Another big warning on debt for Australia. When will we listen?

THE world is shouting at Australia: You’re in over your head with debt. But we’re too revved up on our $1.7 trillion bender to care.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

THE OECD warned Australia on its debt levels in March. The IMF warned us in October. Now the Bank of International Settlements has flipped on the alarms. That’s the whole set of global financial institutions sitting in our rear view mirror telling us to slow the heck down.

Will we pay attention this time? Or are we too revved up on our $1.7 trillion housing debt bender to stop?

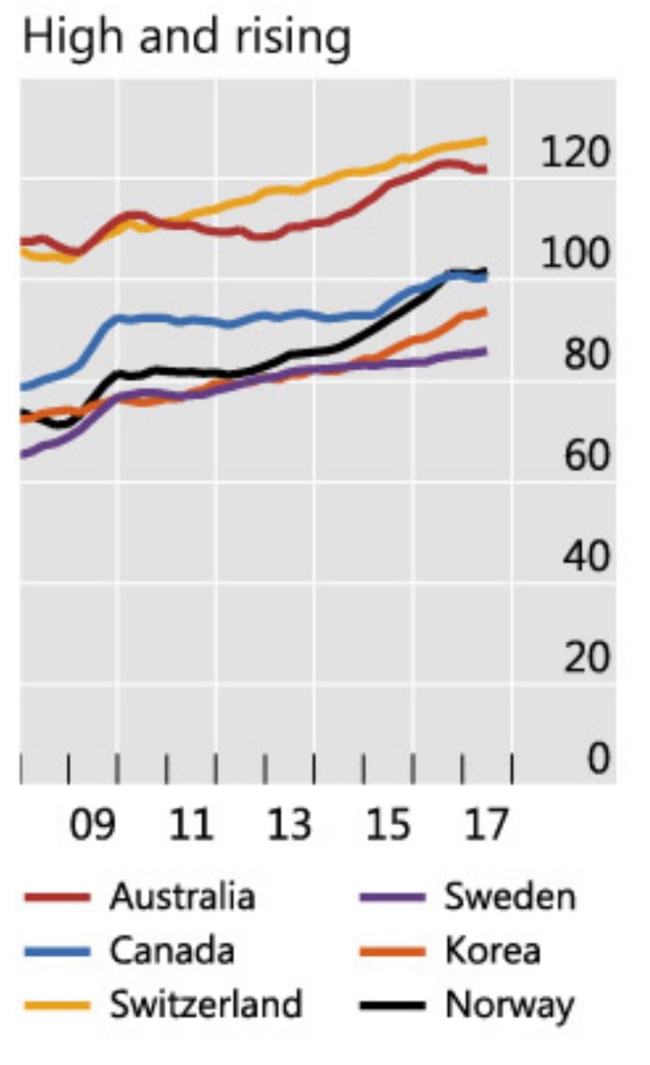

The Bank for International Settlements (BIS) turned on the flashing lights this week with a big report that outlined how far out of line Australia is. It grouped countries into those with high debt, and those with rising debt. Only a handful of countries were both high and rising, but you guessed it, Australia was both.

The BIS is not opposed to debt. It’s a bank after all. But as the bank that has the central banks as its customers, it gets worried when debt builds up too high. It knows a country with a lot of debt is like a truck carrying a heavy load. If something bad happens, it has very limited ability to manoeuvre.

And something bad will happen. It might be a house price disaster, a financial crisis in China, a huge volcano going off in Indonesia or a war in North Korea. We don’t know when and we don’t know what, but disruptions are guaranteed.

“High household debt can make the economy more vulnerable to disruptions, potentially harming growth,” says the BIS.

In Australia, three quarters of households owe something to the bank. The average housing debt is $150,000.

TOO HOT, HOT DAMN

Australia’s debt is high. But our interest rates are low. Record lows in fact, with official rates at the never-before-seen level of 1.5 per cent. Banks set their mortgage rates by reference to the official interest rate, so the interest Australians pay on housing loans is currently low too. So far so good.

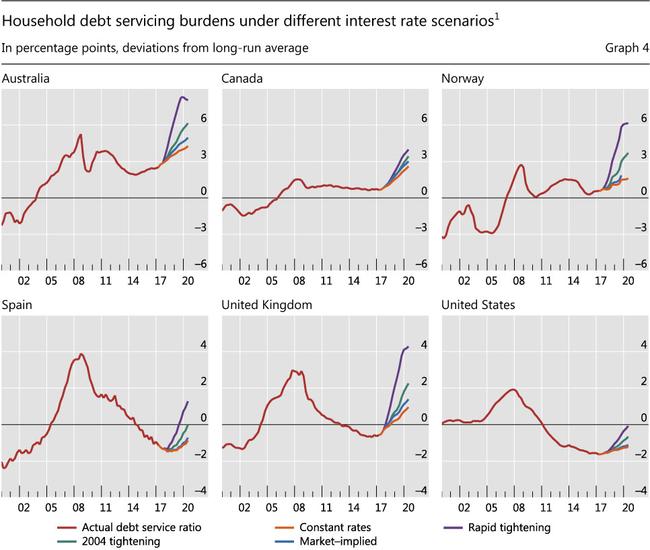

But Australia has really taken advantage of those low interest rates. We’ve absolutely gone to town. Despite the low rates, we are already paying well above the long run amount of our income in interest repayments.

This next graph shows how much various countries were paying in interest compared to the long-term average. Australia is paying 3 per cent more of our income on interest than is historically normal. If you compare our graph to the other countries, we are clearly the highest. If that’s not frightening enough, the interest bill is set to go up when interest rates rise.

The Reserve Bank likes to point out that Australian household debt is not as bad as it seems, because we have a lot of money in mortgage offset accounts. Australians are ahead on their debt repayments, it often claims, and shows a lot of data to prove it. The BIS has gone out of its way to make sure the Reserve Bank doesn’t get too cocky by pointing out that new mortgages, which are bigger and at higher risk of not being repaid, have much smaller buffers.

“In Australia, the liquid prepayment buffers on mortgage-offset accounts are heavily concentrated on older mortgages with less time to maturity, the BIS says.

DEBT: A SET-UP

Debt for investments that produce things and employ people is good debt. Debt for consumption or to bid up the price of unproductive assets is different. It makes the present seem richer by leaving the future poorer. Australia is borrowing so much from the future that the future should start to be worried.

The BIS found debt booms cause busts. It did a study of dozens of countries to find out what happens in the years after debt goes up. It found that in the next year, debt sees growth rise. Later, in years two, three, four and five however, an increase in credit is associated with lower growth.

In future, Australia will be paying off so much housing debt that we will have less for actual productive investments like businesses that employ people. We will also have less for the consumer spending that keeps the economy ticking.

AND WHERE HAS ALL THIS DEBT GOT US?

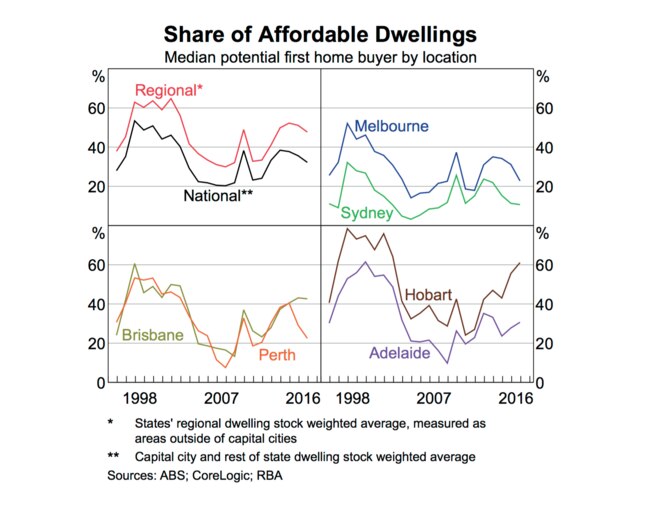

Not only has all this debt made Australia’s national economy vulnerable. It has blown the housing market up to the point that in Australia’s biggest cities first home buyers can’t afford to buy a vast majority of properties.

This next graph shows the proportion of homes that are affordable for the median first homebuyer in Australian cities. In Melbourne, it’s just over 20 per cent of homes. In Sydney, it’s just 10 per cent.

Remember — this graph is the median first homebuyer, which means half of potential first home buyers are even worse off.

As 2017 ends, Australia’s east coast house prices have finally started falling. If that continues in 2018, the government will come under pressure to step in and prop up the housing market. Will it let a slide continue? Or will it encourage debt to rise again to prevent prices falling?

The warning from the BIS is that it is better to stop piling up debt sooner rather than later. If the government chooses more debt to prevent falling housing prices, it will only be kicking the can down the road. Debt has costs and Australia will have to face the costs of its debt binge sooner or later.

Originally published as Another big warning on debt for Australia. When will we listen?