Tightening cycle believed to be ‘ended’ as multiple central banks make interest rates decision

Last week, multiple central banks had to make a decision on whether to up interest rates or keep them the same, prompting a major shift in the global economy.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

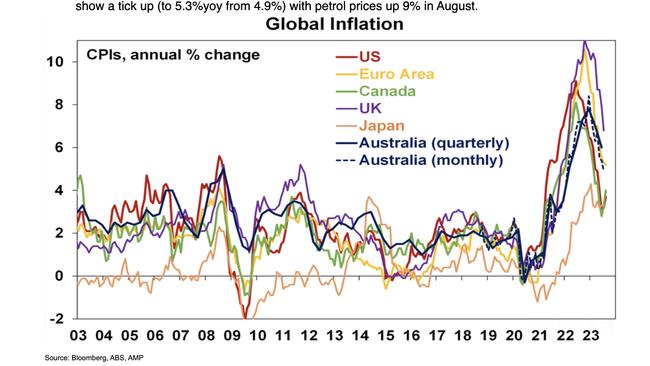

Some experts believe that the economic tightening cycle is over as inflation returns to more stable levels across the world.

Last week, multiple central banks had to make a decision on whether to up interest rates or keep them the same, and they all opted for the latter.

It’s a clear sign that inflation is well past its peak.

Central banks in the US, UK, Japan, and Switzerland all paused interest rates amid signs of inflation abating and this comes as Australia’s own Reserve Bank has kept the cash rate on hold for three consecutive months at 4.1 per cent.

Jennifer McKeown, chief global economist at Capital Economics, told The Financial Times that this was a “milestone” moment for the global economy, which has been teetering on the brink of a worldwide recession for the past year.

“We have reached a milestone in the global monetary policy cycle,” she said. “The global monetary tightening cycle has ended.”

Analysis from Capital Economics has found that the world’s top 30 central banks could actually start slashing their cash rates, an occurrence which hasn’t happened since the height of the Covid-19 pandemic.

The cuts could happen as soon as the next economic quarter.

The chief economist at the US branch of Citi Bank, Nathan Sheets, also said it appeared a pivotal moment had been reached in the global economy, dubbing it a “transition point”.

“We’re seeing evidence of a new regime characterised by gradual disinflation and decelerating growth,” Mr Sheets said.

Financial markets have also shifted their predictions, now betting on no more rate hikes for most of the world’s central banks. They are also forecasting cuts in developing countries.

Head economist at AMP, Shane Oliver, took a more cautionary approach, warning that many of the countries, including Australia, had not ruled out more rate hikes.

“The Bank of England left interest rates on hold at 5.25 per cent in a dovish surprise, but the decision was close and it retained a tightening bias with Governor Bailey saying its ‘premature’ to talk of rate cuts,” Mr Oliver said in an emailed note.

“The Bank of Japan left monetary policy on hold with comments by Governor Ueda suggesting rate (cuts) are still some way off.”

He added that the US central bank, the Federal Reserve, had substantially reduced its “pace of rate cuts”.

Originally published as Tightening cycle believed to be ‘ended’ as multiple central banks make interest rates decision