Data-hungry customers lift NBN earnings

NBN Co has lifted its pre-tax earnings by more than $1bn year-on-year.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

NBN Co has lifted its pre-tax earnings by more than $1bn year-on-year, a turnaround driven by data-hungry customers in lockdown purchasing higher speed connections and by falling payments to Optus and Telstra.

On Wednesday NBN Co, which recently declared “mission accomplished” on its network build, posted total revenue of $2.26bn for the six months to end-December and pre-tax earnings of $424m for the half, up from a loss of $663m from a year earlier.

The network’s bottom line losses for the year narrowed to $2.11bn for the December half, from $2.82bn previously.

The company has been forced to hit pause on new hybrid fibre coaxial (HFC) connections however due to a global supply chain issue that the company said could last for months.

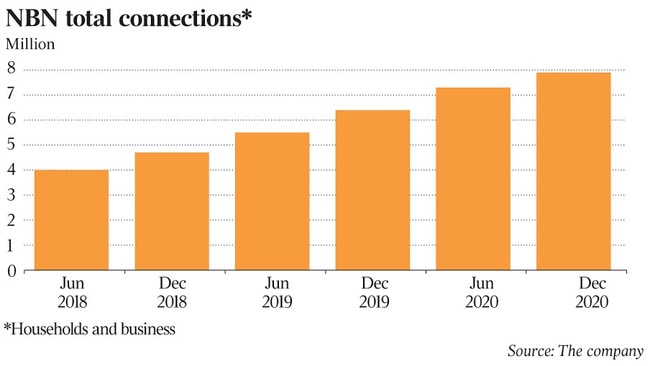

Chief executive Stephen Rue said his infrastructure company was progressing from a “build” phase to a major $4.5bn fibre upgrade of the network, and acquired more than 660,000 new customers in the half. More than 7.9 million premises are now on the NBN nationally, with 11.9 million premises deemed “ready to connect”.

According to Mr Rue, the organisation is on track to meet its 2021 forecasts despite the additional free capacity provided during COVID-19, and issues plaguing the HFC portion of the network.

“Our results in the first half of financial year 2021 are very strong and underscore the strength of the business in what has been a challenging time for all Australians,” he said.

Residential average revenue per user (ARPU) was flat at $45, with high take-up of lucrative ultrafast plans offset by free extra capacity from NBN Co during the pandemic. It paid $809m in subscriber costs to Telstra and Optus for the half, compared with $1.44bn a year earlier.

“These subscriber payments will continue to decrease throughout the fiscal year and are forecast to cease by financial year 2024,” NBN said. The company has also begun paying down its $19.5bn loan from the government, which it received in 2016, with Mr Rue declaring NBN Co was “in the top ranks of Australian corporate borrowers”.

The organisation has raised $10bn in private debt over the last 12 months, including $6.1bn in loans from banks in May 2020, and additional facilities of $4bn. The company deployed $1.4bn on capital expenditure for the half.

“This new financing has enabled the repayment of $3bn of the commonwealth loan, reducing the outstanding loan balance to $16.5bn,” NBN Co chief financial officer Philip Knox said on Wednesday.

“This repayment has decreased our weighted average cost of drawn debt from 3.96 per cent to 3.17 per cent, and we expect this to continue to fall as we further progress refinancing the government loan.”

Mr Knox indicated that securing further external funding would be an immediate priority for the company, as it looks to upgrade premises to higher speed connections across the country.

Customers on hybrid fibre coaxial (HFC) connections would be unable to order new orders for several months, the company said, due to a global shortage of chips used in vital modems. Mr Rue said NBN Co did still have some modems in warehouses to address faults, or for vulnerable customers.

NBN Co has 1.9 million customers using HFC connections.

“What we’re seeing internationally is a global shortage of chipsets, and the reason is because of an unprecedented demand across the across the world. Some of it is driven by COVID, in Asia, but some of it’s driven by the auto market coming out of the pandemic,” Mr Rue told The Australian.

“And having higher manufacturing needs, and some of that’s caused through geopolitical disruptions to supply chains, which has led to a high pre-ordering of chipsets.”

On Wednesday, NBN Co also unveiled the second group of suburbs and towns to receive fibre upgrades as part of the $4.5bn fibre investment program.

Originally published as Data-hungry customers lift NBN earnings