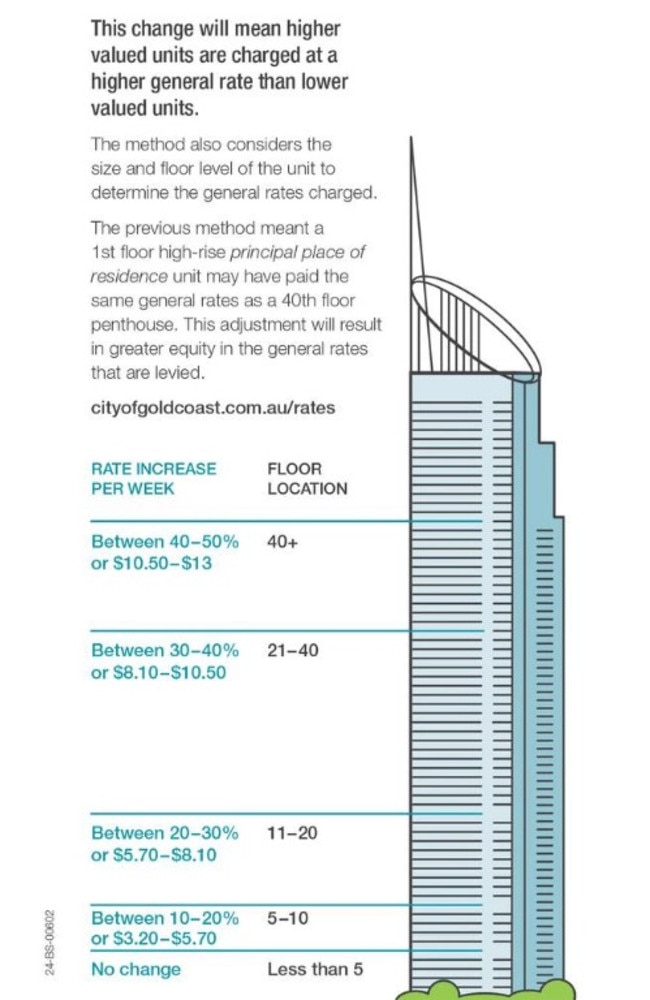

Those living below the fifth floor will see no change, while residents living between the fifth and 10th floor will face an increase of up to 20 per cent and residents located between the 11th and 20th floor face a bill up to 30 per cent higher.

Homeowners with residences between the 21st and 40th floor face increases up to 40 per cent and those above the 40th floor could be slugged up to 50 per cent more.

A City of Gold Coast spokeswoman told news.com.au the new method was used to calculate general rates for high-rise units that are a principal place of residence and was done so “to ensure fairness and equity across all ratepayer categories”.

“The general rate for high-rise units will vary depending on the unit’s rate categorisation which takes into [consideration] the unit’s size and floor level,” the spokeswoman said.

“This change ensures unit owners are charged fairly based on the effect that unit size and floor level has on a property’s value.

“The previous method did not take these factors into account. For example, under the previous method a 1st floor high-rise principal place of residence unit may have paid the same general rates as a 40th floor penthouse.”

She said the change would also bring rates in line with the method used for other units that are permanent or short-term rentals.

Laura Bos, the general manager of Strata Community Association Queensland, said the change to how general rates are calculated for high rises in the Gold Coast has been “terribly handled” with apartment owners feeling “blindsided”.

She said the big issue SCAQ had with the “view tax” was the valuation type that underpinned the high-rise apartment rates.

“Homeowners are rated according to their land value whereas apartment owners are rated according to their property value. The two are very different,” she told news.com.au.

“Why not have the same rate basis for everyone if we are truly talking about parity and equity?”

She also said a problematic assumption was being made that people living in these high-level apartments have more cash available.

“There have been assumptions made about the wealth of people living in apartments, who are facing the same mortgage increases, wages stagnation and cost-of-living issues as everyone else,” Ms Bos said.

“Some are also pensioners. It would have been a much better idea to gradually introduce the new change over a period of time so people could at least prepare.”

SCAQ is concerned more councils will consider adopting the “view tax”.

“We are concerned this will become more widespread as councils grapple with increased costs and little support from state and federal government, something that is understood and acknowledged,” Ms Bos said.

“However, we call on councils to do better and to make sure calculations are truly equitable, where everyone pays rates on the same basis, and that increases are staggered.”

An apartment owner who lives in Chevron Island told Gold Coast Bulletin he was stunned his bill had gone up by 20 per cent and criticised council for not being more transparent about the change – given Gold Coast mayor Tom Tate had announced a rate increase of 4.24 per cent when the budget was handed down last month.

Greg Van Dam said he was concerned about young people who were already struggling.

“We’re OK. We don’t have a mortgage. But you have a lot of young people who bought into high-rises with mortgages because they couldn’t afford a house – this is just another kick in the guts,” he told the publication.

On June 7, when council adopted the change, Gold Coast mayor Tom Tate had boasted about keeping the 2024-25 annual rates increase below the annual Consumer Price Index (CPI).

“Just like the family budget, Council’s costs across the board have also risen substantially. We need to ensure that we deliver the first-class services and infrastructure the city needs, but at a price ratepayers can afford,” Mr Tate said in a statement at the time.

“Since 2012, every annual rate increase (principal-place-of-residence) has been at, or below, CPI and this year we have delivered a rate increase of 4.24 per cent, below the annual CPI of 4.8 per cent).”

A spokeswoman clarified on Monday this 4.24 per cent increase applied only to properties that are a principal place of residence on the minimum general rate or with an average rateable valuation below the city median.

“71.58 per cent of principal place of residence properties received a 4.24 per cent net rates and charges increase or less,” she said.

Originally published as Fears over spread of ‘view tax’ for units as council brings in new rates calculation