RBA interest rates: More financial pain for young households from tomorrow

It’s not just homeowners who are set to have a world of pain unleashed on them with disturbing new research revealing trouble ahead.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

Interest rates are expected to be hiked for the tenth time this week with younger households and those on lower incomes set to be worst hit by one of the most aggressive rate tightening cycles as they soar to a 10 year high.

New analysis shows that the rate rises will force the young and poor to slash their spending as their disposable income shrinks amid skyrocketing rents, groceries, electricity bills and petrol.

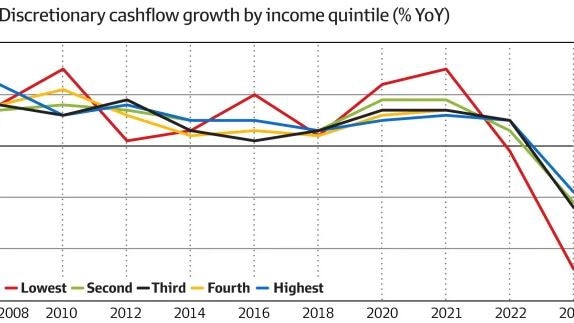

Yarra Capital Management economist Tim Toohey said he had found the discretionary money available to the bottom 20 per cent of income earners will dive by about 24 per cent this year, reported the Australian Financial Review.

“The RBA’s rate hikes already delivered, not to mention an additional 50 bps or more that they suddenly seem intent on delivering, are about to unleash enormous financial pain on the lower income and younger households that risks an abrupt stoppage in retail sales and potentially a sharp jump in the unemployment rate and a raft of delinquencies,” he said in a report.

While the focus has been on the painful hit that homeowners’ finances are taking, Mr Toohey said the young and households with a lower income generally have higher levels of debts.

“They are even more vulnerable to rising interest rates purely from a debt servicing perspective, let alone the fact that food, rent and utilities take up a large share of their income and from the perspective that they have little other by way of assets or financial buffers,” he said.

While Australians saved a massive $260 billion during the pandemic, Mr Toohey said 35 to 44-year-olds were not as savvy and would be caught out as they had continued to “party” by spending throughout lockdowns.

“While everyone else was building their savings balance, this group of ageing Millennials kept right on spending,” he said.

“What they couldn’t spend on travel and restaurants they more than made up for by buying a Peloton bike and home gym, updating their TVs and furniture, stocking up the cellar whilst revealing that they were the only cohort who thought buying a new car was a good idea during mandated travel restrictions.

“As a consequence, 35-44yo households appear to have accumulated no additional savings as a result of consuming less since Covid arrived.”

Overall, the RBA could be at risk of “burying” poorer and younger households after it raised interest rates from a record low of 0.1 per cent to 3.35 per cent in February, Mr Toohey added.

A recent NAB report also found that low income earners were suffering the greatest financial hardship with a quarter of people on incomes of between $50,000 and $75,000 struggling to cover all their bills.

But the housing market is also taking a hit with recent Australian Bureau of Statistics figures showing the value of home loans in January fell by 5.3 per cent and have now dived by a record 35 per cent lower over the past 12 months.

The number of first home buyers taking out loans has also plummeted to its lowest levels in five years and by 57.5 per cent since they peaked in early 2021.

It comes as new research showed that 54 per cent of Aussies feel further interest rate rises is not the solution to bringing inflation back under control and instead they are losing confidence in the government and Reserve Bank of Australia to ease cost of living pressures.

A majority also do not believe that higher interest rates will help to curb consumer spending but people will continue to spend causing a considerable burden, the Canstar research found.

Canstar’s finance expert Steve Mickenbecker said homeowners were “rightly nervous” about rising interest rates.

“There is a sense of urgency added when you consider that around one-third of all home loan debt is on loans taken out over the last two years when property prices were high. Values are now being whittled back and disappearing equity is piling on further pressure,” he explained.

“In spite of the record pace of interest rate increases, inflation is sitting stubbornly at 7.4 per cent for the year to January 2023 and unemployment is at a low 3.7 per cent, giving the Reserve Bank little encouragement to hold back further rate increases.

“With global recession risks looking a bit less threatening, the Reserve Bank won’t be as constrained by concern that it could be overshooting rate increases. But it will be watching for any negative indicators in the medium term.

“A 0.25 percentage point rate increase in March looks inevitable, with another two cash rate rises likely by the end of the financial year.”

Another 0.25 per cent hike in March will mean mortgage repayments on a $500,000 loan will have increased from $2103 in April last year to $3154 per month.

As a result, this will see borrowers forking out an extra $1051 per month or $12,612 per year.

If the cash rate climbs to a forecast 4.1 per cent this year, repayments on this same loan will rise by up to $3320 per month, which adds up to an extra $1217 each month or $14,604 per year.

Its research also revealed that one-in-10 mortgage holders and renters report having missed at least one repayment or bill since rates started rising in April 2022, and a further one-in-five reported they were worried about missing a payment in the near future.

“It is worrying that so early after the first rate increase, some borrowers and renters are already missing payments on their debts, rent and other bills,” said Mr Mickenbecker.

“Interest rate increases deployed to slow spending impact consumers unevenly, with borrowers shouldering most of the burden. The result is that 68 per cent of mortgage holders are feeling financially stressed.”

A shortage of rental properties also sees renters sharing the pain, with 65 per cent of that group reporting feeling financially stressed, he added.

“Unfortunately there will be no early relief, as a pause in rate increases will not mean imminent rate cuts,” he said.

“We are still five 0.25 percentage point interest rate increases short of the long-term average cash rate of 4.6 per cent, and shouldn’t be counting on interest rates returning to the lows of the last few years.

“It is time to batten down the hatches for a long haul of higher rates that in reality are only just returning to a more normal level.”

He added refinancing from the average rate to the lowest in the market could offset six future 0.25 per cent increases.

“Borrowers are taking advantage of this with the latest Australian Bureau of Statistics data showing refinancing activity remains 22.5 per cent up on a year ago. Another month or two of this trend and refinancers will be the biggest segment in the home loan market,” he said.

“Fixed rates may also be back on the agenda for borrowers who can afford repayments today but fear future increases. Three years of repayment stability is now available for an average rate that is only 0.11 per cent more than the average variable.”

“Unfortunately there will be borrowers who can’t find a way to cover their current repayment.

“If people find themselves in this situation, it is best to talk to their bank about relief measures and the long-term cost before considering temporary repayment pauses, switching for the short term to interest only repayments or extending their loan term.”

Originally published as RBA interest rates: More financial pain for young households from tomorrow