Australia’s latest warning on China

A spillover from China’s weak economy and surging petrol prices pose significant challenge to taming inflation, the RBA has cautioned.

A spillover from China’s weak economy and surging petrol prices pose significant challenge to taming inflation, the RBA has cautioned.

All 11 sectors finished in the red on Monday, with the local benchmark dragged down by a sell off in tech stocks.

The share market soared on Friday as strong leads from Wall St and Europe and better-than-expected data from China lifted traders’ confidence about the global economic outlook.

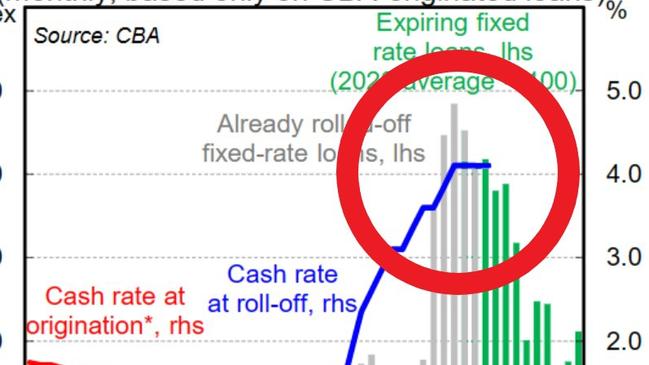

The cash rate seems to have stopped rising – for now – but there’s a worrying sign that things could be about to get a lot worse.

The Reserve Bank has kept the official cash rate on hold at 2.5 per cent but borrowers are warned to brace for hikes next year.

The RBA has left interest rates on hold at 2.5 per cent in March, in a move that was widely expected by markets.

THE International Monetary Fund has argued interest rates should be kept low while Australia’s economy is still ‘soft’.

THE Reserve Bank has left interest rates unchanged at 2.5 per cent.

THE RBA has opted to leave the official cash rate on hold at 2.5 per cent, in a move widely expected by markets.

THE International Monetary Fund (IMF) has warned major economies to keep their interest rates low while budgets are being repaired.

HOME loan demand has climbed to its highest level since the GFC – thanks to low interest rates and a resurgent building industry.

Original URL: https://www.adelaidenow.com.au/business/economy/interest-rates/page/189