Interest rates taking toll on households as food spending climbs

Rising interest rates are proving a heavy burden on many households, with spending on essential items climbing even higher, according to new data.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

Household spending is continuing to climb, with the rising cost of food impacting many families and higher interest rates taking a toll.

Food spending was up 2.4 per cent in August, while alcoholic beverages and tobacco were up 0.2 per cent, according to the latest data from the Australian Bureau of Statistics.

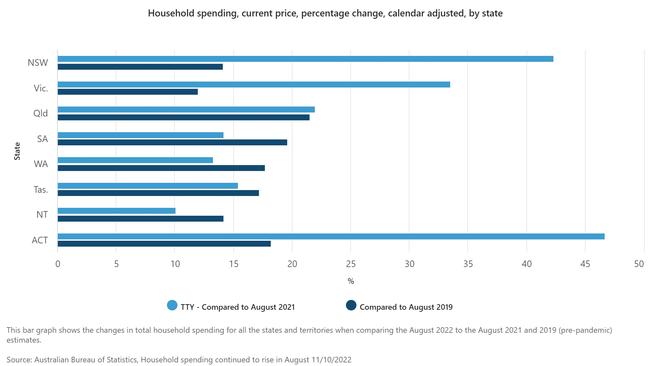

Overall, household spending increased by 29.0 per cent compared to the same time last year.

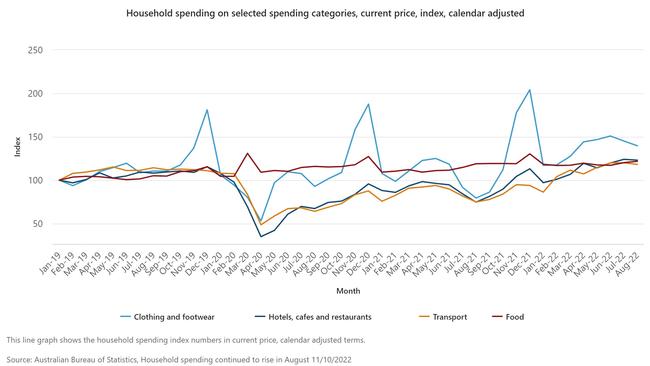

The strongest increases were in clothing and footwear, which were up 75.8 per cent.

Hotels, cafes and restaurants also climbed 64.8 per cent, while transport rose 57.8 per cent.

ABS head of macroeconomic statistics Jacqui Vitas said it was the 18th consecutive month of increases in total household spending, with rises in all categories.

“There were strong increases following Covid-19 Delta lockdowns that reduced spending last year,” she said.

In comparison to life before the Covid-19 pandemic, the ABS data revealed total household spending was 15.8 per cent higher compared to August 2019.

The strongest increases were in recreation and culture (up 31.1 per cent), clothing and footwear (up 26.3 per cent), furnishings and household equipment (up 20.1 per cent) and food (up 15.8 per cent).

Meanwhile, the CommBank household spending intentions index fell 0.5 per cent, down to 114.9 in September from 115.5 a month earlier.

It is the first monthly decline since the Reserve Bank of Australia began hiking interest rates this year.

CBA economists are predicting an even greater impact in the coming months.

The biggest decline came in health and fitness, which was down 11.2 per cent, with fewer visits to doctors and dentists.

There was also a drop in home buying by 4.4 per cent, with increased interest rates slowing demand for home loans.

“The effect of rising interest rates is beginning to impact on household budgets and Australian consumer spending is adjusting accordingly,” CommBank chief economist Stephen Halmarick said.

“Households are seeing a noticeable difference to their mortgage repayments and therefore are considering how they can adjust their expenses elsewhere.”

Originally published as Interest rates taking toll on households as food spending climbs