Predicted cuts to bring meagre relief for Aussies after years of interest rates hell

There are fears that predicted rate cuts won’t be enough to ease cost of living pressures for Australian families.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

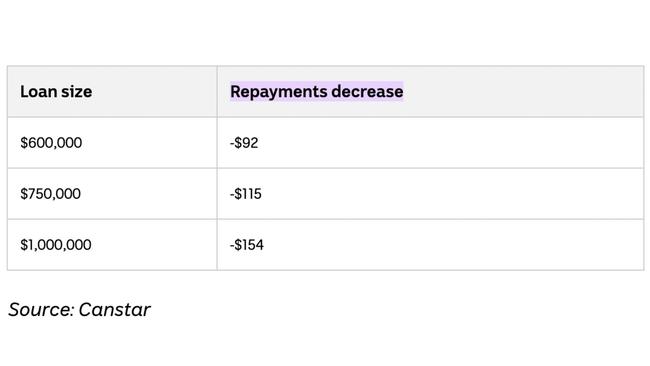

Homeowners have been slugged a whopping $54,000 in extra repayments on their mortgages in Sydney as a result of interest rate rises since the election of the Albanese Government but can only expect relief of around $115 a month if the RBA cuts rates next week.

While the Albanese Government is cautiously confident that the RBA will cut rates next week for the first time since the Covid-19 pandemic, there are fears that it won’t be enough to ease cost of living pressures for families.

That will require several rate cuts, which most banks are confident will occur over the next 12 months if inflation remains under control.

If the RBA does cut next week, it will be the first decrease in the cash rate in over four years, since November 2020 during the Covid-19 pandemic.

The election of Prime Minister Anthony Albanese coincided with a worldwide trend of central banks lifting rates to tackle inflation, and that understandably proved a political headache for the government.

Why some families paid $54,000 in extra home loan repayments

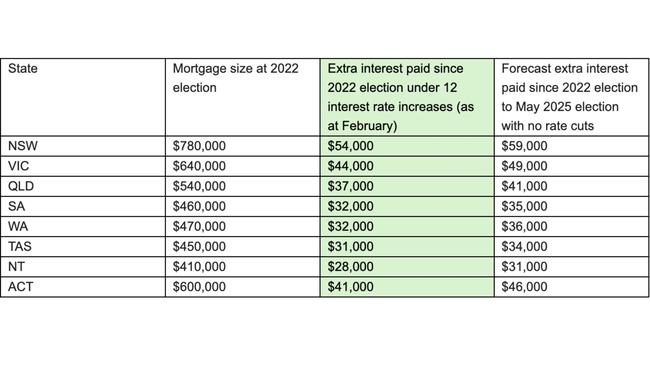

For families in Sydney, successive rate hikes delivered a $54,000 hike based on the average mortgage being $780,000 in 2022.

In Victoria, families have been hit with an additional $44,000 in interest based on a $640,000 home loan, while Queenslanders with a $540,000 home loan have paid $37,000 extra, and South Australians with a $460,000 mortgage have forked out $35,000 more.

In Tasmania, where the average mortgage was $450,000, the extra interest cost households $29,000 each.

Rates started increasing in May 2022, going up a grinding 13 times over the next 15 months to the current level of 4.35 per cent.

“Since the election of Anthony Albanese, Australians with a typical mortgage have paid on average $50,000 more in interest, financially devastating families,’’ Liberal housing spokesman Michael Sukkar told news.com.au.

“Before his election Anthony Albanese promised Australians would have “cheaper mortgages”. This has proven to be yet another lie and proof that Australia can’t afford another three years of Labor.”

The RBA raised the cash rate target by 425 basis points between May 2022 and December 2023. Over this period, the average outstanding mortgage rate increased by around 320 basis points.

“Housing costs have become the number one financial concern for Australians in 2025, with a staggering increase in stress compared to five years ago,” said Canstar’s Data Insights Director Sally Tindall.

“Whether it’s skyrocketing mortgage repayments or surging rents, it’s clear that housing affordability is stretching household budgets to their limits.”

What economists say on when the RBA will cut rates

Economists at the nation’s big four banks are now united in predicting the RBA will cut next week.

ANZ predicts that a cut will occur when the bank’s board meets with further cuts to follow.

Commonwealth Bank economists are optimistic that homeowners will get four cuts over the next year or so.

NAB predicts that we will get five cuts in the next cycle and Westpac currently four cuts in the next cycle.

Why rate cut could increase house prices

Homeowners planning to sell could be set to make a killing if the RBA starts cutting rates in February with predictions some suburbs could record an eye-watering 19 per cent jump in house values based on a one per cent reduction in interest rates.

CoreLogic has predicted the housing market is set to secure a boost as interest rates start falling.

That’s good news for homeowners planning to sell in the next two years but potentially a reason for buyers to make the plunge now before prices start rising.

There are predictions that the RBA could start cutting with a 25 basis point cut on February 18 or at the next meeting on April 1.

Based on previous periods of rate reductions, national dwelling values would increase an average of 6.1 per cent for each one percentage point decline in the cash rate, according to CoreLogic.

But as CoreLogic’s Head of Research Eliza Owen points out, certain markets will see a bigger boost from rate reductions than other suburbs.

“A reduction in the cash rate could spur a recovery trend in the high end of the Sydney and Melbourne housing market, which tend to be the bellwether for broader market recoveries in those cities,’’ she said.

“Lower interest rates are set to boost the housing market in 2025. Lower rates mean buyers can borrow more, spend more, and ultimately make housing a more attractive investment.

“In the current economic climate, these rate cuts should go a long way in boosting consumer confidence, signalling an end to the recent battle against inflation.”

For example, in Leichhardt Sydney where the median value is $2.329 million, house prices have fallen 6.9 per cent from the market peak to January 2025.

But modelled on a change from a one percentage point drop in rates the price could be set to soar by 19.1 per cent or over $460,000.

In Warringah, the old stomping ground of Tony Abbott, the median value is currently $2.4 million, which is a nine per cent decline compared to the previous market peak.

However, prices could rise by 18 per cent if there is a one percentage point drop in interest rates over the next year or so, according to CoreLogic.

Double-digit gains are predicted for Sutherland-Menai-Heathcote, Hurstville, Hornsby, Parramatta, Sydney inner city, Botany and Canterbury.

CoreLogic estimates based on previous periods of rate reductions that national dwelling values would increase an average of 6.1 per cent for each one percentage point decline in the cash rate – but stresses that Australia is not one housing market.

“If history is anything to go by, certain markets will see a bigger boost from rate reductions than others, and it may be because of market characteristics like price point, location and investor interest,’’ Ms Owen said.

Based on CoreLogic’s analysis, relatively expensive markets have historically shown stronger responses to reduced cash rate settings, especially in the housing sector.

Sydney and Melbourne

“Key examples are houses in Leichhardt, Whitehorse and other inner markets of Sydney and Melbourne which have previously shown the strongest reaction to a reduction in the cash rate,’’ she said.

“We’ve compiled the Australian house and unit markets that have had the strongest response to cash rate reductions nationally between 2015 and 2019. These markets are also generally down from peak values, suggesting they have had a strong response to interest rate rises since May 2022.”

In Sydney, Melbourne, Hobart and Canberra, CoreLogic suggests many of the markets with a solid response to rate reductions are also seeing values well below their peak under recent interest rate rises, so easier access to credit may trigger a recovery trend in these markets.

In Melbourne, there are predictions of 18 per cent increases in prices in Whitehorse-West, Essendon and Manningham-West where the median value is $1.4 million.

Brisbane

CoreLogic says the Brisbane markets that have historically had the strongest reaction to a reduction in interest rates are also relatively expensive.

With the exception of Browns Plains, each of the top ten house markets had a median house value of at least $1 million.

Smaller price jumps of around five per cent are predicted for Sunnybank, Nathan, Brisbane’s inner north, Mt Gravatt.

Adelaide and Perth

The relationship between the cash rate and home values is far less pronounced in markets across Adelaide and Perth according to CoreLogic, which had very different market performance throughout the 2010s.

In Perth and WA, market values were far more influenced by the boom-and-bust conditions in the mining sector than movements in the domestic cash rate target.

South Australian dwellings had “slow and steady value changes throughout the 2010s, before seeing a rapid ‘catch up’ in home values through the Covid period.”

Surprisingly, WA and SA also saw virtually no response in the trajectory of home value to higher interest rates, which has further demonstrated the loose relationship between the cash rate and property values in these states.

Originally published as Predicted cuts to bring meagre relief for Aussies after years of interest rates hell